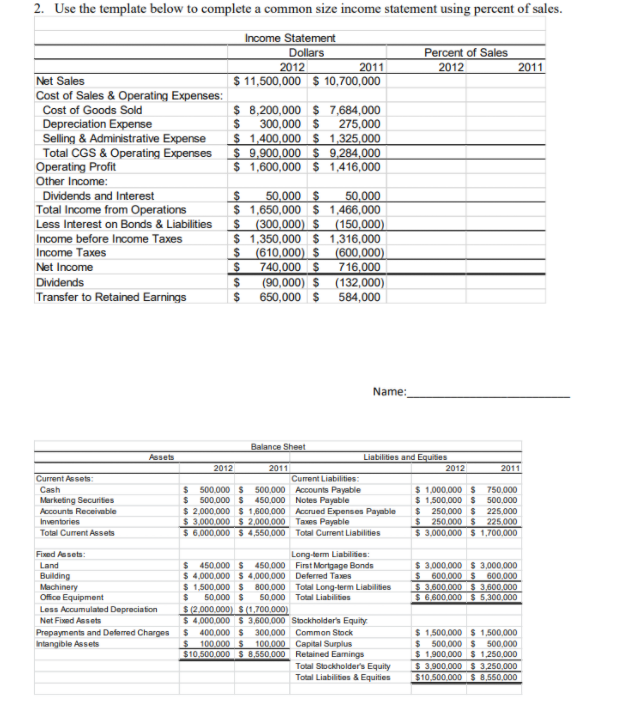

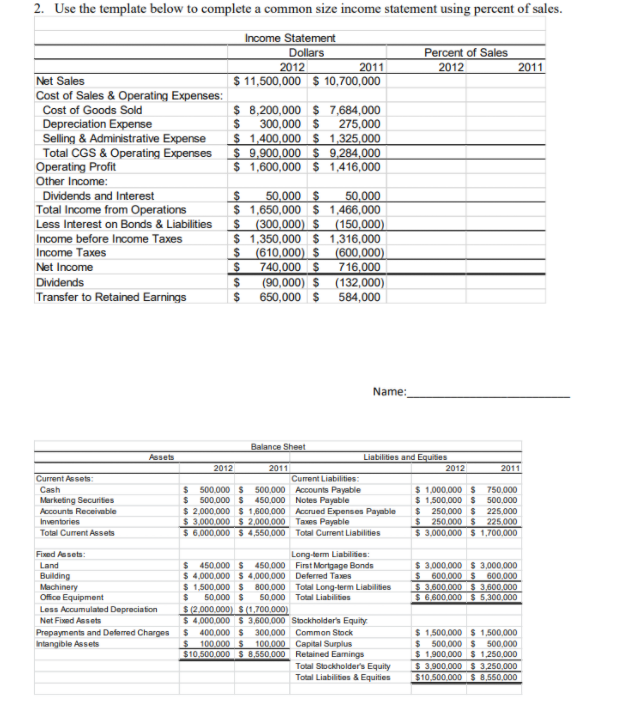

2. Use the template below to complete a common size income statement using percent of sales. Income Statement Dollars Percent of Sales 2012 2011 2012 2011 Net Sales $ 11,500,000 $ 10,700,000 Cost of Sales & Operating Expenses: Cost of Goods Sold $ 8,200,000 $ 7,684,000 Depreciation Expense $ 300,000 $ 275,000 Selling & Administrative Expense $ 1,400,000 $ 1,325,000 Total CGS & Operating Expenses $ 9,900,000 $ 9,284,000 Operating Profit $ 1,600,000 $ 1,416,000 Other Income: Dividends and Interest $ 50,000 $ 50,000 Total Income from Operations $ 1,650,000 $ 1,466,000 Less Interest on Bonds & Liabilities $ (300,000 $ (150,000) Income before Income Taxes $ 1,350,000 $ 1,316,000 Income Taxes $ (610,000 $ (600,000) Net Income $ 740,000 $ 716,000 Dividends $ (90,000) $ (132,000) Transfer to Retained Earnings $ 650,000 $ 584,000 Name: Assets Current Assets Cash Marketing Securities Accounts Receivable Inventories Total Current Assets Balance Sheet Liabilities and Equities 2012 2011 2012 2011 Current Liabilities: $ 500.000 S 500,000 Accounts Payable $ 1,000,000 $ 750,000 $ 500.000 $450,000 Notes Payable $ 1,500,000 $ 500,000 $ 2,000,000 $ 1,600,000 Accrued Expenses Payable $ 250.000 $ 225.000 $ 3,000,000 $2,000,000 Tas Payable $ 250,000 $225,000 $ 6,000,000 $ 4,550,000 Total Current Liabilities $ 3.000.000 $ 1,700,000 Fixed Assets Land Building Machinery Office Equipment Less Accumulated Depreciation Net Fixed Assets Prepayments and Deferred Charges Intangible Assets $ 3.000.000 $3,000,000 $ 600.000 S 600.000 $ 3.600.000 $3,600.000 $ 6.600.000 S 5,300,000 Long-term Liabilities: $ 450,000 $450,000 First Mortgage Bonds $ 4.000.000 $ 4,000,000 Deferred Taxes $ 1,500,000 $ 800,000 Total Long-term Liabilities $ 50.000 $ 50.000 Total Liabilities $(2.000.000) S (1,700,000 $ 4,000,000 $3,600,000 Stockholder's Equity $ 400,000 $300,000 Common Stock $ 100.000 $ 100.000 Capital Surplus $10.500.000 S 8,550,000 Retained Earings Total Stockholder's Equity Total Liabilities & Equities $ 1.500.000 $ 1,500,000 $ 500,000 $ 500.000 $ 1,900,000 $1,250,000 $ 3.900.000 $ 3.250.000 $10.500.000 S 8,550,000