Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) Thomas Enterprises, and all-equity firm, is considering an investment (today, at t=0) of $1.2 million that will be depreciated straight line over its

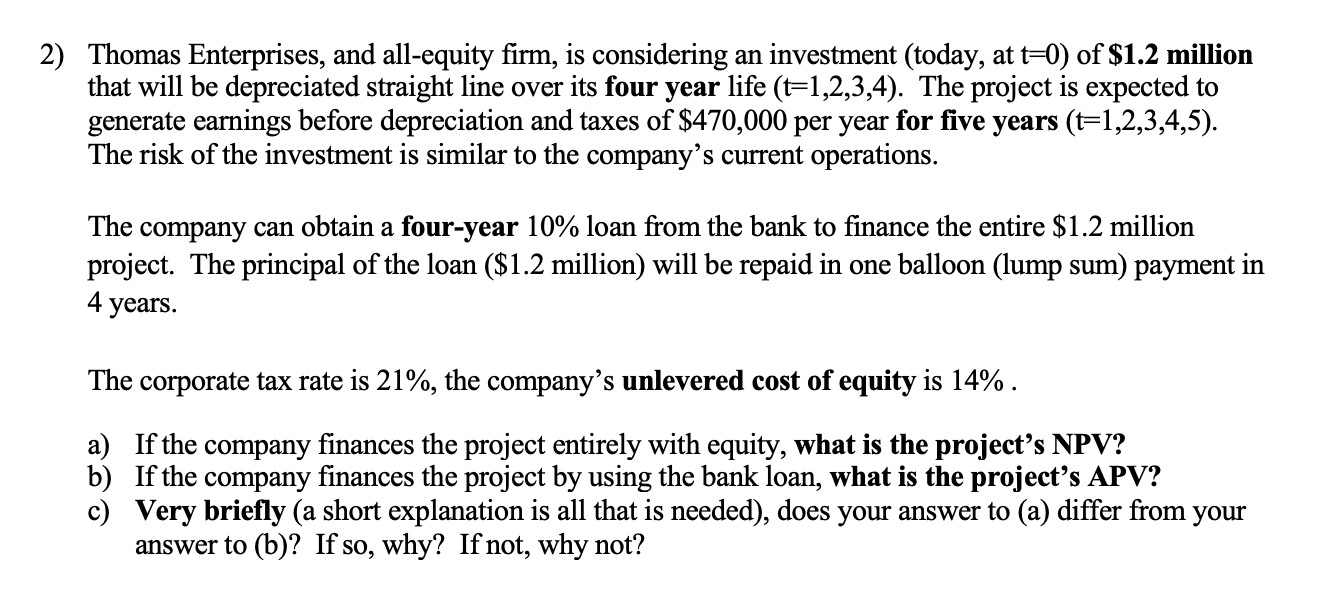

2) Thomas Enterprises, and all-equity firm, is considering an investment (today, at t=0) of $1.2 million that will be depreciated straight line over its four year life (t=1,2,3,4). The project is expected to generate earnings before depreciation and taxes of $470,000 per year for five The risk of the investment is similar to the company's current operations. years (t=1,2,3,4,5). The company can obtain a four-year 10% loan from the bank to finance the entire $1.2 million project. The principal of the loan ($1.2 million) will be repaid in one balloon (lump sum) payment in 4 years. The corporate tax rate is 21%, the company's unlevered cost of equity is 14%. a) If the company finances the project entirely with equity, what is the project's NPV? b) If the company finances the project by using the bank loan, what is the project's APV? c) Very briefly (a short explanation is all that is needed), does your answer to (a) differ from answer to (b)? If so, why? If not, why not? your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started