Question

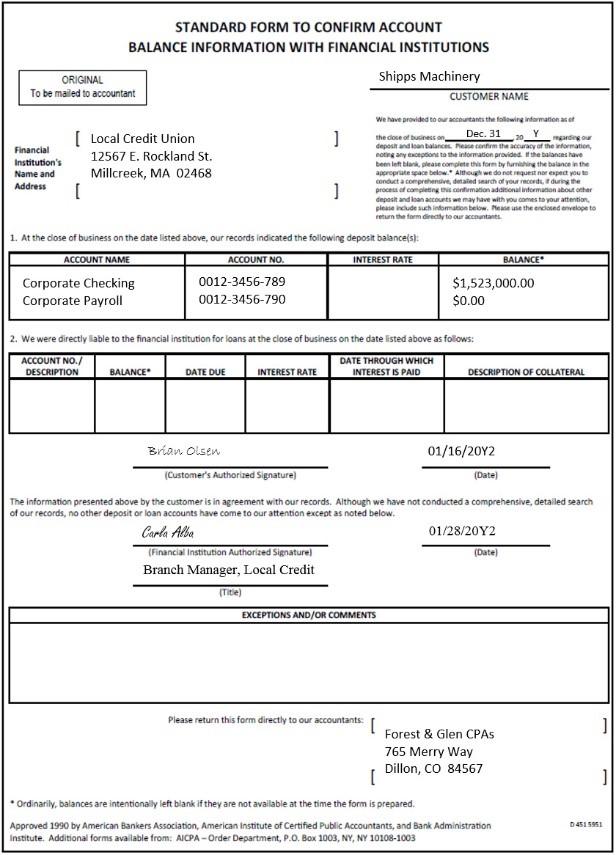

2. To check completeness and existence assertions for Cash , a standard bank confirmation was sent to Local Credit Union. The attached Bank Confirmation was

2. To check completeness and existence assertions for Cash, a standard bank confirmation was sent to Local Credit Union. The attached "Bank Confirmation" was received by the auditors on February 1, Year 2.

(1) Is the evidence collected sufficient and appropriate? A. Yes____ B. No_____

(2) Please determine the auditor's next likely action by selecting the appropriate option from the list provided at the bottom of this question (Options A-J):____________

A. No further action is needed.

B. Accounts payable confirmations should be sent to a sample of vendors with large outstanding balances at year-end.

C. Confirmation responses received electronically should be verified by calling the sender and the sender is also requested to mail the original confirmation directly to the auditor.

D. Confirmations should be sent to an additional sample of customers for further evidence.

E. Engage an audit specialist to review lawsuit and determine independent probability of loss.

F. Inquiries of management should be made as to the $0 balance account, as this may be a sign of fraud.

G. Propose an adjusting journal entry for the maintenance expense incorrectly excluded from Year 1.

H. Request that the attorney send an exact amount of probable loss.

I. Separate confirmation request should be sent to request information regarding any loans or liens outstanding.

J. To test for completeness, perform a search for unrecorded liabilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started