Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. The taxpayer's wage expense for the year is $150,000 so the QBIi is maxed is out at $150,000 3. if the taxpayer changes to

2. The taxpayer's wage expense for the year is $150,000 so the QBIi is maxed is out at $150,000

3. if the taxpayer changes to a c corp, he or she will not be entitled to any qbi deduction.

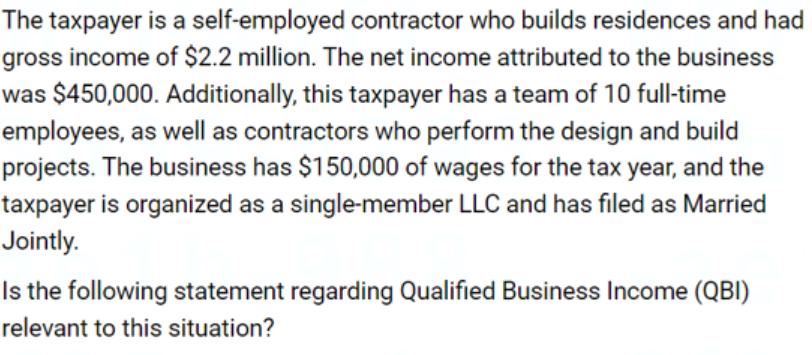

The taxpayer is a self-employed contractor who builds residences and had gross income of $2.2 million. The net income attributed to the business was $450,000. Additionally, this taxpayer has a team of 10 full-time employees, as well as contractors who perform the design and build projects. The business has $150,000 of wages for the tax year, and the taxpayer is organized as a single-member LLC and has filed as Married Jointly. Is the following statement regarding Qualified Business Income (QBI) relevant to this situation?

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Step 12 About Qualified Business Income QBI QBI is the net amount of qualified items of income gain ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started