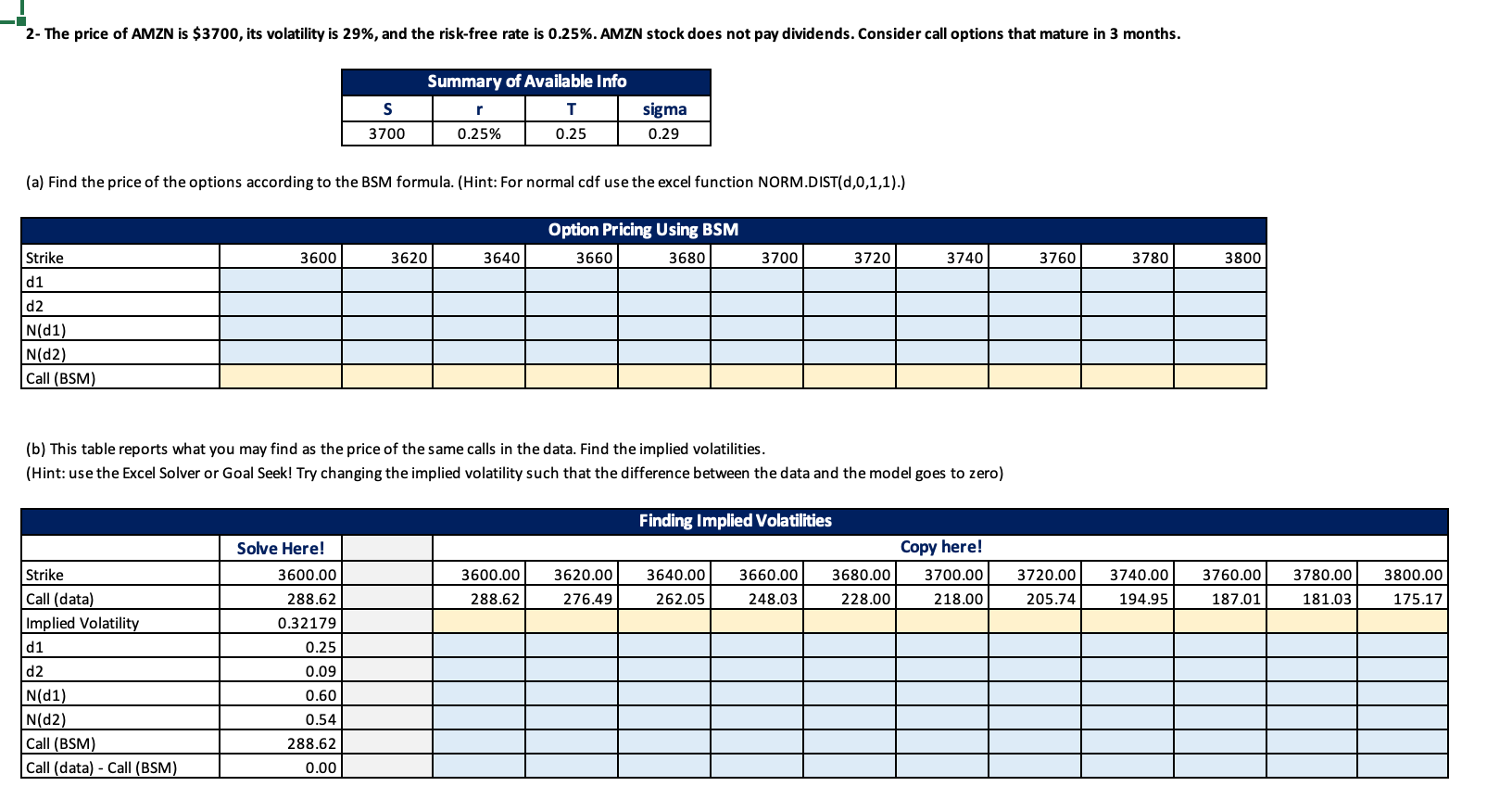

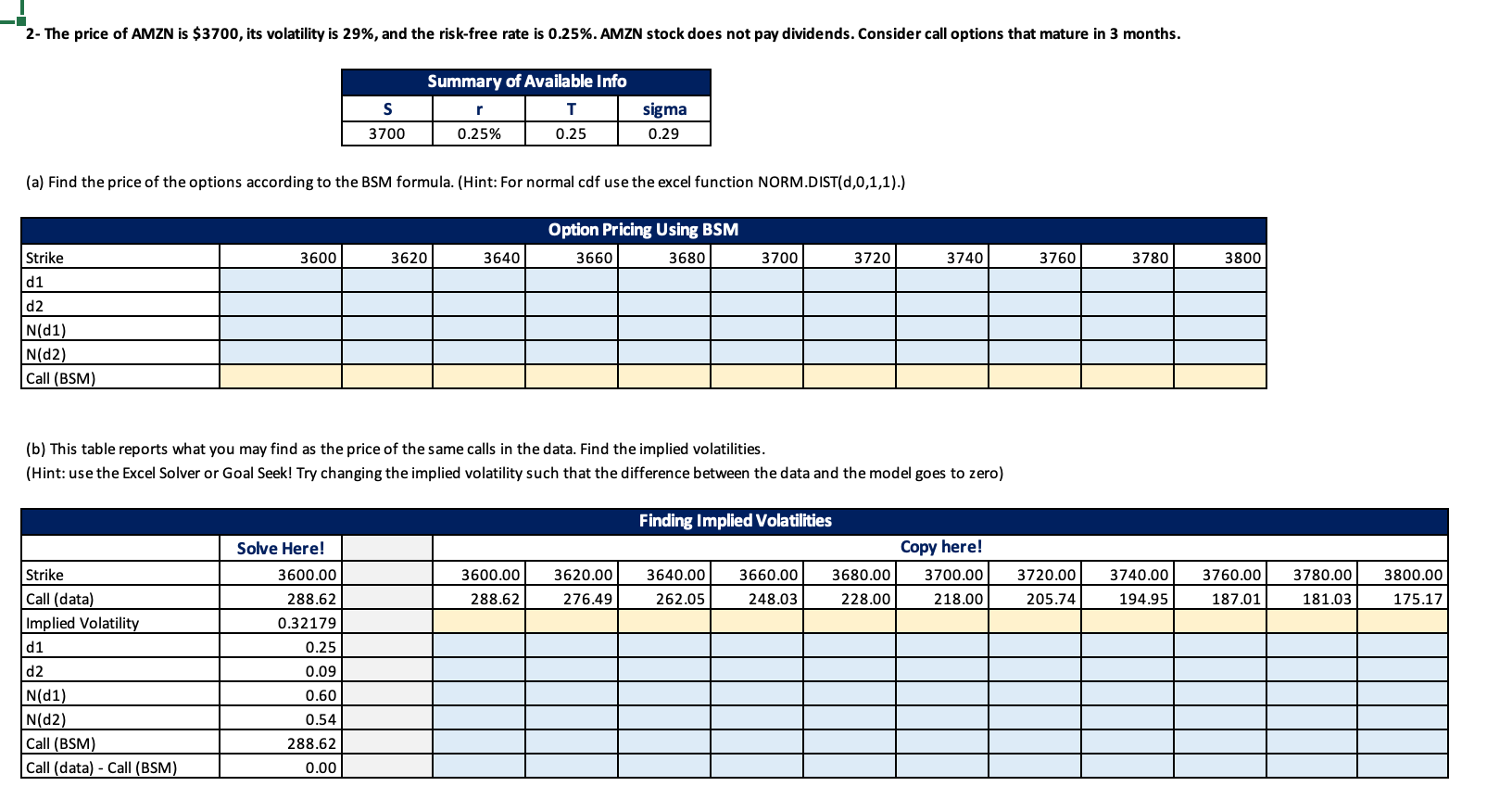

2- The price of AMZN is $3700, its volatility is 29%, and the risk-free rate is 0.25%. AMZN stock does not pay dividends. Consider call options that mature in 3 months. Summary of Available Info r T S 3700 sigma 0.29 0.25% 0.25 (a) Find the price of the options according to the BSM formula. (Hint: For normal cdf use the excel function NORM.DIST(0,0,1,1).) Option Pricing Using BSM 3660 3680 Strike 3600 3620 3640 3700 3720 3740 3760 3780 3800 d1 d2 Nd1) N(2) Call (BSM) (b) This table reports what you may find as the price of the same calls in the data. Find the implied volatilities. (Hint: use the Excel Solver or Goal Seek! Try changing the implied volatility such that the difference between the data and the model goes to zero) Finding Implied Volatilities Solve Here! 3600.00 288.62 3600.00 288.62 3620.00 276.49 3640.00 262.05 3660.00 248.03 3680.00 228.00 Copy here! 3700.00 218.00 3720.00 205.74 3740.00 194.95 3760.00 187.01 3780.00 181.03 3800.00 175.17 Strike Call (data) Implied Volatility d1 0.32179 0.25 d2 0.09 0.60 0.54 N(1) N(02) Call (BSM) Call (data) - Call (BSM) 288.62 0.00 2- The price of AMZN is $3700, its volatility is 29%, and the risk-free rate is 0.25%. AMZN stock does not pay dividends. Consider call options that mature in 3 months. Summary of Available Info r T S 3700 sigma 0.29 0.25% 0.25 (a) Find the price of the options according to the BSM formula. (Hint: For normal cdf use the excel function NORM.DIST(0,0,1,1).) Option Pricing Using BSM 3660 3680 Strike 3600 3620 3640 3700 3720 3740 3760 3780 3800 d1 d2 Nd1) N(2) Call (BSM) (b) This table reports what you may find as the price of the same calls in the data. Find the implied volatilities. (Hint: use the Excel Solver or Goal Seek! Try changing the implied volatility such that the difference between the data and the model goes to zero) Finding Implied Volatilities Solve Here! 3600.00 288.62 3600.00 288.62 3620.00 276.49 3640.00 262.05 3660.00 248.03 3680.00 228.00 Copy here! 3700.00 218.00 3720.00 205.74 3740.00 194.95 3760.00 187.01 3780.00 181.03 3800.00 175.17 Strike Call (data) Implied Volatility d1 0.32179 0.25 d2 0.09 0.60 0.54 N(1) N(02) Call (BSM) Call (data) - Call (BSM) 288.62 0.00