Question

2. We classify a lease as a finance lease if: Multiple Choice the lessee obtains control of the use of the asset. the usual risks

2.

2.

We classify a lease as a finance lease if:

Multiple Choice

-

the lessee obtains control of the use of the asset.

-

the usual risks and rewards are retained by the lessor.

-

the present value of lease payments is less than the asset's book value.

-

the present value of lease payments is less than the asset's fair value.

3.

From the perspective of the lessee, leases may be classified as either:

Multiple Choice

-

Sales-type or operating.

-

Finance or operating.

-

Finance or sales-type without selling profit.

-

Sales-type without selling profit or sales-type with selling profit.

4.

In a finance lease:

Multiple Choice

-

the lessee records an asset and a liability for the total of the lease payments.

-

the lessee records an asset and a liability for the present value of lease payments.

-

the lessor records an asset and a liability for the present value of lease payments.

-

the lessor records an asset and a liability for the total of the lease payments.

5.

A Co. recorded a right-of-use asset of $400,000 in a 10-year operating lease. Payments of $65,100 are made annually at the end of each year. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset after the first year will be:

rev: 01_07_2020_QC_CS-194706

Multiple Choice

-

$376,900.

-

$360,000.

-

$374,900.

-

$400,000.

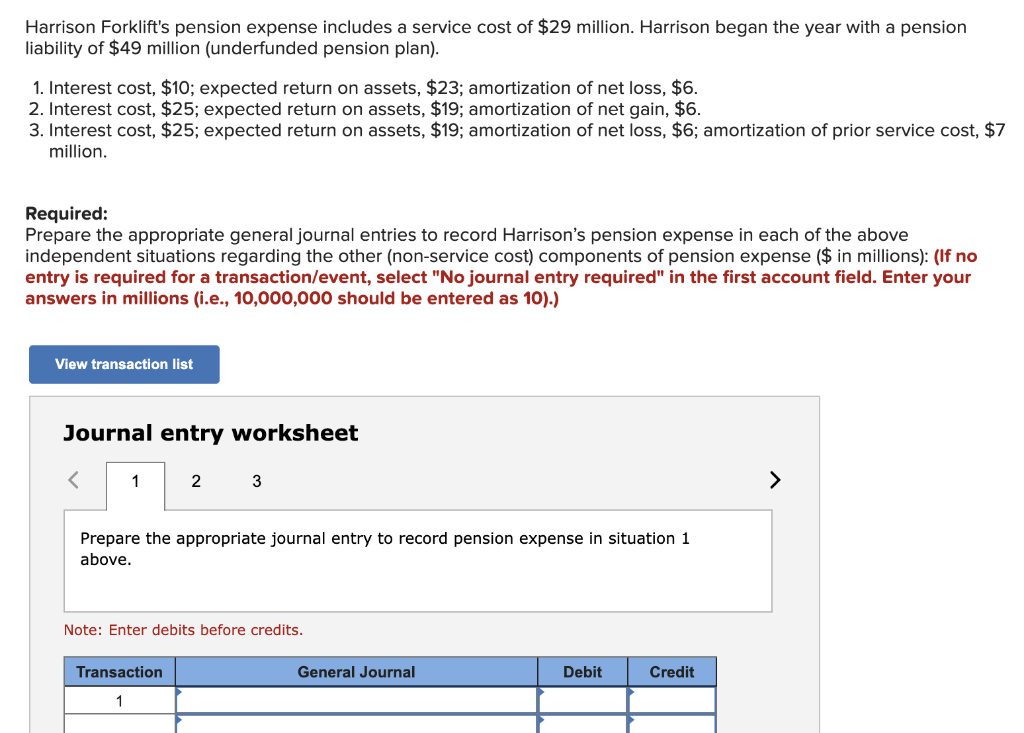

Harrison Forklift's pension expense includes a service cost of $29 million. Harrison began the year with a pension liability of $49 million (underfunded pension plan). 1. Interest cost, $10; expected return on assets, $23; amortization of net loss, $6. 2. Interest cost, $25; expected return on assets, $19; amortization of net gain, $6. 3. Interest cost, $25; expected return on assets, $19; amortization of net loss, $6; amortization of prior service cost, $7 million. Required: Prepare the appropriate general journal entries to record Harrison's pension expense in each of the above independent situations regarding the other (non-service cost) components of pension expense ($ in millions): (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started