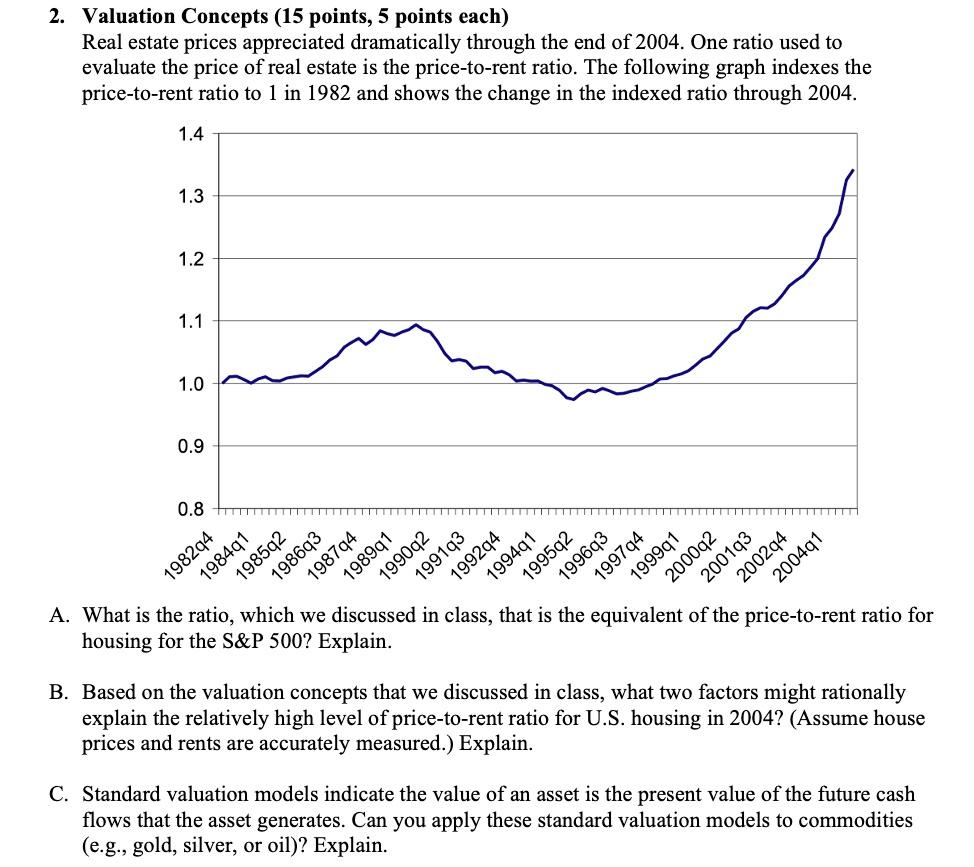

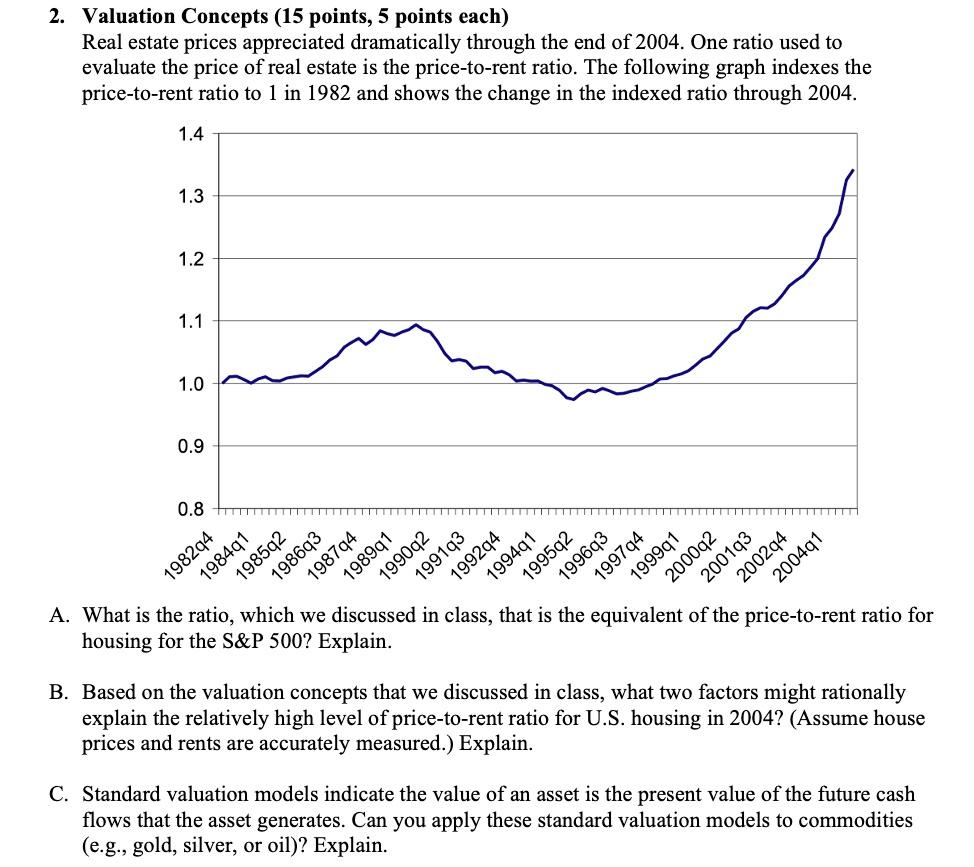

2. Valuation Concepts (15 points, 5 points each) Real estate prices appreciated dramatically through the end of 2004. One ratio used to evaluate the price of real estate is the price-to-rent ratio. The following graph indexes the price-to-rent ratio to 1 in 1982 and shows the change in the indexed ratio through 2004. 1.4 1.3 1.2 1.1 1.0 0.9 0.8 198294 198592 198794 1989q1 199294 20002 200294 1984q1 198693 1994q1 1999q1 2001q3 2004q1 1990q2 1991q3 A. What is the ratio, which we discussed in class, that is the equivalent of the price-to-rent ratio for housing for the S&P 500? Explain. B. Based on the valuation concepts that we discussed in class, what two factors might rationally explain the relatively high level of price-to-rent ratio for U.S. housing in 2004? (Assume house prices and rents are accurately measured.) Explain. C. Standard valuation models indicate the value of an asset is the present value of the future cash flows that the asset generates. Can you apply these standard valuation models to commodities (e.g., gold, silver, or oil)? Explain. 2. Valuation Concepts (15 points, 5 points each) Real estate prices appreciated dramatically through the end of 2004. One ratio used to evaluate the price of real estate is the price-to-rent ratio. The following graph indexes the price-to-rent ratio to 1 in 1982 and shows the change in the indexed ratio through 2004. 1.4 1.3 1.2 1.1 1.0 0.9 0.8 198294 198592 198794 1989q1 199294 20002 200294 1984q1 198693 1994q1 1999q1 2001q3 2004q1 1990q2 1991q3 A. What is the ratio, which we discussed in class, that is the equivalent of the price-to-rent ratio for housing for the S&P 500? Explain. B. Based on the valuation concepts that we discussed in class, what two factors might rationally explain the relatively high level of price-to-rent ratio for U.S. housing in 2004? (Assume house prices and rents are accurately measured.) Explain. C. Standard valuation models indicate the value of an asset is the present value of the future cash flows that the asset generates. Can you apply these standard valuation models to commodities (e.g., gold, silver, or oil)? Explain