Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) Venus Foods Inc is considering introducing a new line of dried flowers. The firm expects to be able to generate $ 4 million in

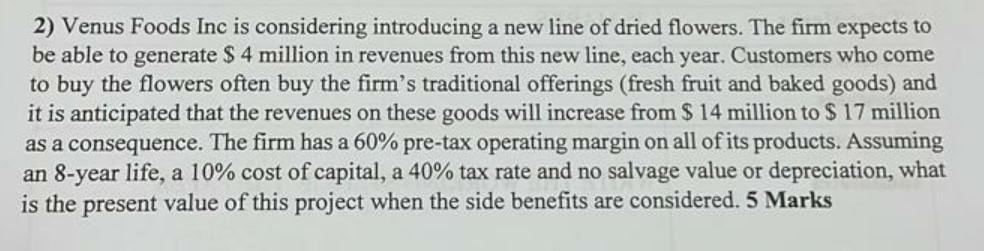

2) Venus Foods Inc is considering introducing a new line of dried flowers. The firm expects to be able to generate $ 4 million in revenues from this new line, each year. Customers who come to buy the flowers often buy the firm's traditional offerings (fresh fruit and baked goods) and it is anticipated that the revenues on these goods will increase from $ 14 million to $ 17 million as a consequence. The firm has a 60% pre-tax operating margin on all of its products. Assuming an 8-year life, a 10% cost of capital, a 40% tax rate and no salvage value or depreciation, what is the present value of this project when the side benefits are considered. 5 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started