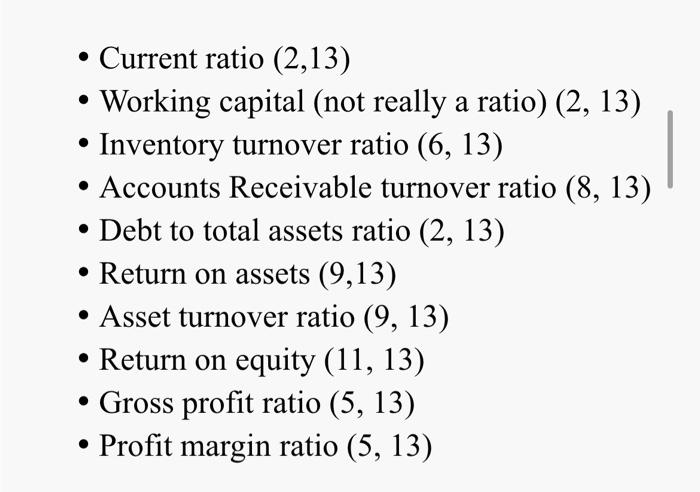

2. Using an Excel spreadsheet* and your company's financial statements, compute the following ratios for the most recent two years

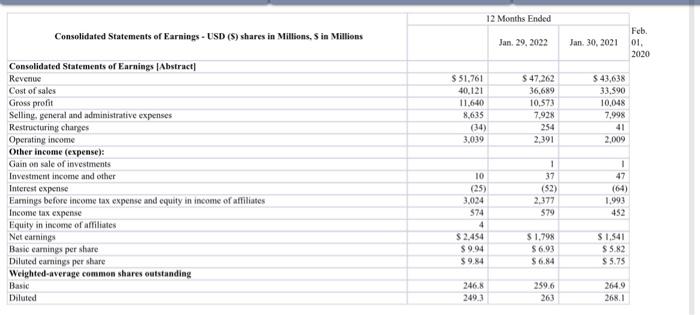

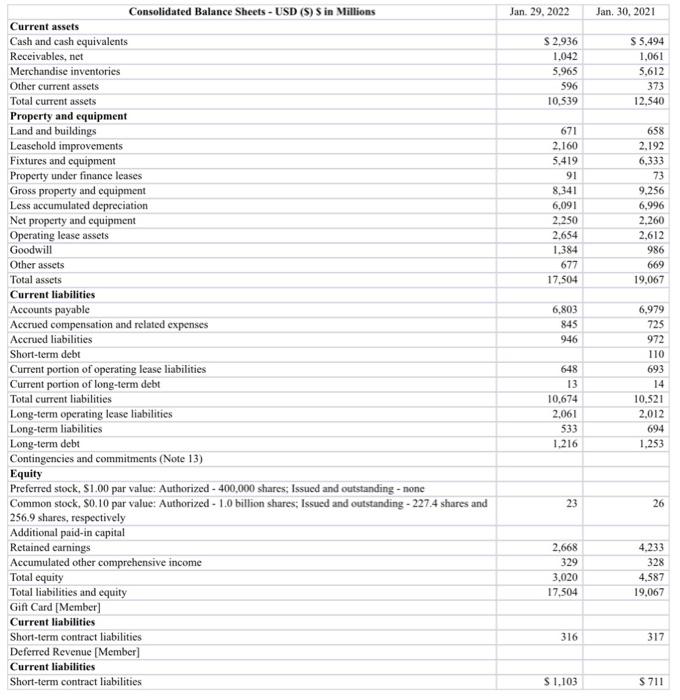

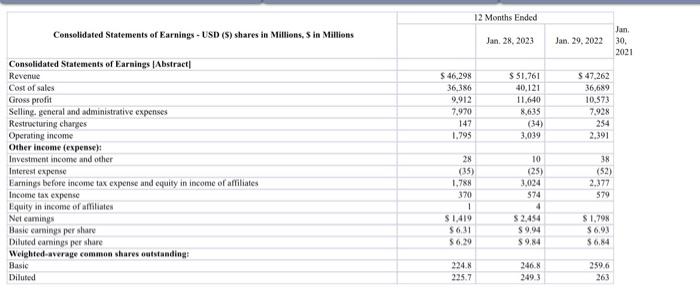

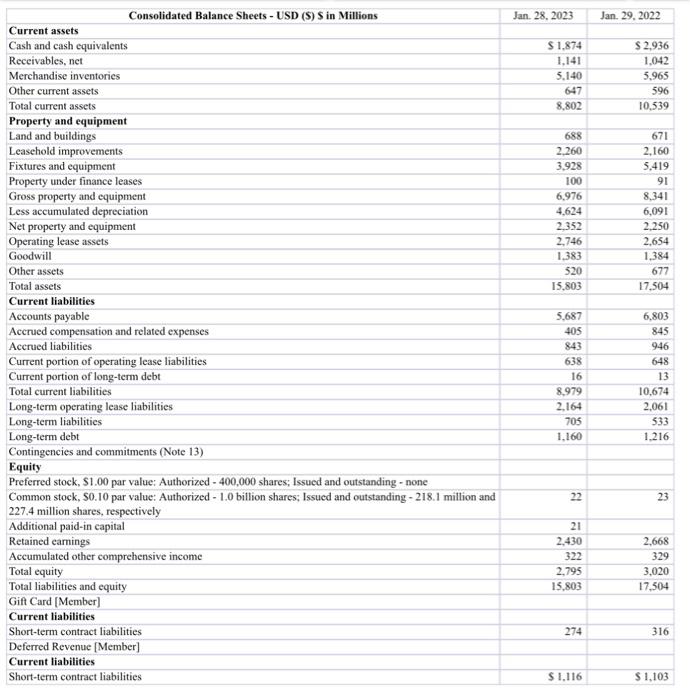

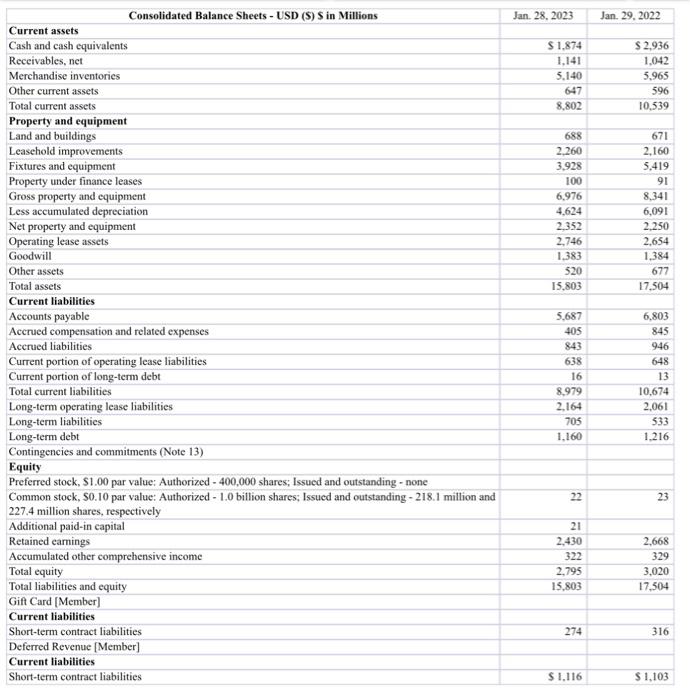

- Current ratio (2,13) - Working capital (not really a ratio) (2,13) - Inventory turnover ratio (6,13) - Accounts Receivable turnover ratio (8,13) - Debt to total assets ratio (2,13) - Return on assets (9,13) - Asset turnover ratio (9,13) - Return on equity (11,13) - Gross profit ratio (5,13) - Profit margin ratio (5,13) \begin{tabular}{|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Consolidated Statements of Earnings - USD (\$) shares in Millions, 5 in Millions } & \multicolumn{3}{|c|}{12 Months Ended } & \multirow[b]{2}{*}{\begin{tabular}{l} Feb \\ 01 \\ 202 \end{tabular}} \\ \hline & & Jan. 29,2022 & Jan. 30,2021 & \\ \hline \multicolumn{4}{|l|}{ Consolidated Statements of Earnings [Abstract] } & \\ \hline Revenue & $51,761 & $47,262 & $43,638 & \\ \hline Cost of sales & 40,121 & 36,689 & 33,590 & \\ \hline Gross profit & 11,640 & 10,573 & 10,048 & \\ \hline Selling. general and administrative expenses & 8,635 & 7,928 & 7,998 & \\ \hline Restructuring charges & (34) & 254 & 41 & \\ \hline Operating income & 3,039 & 2,391 & 2,009 & \\ \hline \multicolumn{4}{|l|}{ Other income (expense): } & \\ \hline Gain on sale of investments & & 1 & 1 & \\ \hline Investment income and other & 10 & 37 & 47 & \\ \hline Interest expense & (25) & (52) & (64) & \\ \hline Eamings before income tax expense and equity in income of aftiliates & 3.024 & 2,377 & 1,993 & \\ \hline Income tax expense & 574 & 579 & 452 & \\ \hline Equity in income of affiliates & 4 & & & \\ \hline Net earnings & $2,454 & $1,798 & $1,541 & \\ \hline Basic earnings per share & $9.94 & $6.93 & $5.82 & \\ \hline Diluted earnings per share & $9.84 & $6.84 & $5.75 & \\ \hline \multicolumn{4}{|l|}{ Weighted-average commes shares outstandiag } & \\ \hline Basic & 246.8 & 259.6 & 264.9 & \\ \hline Diluted & 249.3 & 263 & 268.1 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Consolidated Balance Sheets - USD (\$) S in Millions & Jan. 29,2022 & Jan. 30,2021 \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & $2,936 & $5,494 \\ \hline Receivables, net & 1,042 & 1,061 \\ \hline Merchandise inventories & 5,965 & 5,612 \\ \hline Other current assets & 596 & 373 \\ \hline Total current assets & 10,539 & 12,540 \\ \hline \multicolumn{3}{|l|}{ Property and equipment } \\ \hline Land and buildings & 671 & 658 \\ \hline Leaschold improvements & 2,160 & 2,192 \\ \hline Fixtures and equipment & 5,419 & 6,333 \\ \hline Property under finance leases & 91 & 73 \\ \hline Gross property and equipment & 8,341 & 9.256 \\ \hline Less accumulated depreciation & 6,091 & 6,996 \\ \hline Net property and equipment & 2,250 & 2,260 \\ \hline Operating lease assets & 2,654 & 2,612 \\ \hline Goodwill & 1.384 & 986 \\ \hline Other assets & 677 & 669 \\ \hline Total assets & 17,504 & 19,067 \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Accounts payable & 6,803 & 6,979 \\ \hline Accrued compensation and related expenses & 845 & 725 \\ \hline Accrued liabilities & 946 & 972 \\ \hline Short-term debt & & 110 \\ \hline Current portion of operating lease liabilities & 648 & 693 \\ \hline Current portion of long-term debt & 13 & 14 \\ \hline Total current liabilities & 10,674 & 10.521 \\ \hline Long-term operating lease liabilities & 2,061 & 2,012 \\ \hline Long-term liabilities & 533 & 694 \\ \hline Long-term debt & 1,216 & 1,253 \\ \hline \multicolumn{3}{|l|}{ Contingencies and commitments (Note 13) } \\ \hline \multicolumn{3}{|l|}{ Equity } \\ \hline \multicolumn{3}{|l|}{ Preferred stock, $1.00 par value: Authorized - 400,000 shares; Issued and outstanding - none } \\ \hline \begin{tabular}{l} Common stock, 50.10 par value: Authorized - 1.0 billion shares; Issued and outstanding - 227.4 shares and \\ 256.9 shares, respectively \end{tabular} & 23 & 26 \\ \hline \multicolumn{3}{|l|}{ Additional paid-in capital } \\ \hline Retained earnings & 2,668 & 4,233 \\ \hline Accumulated other comprehensive income & 329 & 328 \\ \hline Total equity & 3,020 & 4,587 \\ \hline Total liabilities and equity & 17,504 & 19,067 \\ \hline \multicolumn{3}{|l|}{ Gift Card [Member] } \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Short-term contract liabilities & 316 & 317 \\ \hline \multicolumn{3}{|l|}{ Deferred Revenue [Member] } \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Short-term contract liabilities & $1,103 & $711 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Consolidated Balance Sheets - USD (S) S in Millions & Jan28,2023 & Jan. 29,2022 \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & $1,874 & $2,936 \\ \hline Receivables, net & 1,141 & 1,042 \\ \hline Merchandise inventories & 5,140 & 5,965 \\ \hline Other current assets & 647 & 596 \\ \hline Total current assets & 8,802 & 10,539 \\ \hline \multicolumn{3}{|l|}{ Property and equipment } \\ \hline Land and buildings & 688 & 671 \\ \hline Leasehold improvements & 2,260 & 2,160 \\ \hline Fixtures and equipment & 3,928 & 5,419 \\ \hline Property under finance leases & 100 & 91 \\ \hline Gross property and equipment & 6,976 & 8,341 \\ \hline Less accumulated depreciation & 4,624 & 6,091 \\ \hline Net property and equipment & 2,352 & 2,250 \\ \hline Operating lease assets & 2,746 & 2,654 \\ \hline Goodwill & 1,383 & 1,384 \\ \hline Other assets & 520 & 677 \\ \hline Total assets & I5,803 & 17,504 \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Accounts payable & 5,687 & 6,803 \\ \hline Accrued compensation and related expenses & 405 & 845 \\ \hline Accrued liabilities & 843 & 946 \\ \hline Current portion of operating lease liabilities & 638 & 648 \\ \hline Current portion of long-term debt & 16 & 13 \\ \hline Total current liabilities & 8,979 & 10,674 \\ \hline Long-term operating lease liabilities & 2,164 & 2,061 \\ \hline Long-term liabilities & 705 & 533 \\ \hline Long-term debt & 1,160 & 1,216 \\ \hline \multicolumn{3}{|l|}{ Contingencies and commitments (Note 13) } \\ \hline \multicolumn{3}{|l|}{ Equity } \\ \hline \multicolumn{3}{|l|}{ Preferred stock, \$1.00 par value: Authorized - 400,000 shares; Issued and outstanding - none } \\ \hline \begin{tabular}{l} Common stock, 50.10 par value: Authorized - 1.0 billion shares; Issued and outstanding - 218.1 million and \\ 227.4 million shares, respectively \end{tabular} & 22 & 23 \\ \hline Additional paid-in capital & 21 & \\ \hline Retained earnings & 2,430 & 2,668 \\ \hline Accumulated other comprehensive income & 322 & 329 \\ \hline Total equity & 2,795 & 3,020 \\ \hline Total liabilities and equity & 15,803 & 17,504 \\ \hline \multicolumn{3}{|l|}{ Gift Card [Member] } \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Short-term contract liabilities & 274 & 316 \\ \hline \multicolumn{3}{|l|}{ Deferred Revenue [Member] } \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Short-term contract liabilities & $1,116 & $1,103 \\ \hline \end{tabular}