Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. The following is the financial information of Flora Inc. Find the NPV and P.I @12% for the following Investment $500000. Depreciation will be

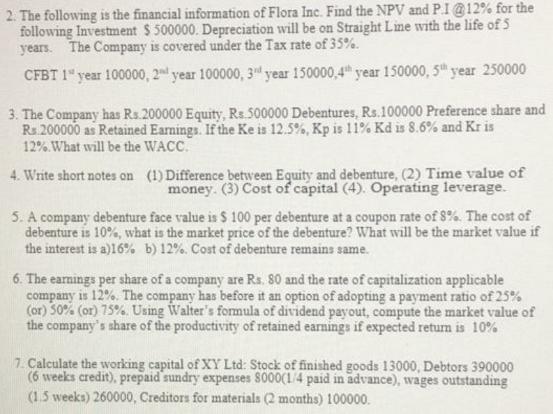

2. The following is the financial information of Flora Inc. Find the NPV and P.I @12% for the following Investment $500000. Depreciation will be on Straight Line with the life of 5 years. The Company is covered under the Tax rate of 35%. CFBT 1 year 100000, 2 year 100000, 3 year 150000,4th year 150000, 5th year 250000 3. The Company has Rs.200000 Equity, Rs 500000 Debentures, Rs.100000 Preference share and Rs 200000 as Retained Earnings. If the Ke is 12.5%, Kp is 11% Kd is 8.6% and Kris 12%. What will be the WACC. 4. Write short notes on (1) Difference between Equity and debenture, (2) Time value of money. (3) Cost of capital (4). Operating leverage. 5. A company debenture face value is $ 100 per debenture at a coupon rate of 8%. The cost of debenture is 10%, what is the market price of the debenture? What will be the market value if the interest is a)16% b) 12%. Cost of debenture remains same. 6. The earnings per share of a company are Rs. 80 and the rate of capitalization applicable company is 12%. The company has before it an option of adopting a payment ratio of 25% (or) 50% (or) 75%. Using Walter's formula of dividend payout, compute the market value of the company's share of the productivity of retained earnings if expected return is 10% 7. Calculate the working capital of XY Ltd: Stock of finished goods 13000, Debtors 390000 (6 weeks credit), prepaid sundry expenses 8000(1/4 paid in advance), wages outstanding (1.5 weeks) 260000, Creditors for materials (2 months) 100000.

Step by Step Solution

★★★★★

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV and Profitability Index PI at a discount rate of 12 we need to discount the cash flows and consider the depreciation tax shield The depreciation tax shield is th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started