Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. We want to determine the impact of the tax increase on federal gov- ernment revenues. Note the following: Federal revenue raised from the

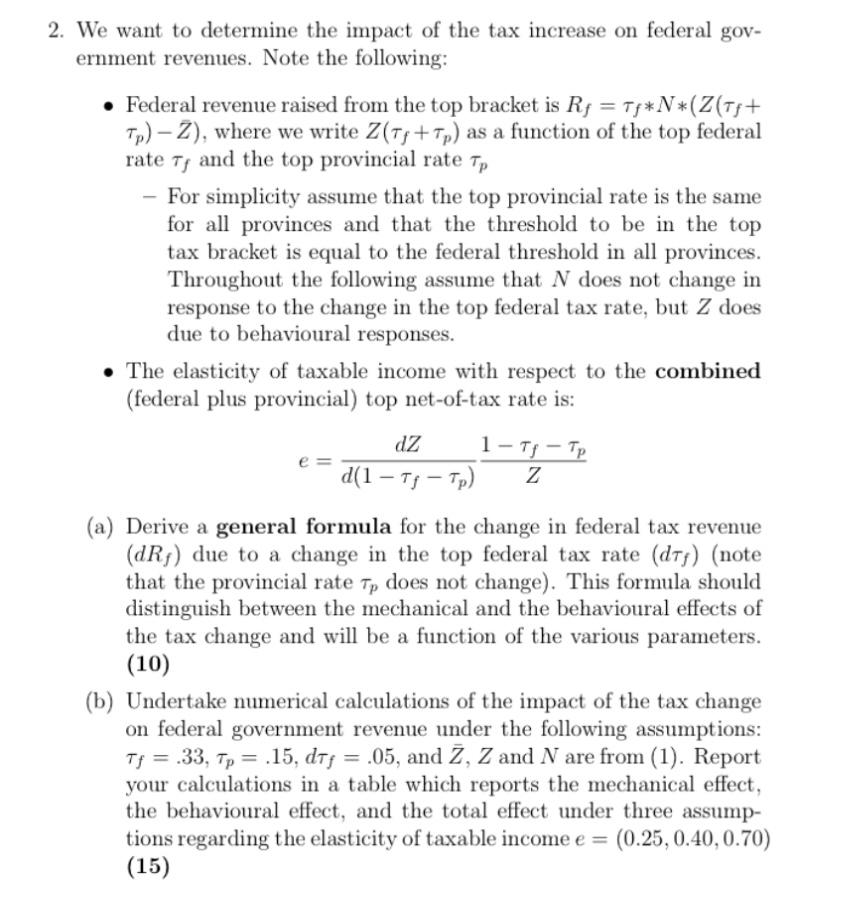

2. We want to determine the impact of the tax increase on federal gov- ernment revenues. Note the following: Federal revenue raised from the top bracket is Rf = Tf*N*(Z(T+ Tp)-Z), where we write Z(T+Tp) as a function of the top federal rate 7 and the top provincial rate Tp - For simplicity assume that the top provincial rate is the same for all provinces and that the threshold to be in the top tax bracket is equal to the federal threshold in all provinces. Throughout the following assume that N does not change in response to the change in the top federal tax rate, but Z does due to behavioural responses. The elasticity of taxable income with respect to the combined (federal plus provincial) top net-of-tax rate is: dz d(1 - Tj - Tp) 1- Tf - Tp Z (a) Derive a general formula for the change in federal tax revenue (dR) due to a change in the top federal tax rate (dry) (note that the provincial rate Tp does not change). This formula should distinguish between the mechanical and the behavioural effects of the tax change and will be a function of the various parameters. (10) == (b) Undertake numerical calculations of the impact of the tax change on federal government revenue under the following assumptions: Tf = .33, Tp = .15, dr;= .05, and Z, Z and N are from (1). Report your calculations in a table which reports the mechanical effect, the behavioural effect, and the total effect under three assump- tions regarding the elasticity of taxable income e = (0.25, 0.40, 0.70) (15)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started