Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Multiple Choice - Problem 4-3: Tax compliance 1. A taxpayer filed his income tax return in October 28, 2022. The deadline for the return

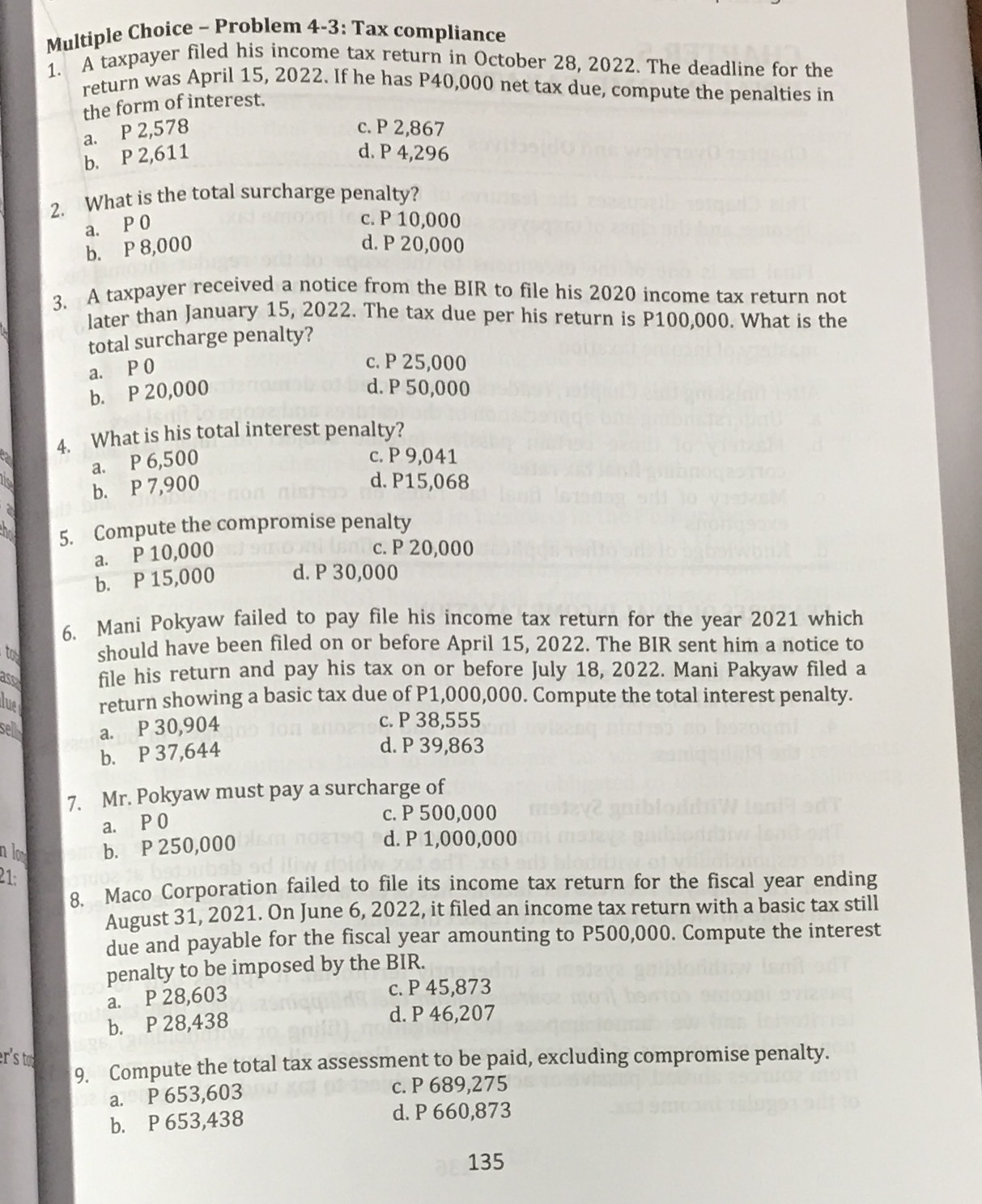

Multiple Choice - Problem 4-3: Tax compliance 1. A taxpayer filed his income tax return in October 28, 2022. The deadline for the return was April 15, 2022. If he has P40,000 net tax due, compute the penalties in the form of interest. a. P 2,578 b. P 2,611 c. P 2,867 d. P 4,296 2. What is the total surcharge penalty? a. PO b. P 8,000 c. P 10,000 d. P 20,000 3. A taxpayer received a notice from the BIR to file his 2020 income tax return not later than January 15, 2022. The tax due per his return is P100,000. What is the total surcharge penalty? a. PO b. P 20,000 c. P 25,000 d. P 50,000 4. What is his total interest penalty? ass lue lo 21: a. P 6,500 b. P 7,900 c. P 9,041 d. P15,068 -non nis 5. Compute the compromise penalty a. P 10,000 b. P 15,000 on Unc. P 20,000 d. P 30,000 6. Mani Pokyaw failed to pay file his income tax return for the year 2021 which should have been filed on or before April 15, 2022. The BIR sent him a notice to file his return and pay his tax on or before July 18, 2022. Mani Pakyaw filed a return showing a basic tax due of P1,000,000. Compute the total interest penalty. a. P 30,904 200 on a10219 b. P 37,644 c. P 38,555 d. P 39,863 7. Mr. Pokyaw must pay a surcharge of a. PO b. P 250,000 c. P 500,000 d. P 1,000,000 8. Maco Corporation failed to file its income tax return for the fiscal year ending August 31, 2021. On June 6, 2022, it filed an income tax return with a basic tax still due and payable for the fiscal year amounting to P500,000. Compute the interest penalty to be imposed by the BIR. a. P 28,603 c. P 45,873 er's to b. P 28,438 d. P 46,207 9. Compute the total tax assessment to be paid, excluding compromise penalty. a. P 653,603 b. P 653,438 c. P 689,275 d. P 660,873 135

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay here are the detailed workings 1 Taxpayer filed return on Oct 28 2022 for tax year 2022 Deadlin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started