Answered step by step

Verified Expert Solution

Question

1 Approved Answer

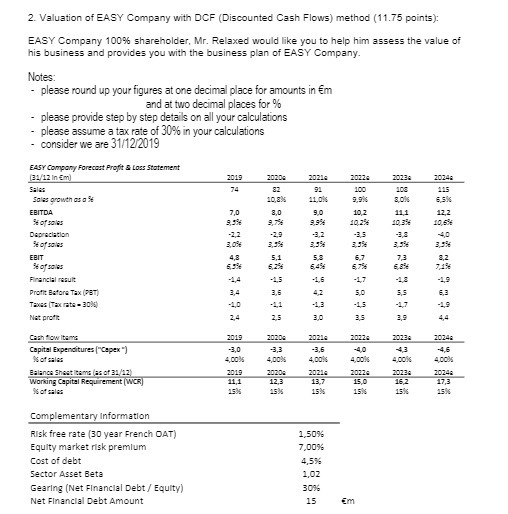

2. Valuation of EASY Company with DCF (Discounted Cash Flows) method (11.75 points): EASY Company 100% shareholder, Mr. Relaxed would like you to help

2. Valuation of EASY Company with DCF (Discounted Cash Flows) method (11.75 points): EASY Company 100% shareholder, Mr. Relaxed would like you to help him assess the value of his business and provides you with the business plan of EASY Company. Notes: - please round up your figures at one decimal place for amounts in m and at two decimal places for % please provide step by step details on all your calculations please assume a tax rate of 30% in your calculations - consider we are 31/12/2019 EASY Company Forecast Profit & Loss Statement (31/12 Inm) Sales Sales growth as a % 2019 2020 2021 2022 2023 2024 74 82 91 100 108 115 10,8% 11,0% 9,9% 3,0% 6,5% EBITDA 36 of sales 7,0 8,0 9,0 10,2 111 12,2 9.356 9,7% 9.9% 10.2% 10.356 10,6% Depreciation % of sales EBIT -2,2 -2.9 -3,2 -3,5 SE- -4,0 3.0% 3,3% 3.5% 3,5% 3,556 3,356 4,8 5,1 5,3 6,7 7,3 8,2 Sofas 6.356 6,2% 6.4% 6.7% 6,856 7,156 Financial result -1,4 -1,5 -1,5 -1,7 -18 -19 Profit Before Tax (PBT) 3,4 3,6 4,2 5,0 5,5 6,3 Taxes (Taxrate=309) -1,0 -11 -1,3 -15 -17 -19 Net profit 2,4 2,5 3,0 3,5 3,9 4,4 Cashflow Items 2019 2020 2021 2022 2023 2024 Capital Expenditures ("Capex") -3,0 -3,3 -3,6 -4,0 4,3 -4,6 % of sales 4,00% 4,00% 4,00% 4,00% 4,00% 4,00% Balance Sheet Items (as of 31/12) 2019 2020 2021 2022 20234 20244 Working Capital Requirement (WCR) 11,1 12,3 13,7 15,0 16,2 17,3 % of sales 15% 15% 15% 15% 15% 15% Complementary Information Risk free rate (30 year French OAT) Equity market risk premium Cost of debt Sector Asset Beta 1,50% 7,00% 4,5% 1,02 Gearing (Net Financial Debt/Equity) 30% Net Financial Debt Amount 15 Em

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the valuation of EASY Company using the Discounted Cash Flow DCF method we need to esti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started