Answered step by step

Verified Expert Solution

Question

1 Approved Answer

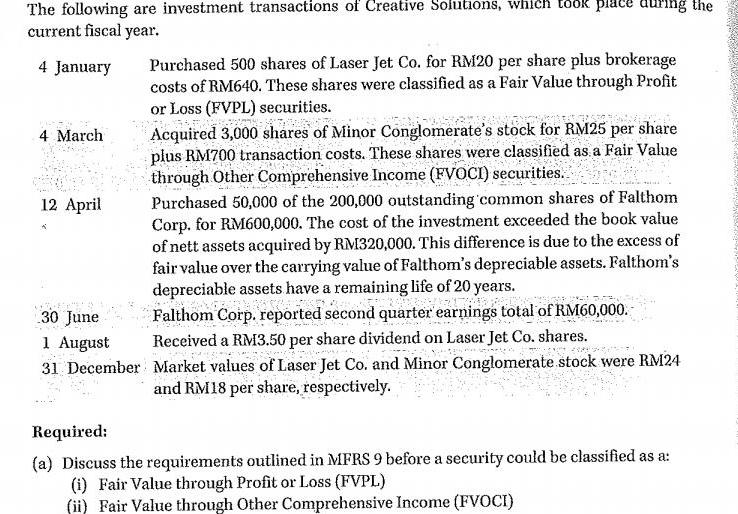

The following are investment transactions of Creative Solutions, which took place uuring the current fiscal year. Purchased 500 shares of Laser Jet Co. for

The following are investment transactions of Creative Solutions, which took place uuring the current fiscal year. Purchased 500 shares of Laser Jet Co. for RM20 per share plus brokerage costs of RM640. These shares were classified as a Fair Value through Profit or Loss (FVPL) securities. Acquired 3,000 shares of Minor Conglomerate's stock for RM25 per share plus RM700 transaction costs. These shares were classified as, a Fair Value through Other Comprehensive Income (FVOCI) securities. 4 January 4 March Purchased 50,000 of the 200,000 outstanding 'common shares of Falthom Corp. for RM600,000. The cost of the investment exceeded the book value of nett assets acquired by RM320,000. This difference is due to the excess of fair value over the carrying value of Falthom's depreciable assets. Falthom's depreciable assets have a remaining life of 20 years. Falthom Corp. reported second quarter earnings total of RM60,000. Received a RM3.50 per share dividend on Laser Jet Co. shares. 12 April 30 June 1 August 31 December Market values of Laser Jet Co. and Minor Conglomerate stock were RM24 and RM18 per share, respectively. Required: (a) Discuss the requirements outlined in MFRS 9 before a security could be classified as a: (i) Fair Value through Profit or Loss (FVPL) (ii) Fair Value through Other Comprehensive Income (FVOCI)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Under MFRS 9 there are broadly two types of investements Investments in Equity Instruments Investm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started