Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. The current stock price is $80 and the stock pays no dividend. Each month, the stock price is either going up by 3%

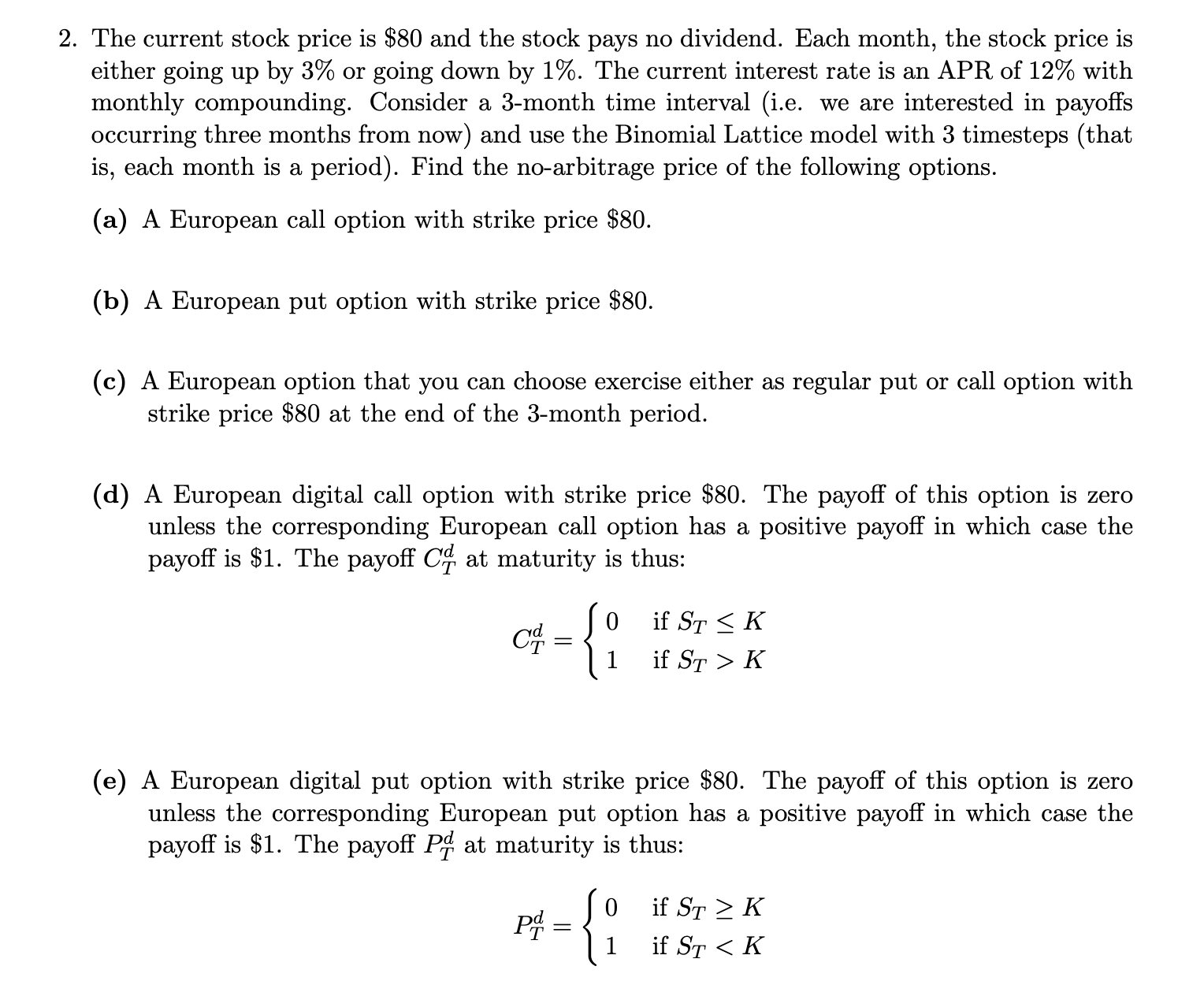

2. The current stock price is $80 and the stock pays no dividend. Each month, the stock price is either going up by 3% or going down by 1%. The current interest rate is an APR of 12% with monthly compounding. Consider a 3-month time interval (i.e. we are interested in payoffs occurring three months from now) and use the Binomial Lattice model with 3 timesteps (that is, each month is a period). Find the no-arbitrage price of the following options. (a) A European call option with strike price $80. (b) A European put option with strike price $80. (c) A European option that you can choose exercise either as regular put or call option with strike price $80 at the end of the 3-month period. (d) A European digital call option with strike price $80. The payoff of this option is zero unless the corresponding European call option has a positive payoff in which case the payoff is $1. The payoff C at maturity is thus: Ca = P = 1 (e) A European digital put option with strike price $80. The payoff of this option is zero unless the corresponding European put option has a positive payoff in which case the payoff is $1. The payoff P at maturity is thus: { 0 if ST < K if ST > K 1 if ST > K if ST < K

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Binomial Option Pricing with NoArbitrage Given Current Stock Price S 80 Upward Price Movement u 103 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started