Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[Q: 21-6657664] Real Options with the Binomial Model. A construction company owns the right to build an office building in downtown Sacramento over the

![[Q: 21-6657664] Real Options with the Binomial Model. A construction company owns the right to build an office building in do](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/6318818a4b506_1662550410298.jpg)

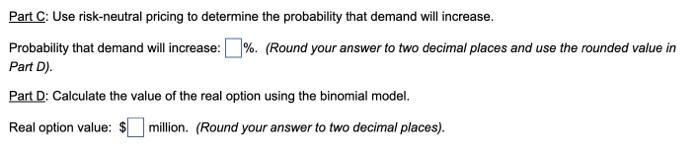

[Q: 21-6657664] Real Options with the Binomial Model. A construction company owns the right to build an office building in downtown Sacramento over the next year. The building would cost $44 million to construct. Due to low demand for office space, the office building would be worth $42.9 million today. If demand increases, the building would be worth $46.6 million in one year. If demand decreases, the building would be worth $39.6 million in one year. The company can borrow and lend at the risk-free annual effective rate of 5.5%. Use the binomial model to determine the value of the company's real option. Part A: Calculate the rate of return on the office building for each scenario. Rate of return if demand increases: %. (Round your answer to two decimal places and use the rounded value in Parts C and D). Rate of return if demand decreases:%. (Round your answer to two decimal places and use the rounded value in Parts C and D). Part B: Calculate the two potential payoffs for the option at expiration. Hint: you'll want to think about whether the option to build is a call option or a put option and what the exercise price is. million. (Round your answer to two decimal places and use the rounded value in Parts Payoff if demand increases: $ C and D). Payoff if demand decreases: $ Parts C and D). million. (Round your answer to two decimal places and use the rounded value in Part C: Use risk-neutral pricing to determine the probability that demand will increase. Probability that demand will increase: %. (Round your answer to two decimal places and use the rounded value in Part D). Part D: Calculate the value of the real option using the binomial model. Real option value: $ million. (Round your answer to two decimal places).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 13 Part A Rate of Return if Demand Increase Iu Wor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started