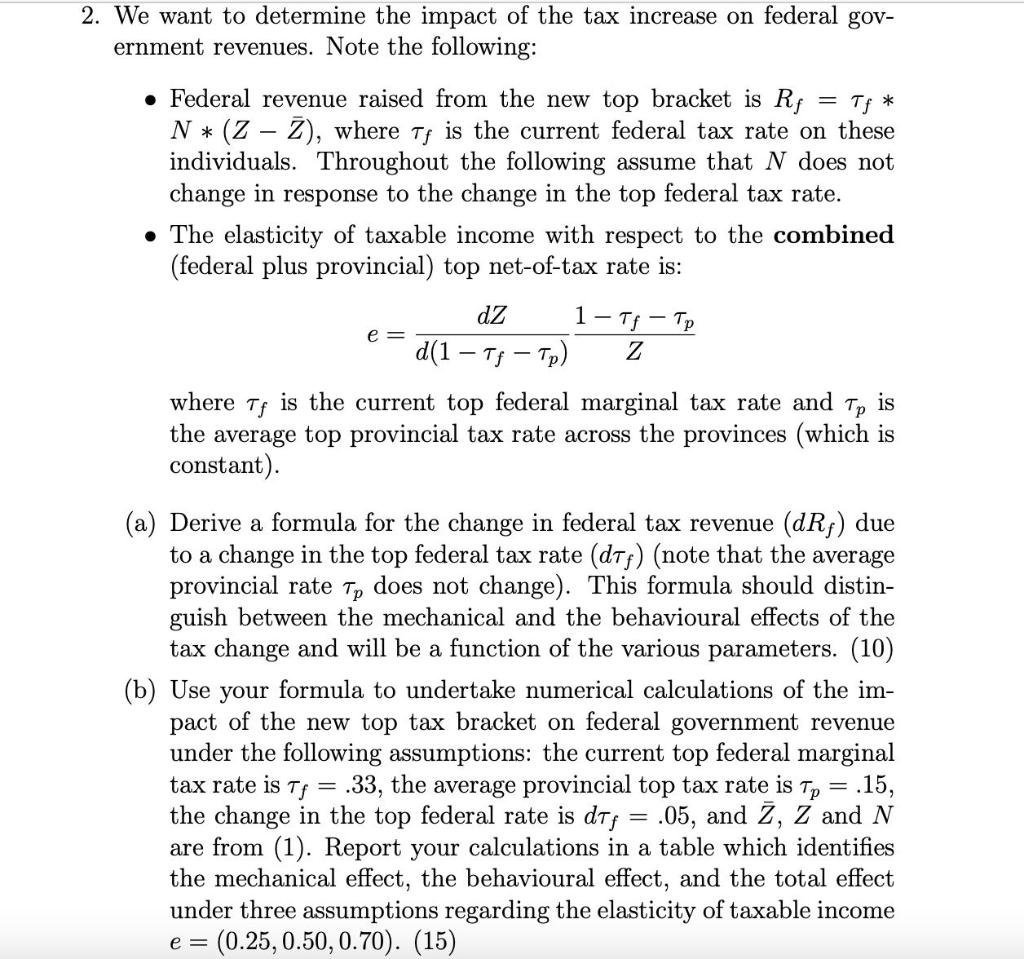

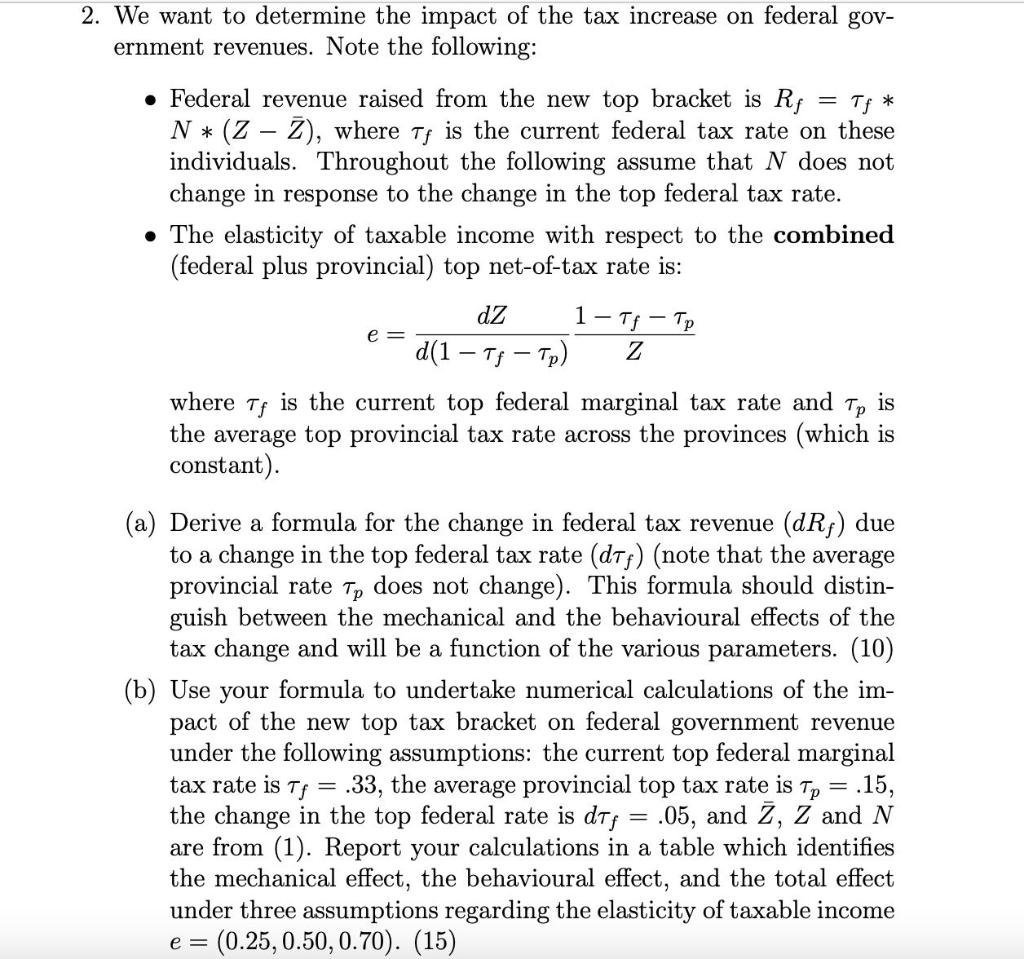

2. We want to determine the impact of the tax increase on federal gov- ernment revenues. Note the following: - Federal revenue raised from the new top bracket is Rf = Tf * N * (Z - Z), where tf is the current federal tax rate on these individuals. Throughout the following assume that N does not change in response to the change in the top federal tax rate. The elasticity of taxable income with respect to the combined (federal plus provincial) top net-of-tax rate is: dZ 1- Tf - Tp d(1 Tf - Tp) Z where f is the current top federal marginal tax rate and Tp is the average top provincial tax rate across the provinces (which is constant). e = (a) Derive a formula for the change in federal tax revenue (dRf) due to a change in the top federal tax rate (dTf) (note that the average provincial rate Tp does not change). This formula should distin- guish between the mechanical and the behavioural effects of the tax change and will be a function of the various parameters. (10) (b) Use your formula to undertake numerical calculations of the im- pact of the new top tax bracket on federal government revenue under the following assumptions: the current top federal marginal tax rate is Tg = .33, the average provincial top tax rate is Tp .15, the change in the top federal rate is dtf .05, and Z, Z and N are from (1). Report your calculations in a table which identifies the mechanical effect, the behavioural effect, and the total effect under three assumptions regarding the elasticity of taxable income = (0.25, 0.50, 0.70). (15) e = 2. We want to determine the impact of the tax increase on federal gov- ernment revenues. Note the following: - Federal revenue raised from the new top bracket is Rf = Tf * N * (Z - Z), where tf is the current federal tax rate on these individuals. Throughout the following assume that N does not change in response to the change in the top federal tax rate. The elasticity of taxable income with respect to the combined (federal plus provincial) top net-of-tax rate is: dZ 1- Tf - Tp d(1 Tf - Tp) Z where f is the current top federal marginal tax rate and Tp is the average top provincial tax rate across the provinces (which is constant). e = (a) Derive a formula for the change in federal tax revenue (dRf) due to a change in the top federal tax rate (dTf) (note that the average provincial rate Tp does not change). This formula should distin- guish between the mechanical and the behavioural effects of the tax change and will be a function of the various parameters. (10) (b) Use your formula to undertake numerical calculations of the im- pact of the new top tax bracket on federal government revenue under the following assumptions: the current top federal marginal tax rate is Tg = .33, the average provincial top tax rate is Tp .15, the change in the top federal rate is dtf .05, and Z, Z and N are from (1). Report your calculations in a table which identifies the mechanical effect, the behavioural effect, and the total effect under three assumptions regarding the elasticity of taxable income = (0.25, 0.50, 0.70). (15) e =