2. Using an Excel spreadsheet* and your company's financial statements, compute the following for the most recent two years (chapters with information on each ratio are in parenthesis next to the ratio, refer to the tables in Section 13.3 Ratio Analysis on WileyPlus or pages 661-662, Appendix 13A provides a great example of ratio analysis):

Working capital (not really a ratio) (2, 13) Inventory turnover ratio (6, 13) Accounts Receivable turnover ratio (8, 13) Debt to total assets ratio (2, 13)

Gross profit ratio (5, 13)

Gross profit ratio (5, 13)

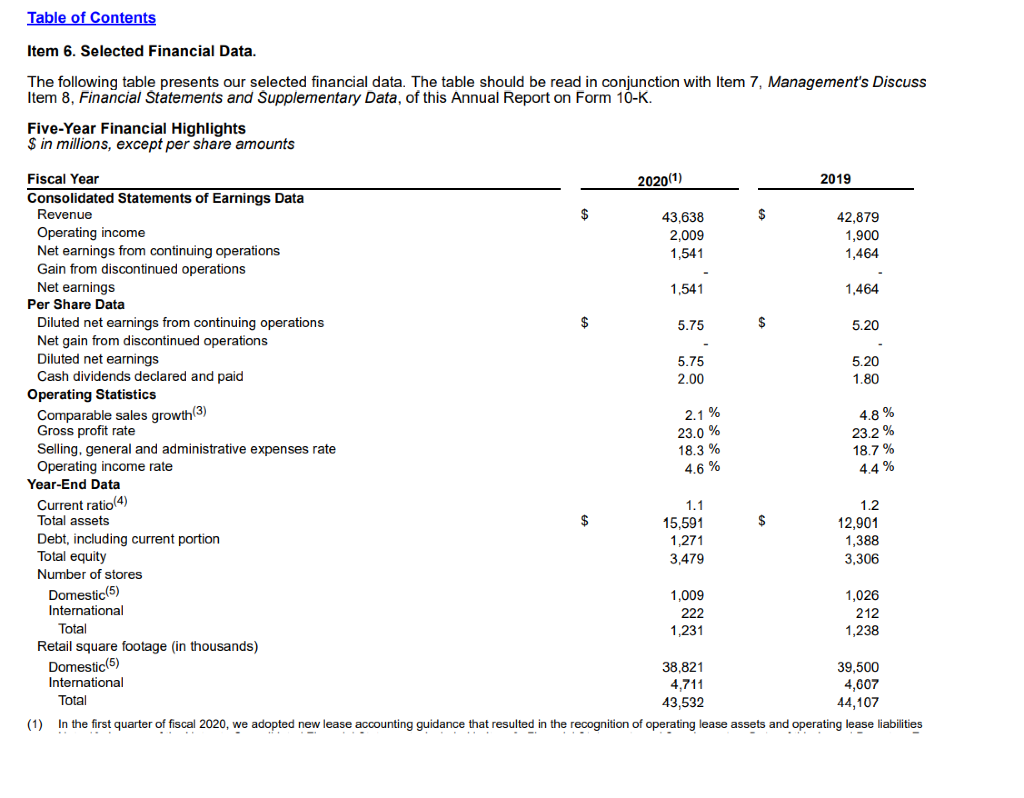

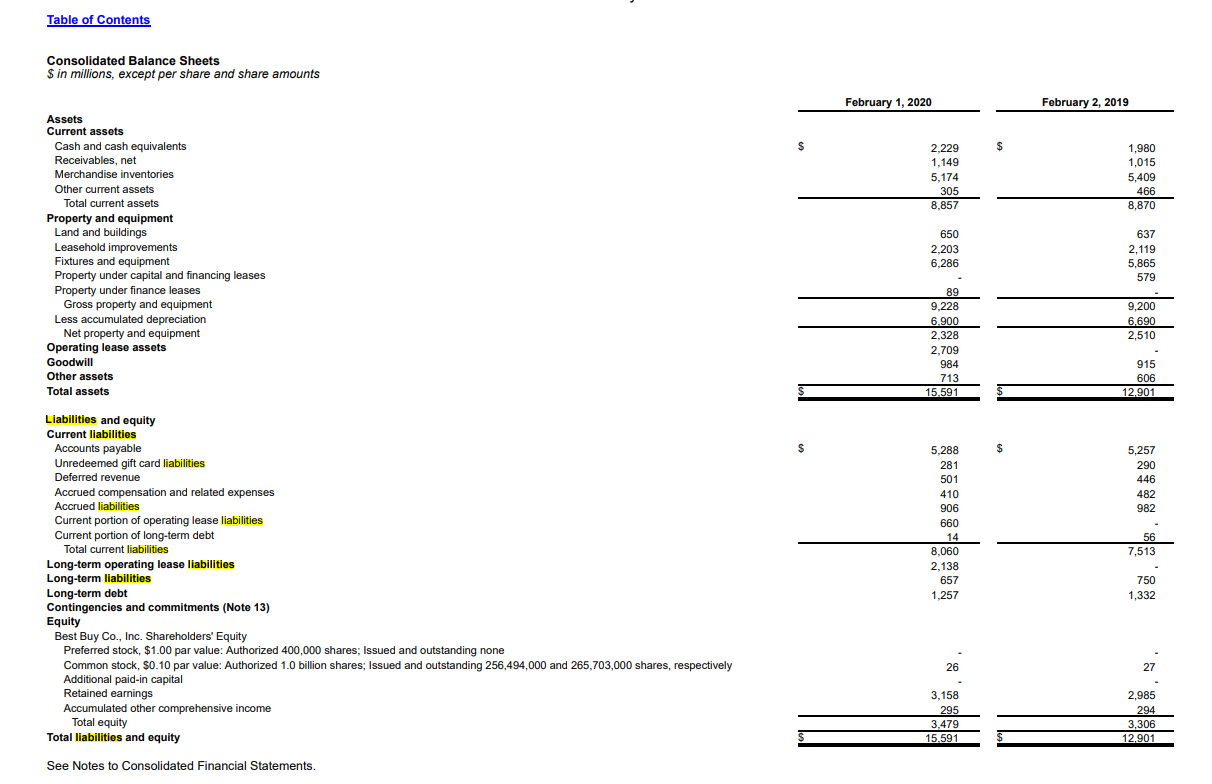

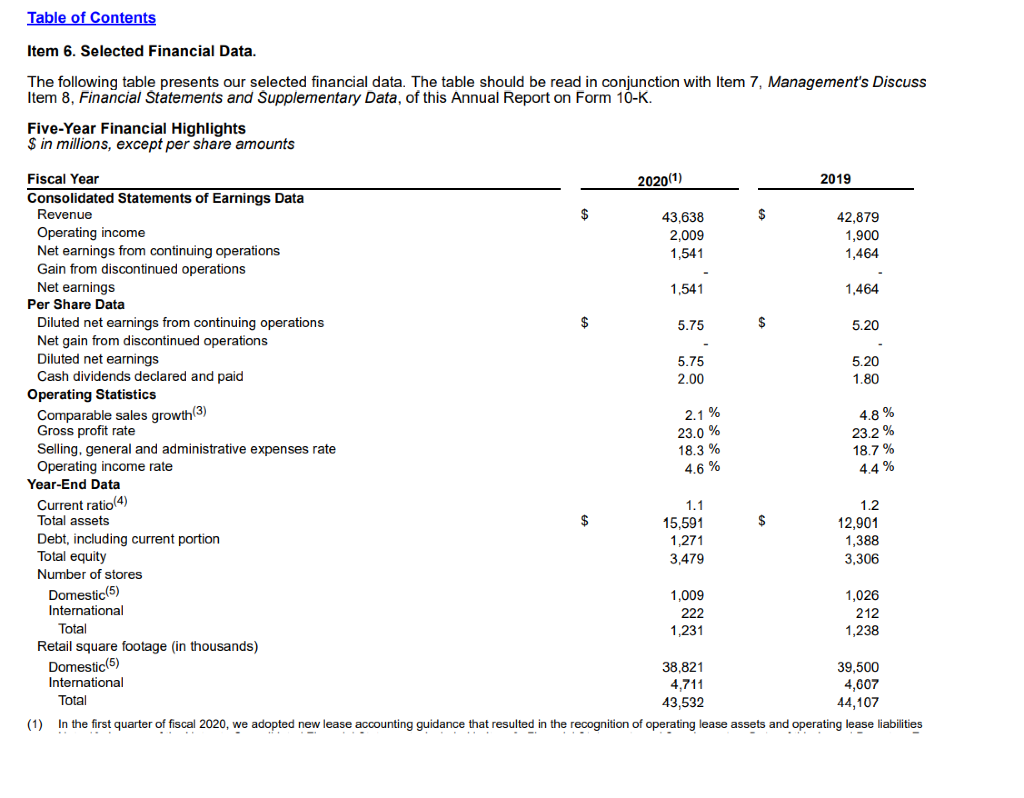

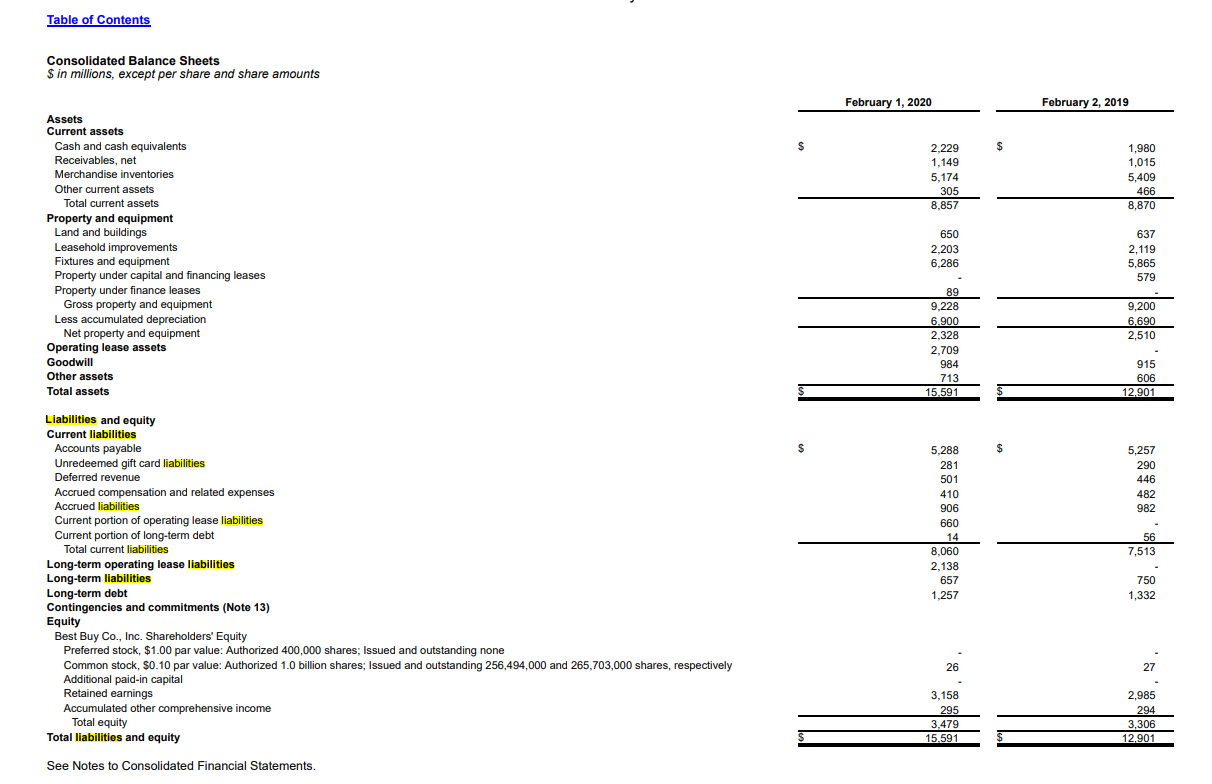

Table of Contents Item 6. Selected Financial Data. The following table presents our selected financial data. The table should be read in conjunction with Item 7, Management's Discuss Item 8, Financial Statements and Supplementary Data, of this Annual Report on Form 10-K. Five-Year Financial Highlights $ in millions, except per share amounts Fiscal Year 2020(1) 2019 Consolidated Statements of Earnings Data Revenue $ 43,638 $ 42,879 Operating income 2,009 1,900 Net earnings from continuing operations 1,541 1,464 Gain from discontinued operations Net earnings 1,541 1,464 Per Share Data Diluted net earnings from continuing operations $ 5.75 $ 5.20 Net gain from discontinued operations Diluted net earnings 5.75 5.20 Cash dividends declared and paid 2.00 1.80 Operating Statistics Comparable sales growth(3) Gross profit rate Selling, general and administrative expenses rate Operating income rate Year-End Data Current ratio (4) 1.1 1.2 Total assets $ 15,591 $ 12,901 Debt, including current portion 1,271 1,388 Total equity 3,479 3,306 Number of stores Domestic(5) 1,009 1,026 International 222 212 Total 1.231 1,238 Retail square footage (in thousands) Domestic(5) 38,821 39,500 International 4,711 4,607 Total 43,532 44,107 (1) In the first quarter of fiscal 2020, we adopted new lease accounting guidance that resulted in the recognition of operating lease assets and operating lease liabilities 2.1 % 23.0 % 18.3 % 4.6% 4.8 % 23.2% 18.7 % 4.4 % Table of Contents Consolidated Balance Sheets $ in millions, except per share and share amounts February 1, 2020 February 2, 2019 $ $ 2.229 1,149 5,174 305 8,857 1,980 1,015 5,409 466 8,870 Assets Current assets Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Property and equipment Land and buildings Leasehold improvements Fixtures and equipment Property under capital and financing leases Property under finance leases Gross property and equipment Less accumulated depreciation Net property and equipment Operating lease assets Goodwill Other assets Total assets 650 2,203 6,286 637 2,119 5,865 579 9,200 6.690 2,510 89 9.228 6.900 2.328 2.709 984 713 15,591 915 606 12.901 5,257 290 446 482 982 Liabilities and equity Current liabilities Accounts payable Unredeemed gift card liabilities Deferred revenue Accrued compensation and related expenses Accrued liabilities Current portion of operating lease liabilities Current portion of long-term debt Total current liabilities Long-term operating lease liabilities Long-term liabilities Long-term debt Contingencies and commitments (Note 13) Equity Best Buy Co., Inc. Shareholders' Equity Preferred stock, $1.00 par value: Authorized 400,000 shares; Issued and outstanding none Common stock, $0.10 par value: Authorized 1.0 billion shares; Issued and outstanding 256,494,000 and 265,703,000 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive income Total equity Total liabilities and equity 5,288 281 501 410 906 660 14 8,060 2,138 657 1,257 56 7,513 750 1,332 26 27 3,158 295 3,479 15.591 2,985 294 3,306 12.901 See Notes to Consolidated Financial Statements

Gross profit ratio (5, 13)

Gross profit ratio (5, 13)