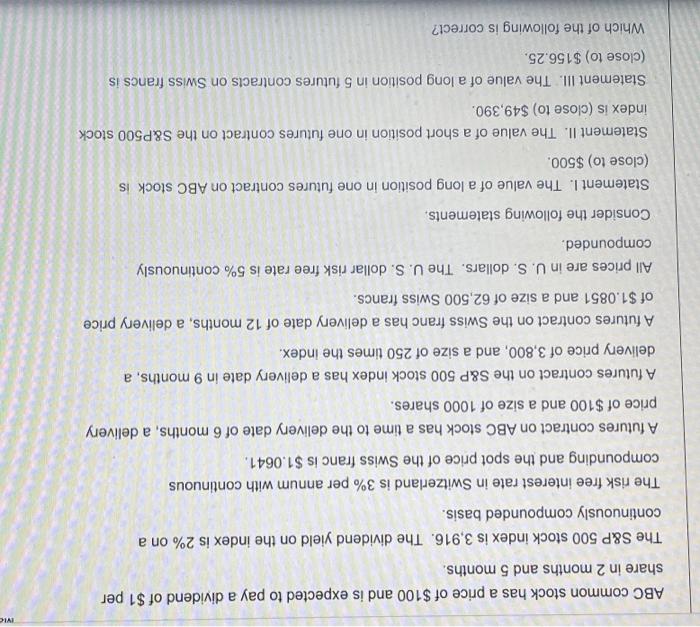

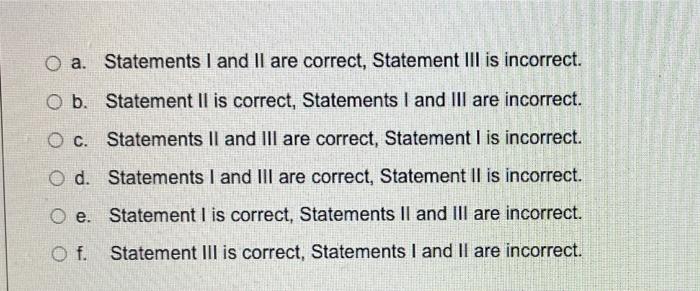

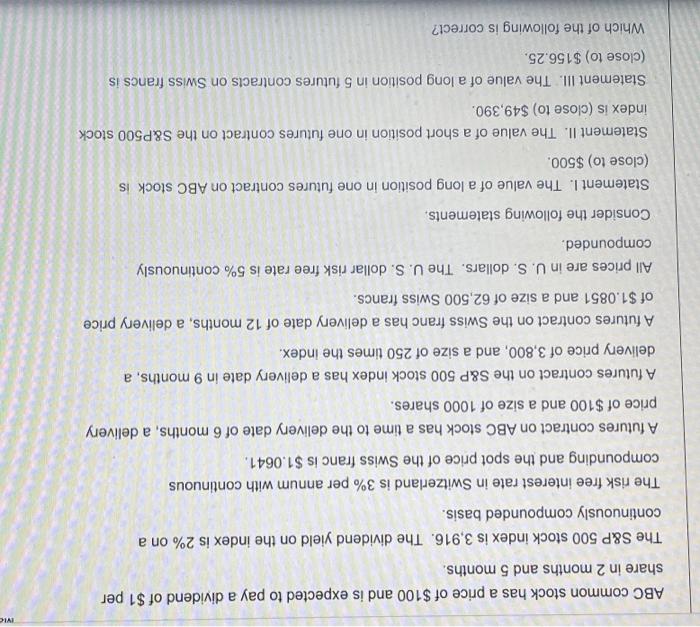

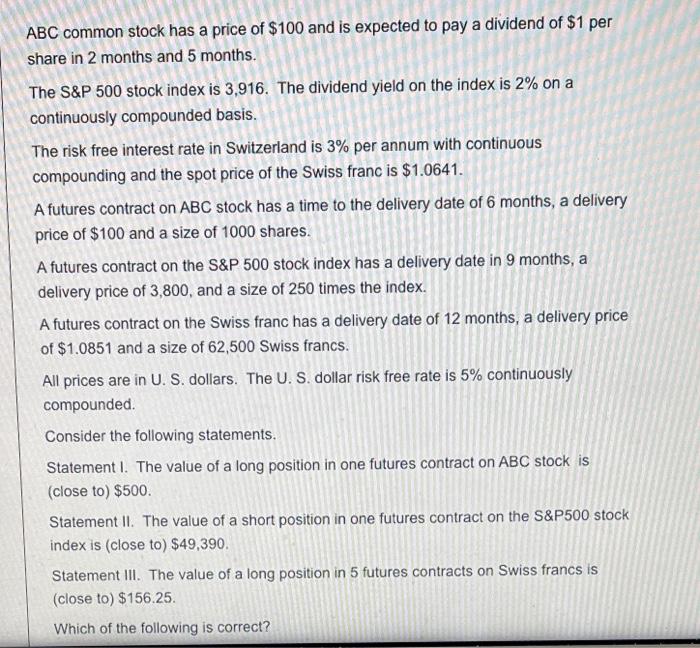

vid ABC common stock has a price of $100 and is expected to pay a dividend of $1 per share in 2 months and 5 months. The S&P 500 stock index is 3,916. The dividend yield on the index is 2% on a continuously compounded basis. The risk free interest rate in Switzerland is 3% per annum with continuous compounding and the spot price of the Swiss franc is $1.0641. A futures contract on ABC stock has a time to the delivery date of 6 months, a delivery price of $100 and a size of 1000 shares. A futures contract on the S&P 500 stock index has a delivery date in 9 months, a delivery price of 3,800, and a size of 250 times the index. A futures contract on the Swiss franc has a delivery date of 12 months, a delivery price of $1.0851 and a size of 62,500 Swiss francs. All prices are in U.S. dollars. The U. S. dollar risk free rate is 5% continuously compounded. Consider the following statements. Statement I. The value of a long position in one futures contract on ABC stock is (close to) $500. Statement II. The value of a short position in one futures contract on the S&P500 stock index is (close to) $49,390. Statement III. The value of a long position in 5 futures contracts on Swiss francs is (close to) $156.25. Which of the following is correct? O a. Statements I and II are correct, Statement III is incorrect. O b. Statement Il is correct, Statements I and Ill are incorrect. O c. Statements II and III are correct, Statement I is incorrect. O d. Statements I and III are correct, Statement II is incorrect. O e. Statement is correct, Statements II and Ill are incorrect. Of. Statement III is correct, Statements I and II are incorrect. ABC common stock has a price of $100 and is expected to pay a dividend of $1 per share in 2 months and 5 months. The S&P 500 stock index is 3,916. The dividend yield on the index is 2% on a continuously compounded basis. The risk free interest rate in Switzerland is 3% per annum with continuous compounding and the spot price of the Swiss franc is $1.0641. A futures contract on ABC stock has a time to the delivery date of 6 months, a delivery price of $100 and a size of 1000 shares. A futures contract on the S&P 500 stock index has a delivery date in 9 months, a delivery price of 3,800, and a size of 250 times the index. A futures contract on the Swiss franc has a delivery date of 12 months, a delivery price of $1.0851 and a size of 62,500 Swiss francs. All prices are in U. S. dollars. The U. S. dollar risk free rate is 5% continuously compounded. Consider the following statements. Statement 1. The value of a long position in one futures contract on ABC stock is (close to) $500. Statement II. The value of a short position in one futures contract on the S&P500 stock index is (close to) $49,390. Statement III. The value of a long position in 5 futures contracts on Swiss francs is (close to) $156.25 Which of the following is correct