Question

Mr. Gilbert is self-employed and makes annual contributions to a Keogh plan. Mrs. Gilbert's employer doesn't offer any type of qualified retirement plan. Each

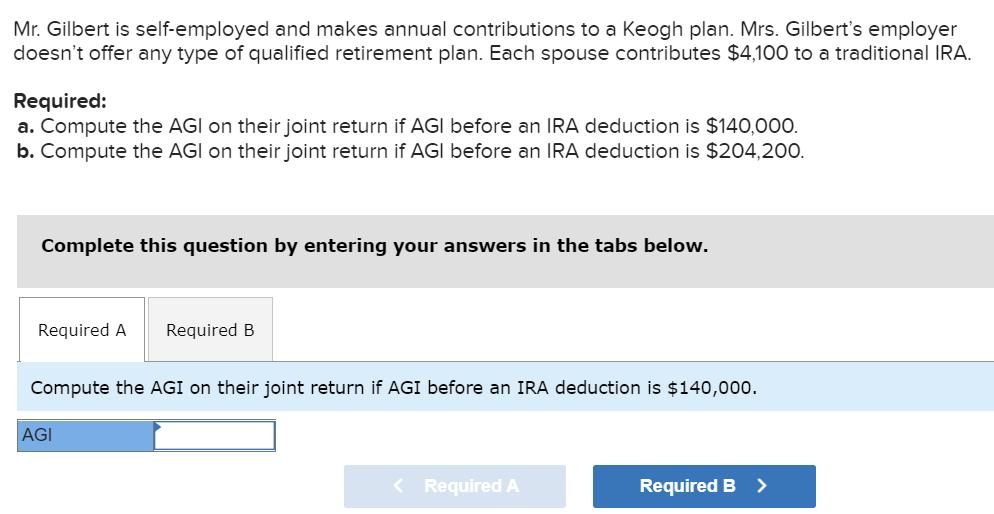

Mr. Gilbert is self-employed and makes annual contributions to a Keogh plan. Mrs. Gilbert's employer doesn't offer any type of qualified retirement plan. Each spouse contributes $4,100 to a traditional IRA. Required: a. Compute the AGI on their joint return if AGI before an IRA deduction is $140,000. b. Compute the AGI on their joint return if AGI before an IRA deduction is $204,200. Complete this question by entering your answers in the tabs below. Required A Required B Compute the AGI on their joint return if AGI before an IRA deduction is $140,000. AGI < Required A Required B >

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a As the adjusted gross income is more thn 110000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematical Interest Theory

Authors: Leslie Jane, James Daniel, Federer Vaaler

3rd Edition

147046568X, 978-1470465681

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App