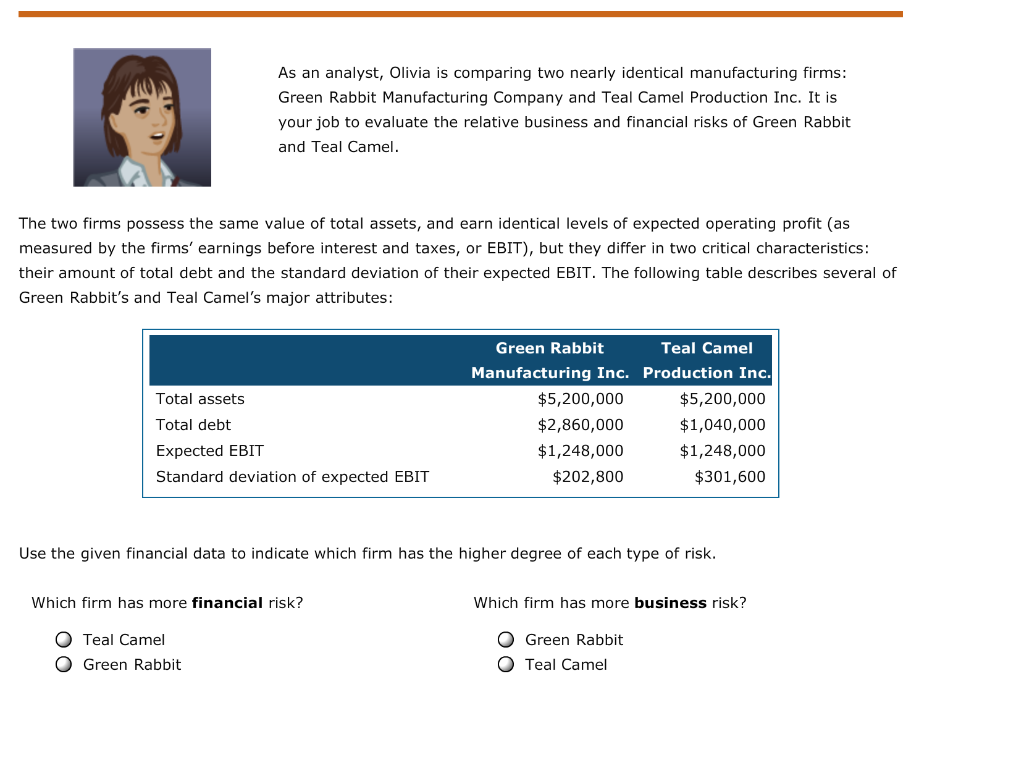

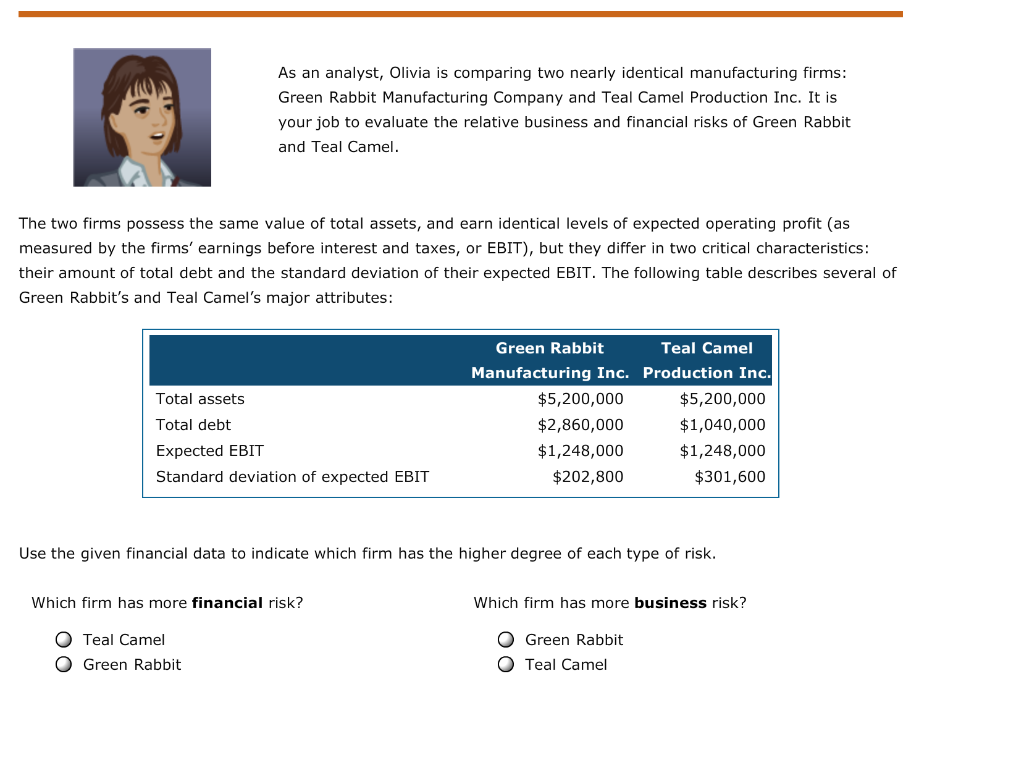

2. Understanding business and financial risks Aa Aa E The total risk in a firm is determined by evaluating the firm's business risk and financial risk. True or False: Firms operating in more price-competitive industries, or exhibiting lower levels of market power, generally exhibit lower levels of business risk, all other things being equal. This statement is: O O True False The use of financial leverage, or fixed-cost sources of capital, involves a trade-off between its effect on the firm's shareholders and its effect on the riskiness of the firm. Read each statement below, and indicate whether Statement 1, Statement 2, or both statements are correct, or neither statement is correct. Statement 1 Which response is correct? The objective of capital structure management is to determine the mix of debt and equity that leads to the maximization of the wealth of the firm's shareholders. Only Statement 1 is correct. Only Statement 2 is correct. Both statements are correct. Neither statement is correct. O Statement 2 One result associated with the use of increased financial leverage is a decreased return earned by the firm's shareholders as the firm's earnings increase. As an analyst, Olivia is comparing two nearly identical manufacturing firms: Green Rabbit Manufacturing Company and Teal Camel Production Inc. It is your job to evaluate the relative business and financial risks of Green Rabbit and Teal Camel. The two firms possess the same value of total assets, and earn identical levels of expected operating profit (as measured by the firms' earnings before interest and taxes, or EBIT), but they differ in two critical characteristics: their amount of total debt and the standard deviation of their expected EBIT. The following table describes several of Green Rabbit's and Teal Camel's major attributes: Total assets Total debt Expected EBIT Standard deviation of expected EBIT Green Rabbit Teal Camel Manufacturing Inc. Production Inc $5,200,000 $5,200,000 $2,860,000 $1,040,000 $1,248,000 $1,248,000 $202,800 $301,600 Use the given financial data to indicate which firm has the higher degree of each type of risk. Which firm has more financial risk? Which firm has more business risk? O Teal Camel O Green Rabbit O Green Rabbit Teal Camel 2. Understanding business and financial risks Aa Aa E The total risk in a firm is determined by evaluating the firm's business risk and financial risk. True or False: Firms operating in more price-competitive industries, or exhibiting lower levels of market power, generally exhibit lower levels of business risk, all other things being equal. This statement is: O O True False The use of financial leverage, or fixed-cost sources of capital, involves a trade-off between its effect on the firm's shareholders and its effect on the riskiness of the firm. Read each statement below, and indicate whether Statement 1, Statement 2, or both statements are correct, or neither statement is correct. Statement 1 Which response is correct? The objective of capital structure management is to determine the mix of debt and equity that leads to the maximization of the wealth of the firm's shareholders. Only Statement 1 is correct. Only Statement 2 is correct. Both statements are correct. Neither statement is correct. O Statement 2 One result associated with the use of increased financial leverage is a decreased return earned by the firm's shareholders as the firm's earnings increase. As an analyst, Olivia is comparing two nearly identical manufacturing firms: Green Rabbit Manufacturing Company and Teal Camel Production Inc. It is your job to evaluate the relative business and financial risks of Green Rabbit and Teal Camel. The two firms possess the same value of total assets, and earn identical levels of expected operating profit (as measured by the firms' earnings before interest and taxes, or EBIT), but they differ in two critical characteristics: their amount of total debt and the standard deviation of their expected EBIT. The following table describes several of Green Rabbit's and Teal Camel's major attributes: Total assets Total debt Expected EBIT Standard deviation of expected EBIT Green Rabbit Teal Camel Manufacturing Inc. Production Inc $5,200,000 $5,200,000 $2,860,000 $1,040,000 $1,248,000 $1,248,000 $202,800 $301,600 Use the given financial data to indicate which firm has the higher degree of each type of risk. Which firm has more financial risk? Which firm has more business risk? O Teal Camel O Green Rabbit O Green Rabbit Teal Camel