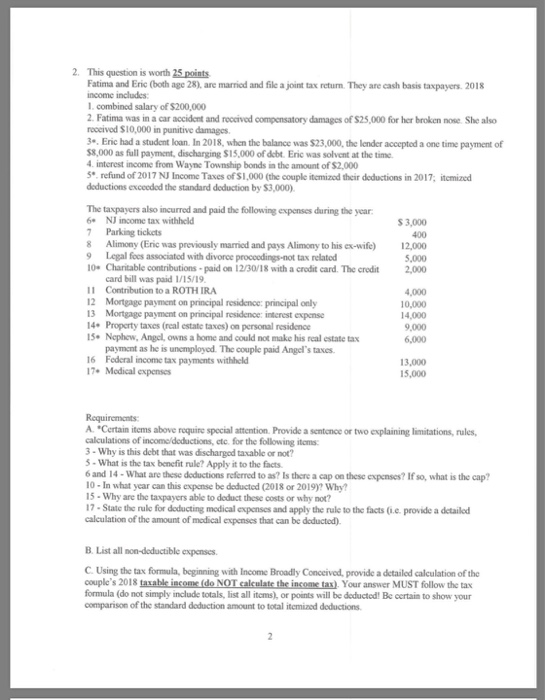

2. This question is worth 25 points Fatima and Eric (both age 28), are married and file a joint tax return. They are cash basis taxpayers. 2018 income includes I. combined salary of $200,000 Fatima was in a car accident and roccived compensatory damages of $25,000 for her broken nose She also roccived $10,000 in punitive damages , Eric had a student loan. In 2018, when the balance was $23,000, the lender acceptod a one time payment of $8,000 as full payment, discharging $15,000 of debt.Eric was solvent at the time interest income from Wayne Township bonds in the amount of $2,000 S refund of 2017 NJ Income Taxes of S1,000 (the couple itemizod their deductions in 2017, itemized deductions exceedod the standard deduction by $3,000) The taxpayers also incurred and paid the following expenses during the year the yoar NJ income tax withheld $3,000 Parking tickcts 400 8 Alimony (Eric was previously married and pays Alimony to his ex-wife)12,000 5,000 0 Charitable contributions -paid on 12/30/18 with a crodit card. The credit 2,000 9Legal focs associatod with divorce proccodings-not tax relatod card bill was paid 1/15/19 Contribution to a ROTH IRA I1 12 Mortgage payment on principal residence principal only 13 Mortgage payment on principal residence: intcrest expenso 14 Property taxes (real estate taxes) on personal residence S. Nephew, Angel, owns a home and could not make his real estate tax 4,000 10,000 14,000 9,000 6,000 payment as he is unemployod. The couple paid Angel's taxes 16 Federal income tax payments withheld 7. Medical expenses 13,000 15,000 A. "Certain items above rquire special attention. Provide a sentence or two eplaining limitations, rules, calculations of incomo/deductions, ctc. for the following itms: 3-Why is this debt that was dischargod taxable or not? 5- What is the tax benefit rule? Apply it to the facts 6 and 14-What are these doductions referred to as? Is there a cap on these expenses? If so, what is the cap? 10- In what year can this expense be deducted (2018 or 2019)? Why 5-Why are the taxpayers able to deduct these costs or why not? 17-State the rulke for deducting modical expenses and apply the rule to the facts (.e provide a detailed calculation of the amount of modical expenses that can be deductod) B. List all non-deductible expenses. C. Using the tax formula, beginning with Income Broadly Conceived, provide a detailed calculation of the couple's 201S taxable income (do NOT calculate the income tax) Your answer MUST follow the tax formula (do not simply include totals, list all itcms), or points will be deductod! Be certain to show your comparison of the standard deduction amount to total itemized deductions