Answered step by step

Verified Expert Solution

Question

1 Approved Answer

returns from customers result in the goods being returned to inventory; the inventory is and ending imventory under (2) Which inventory cost flow method

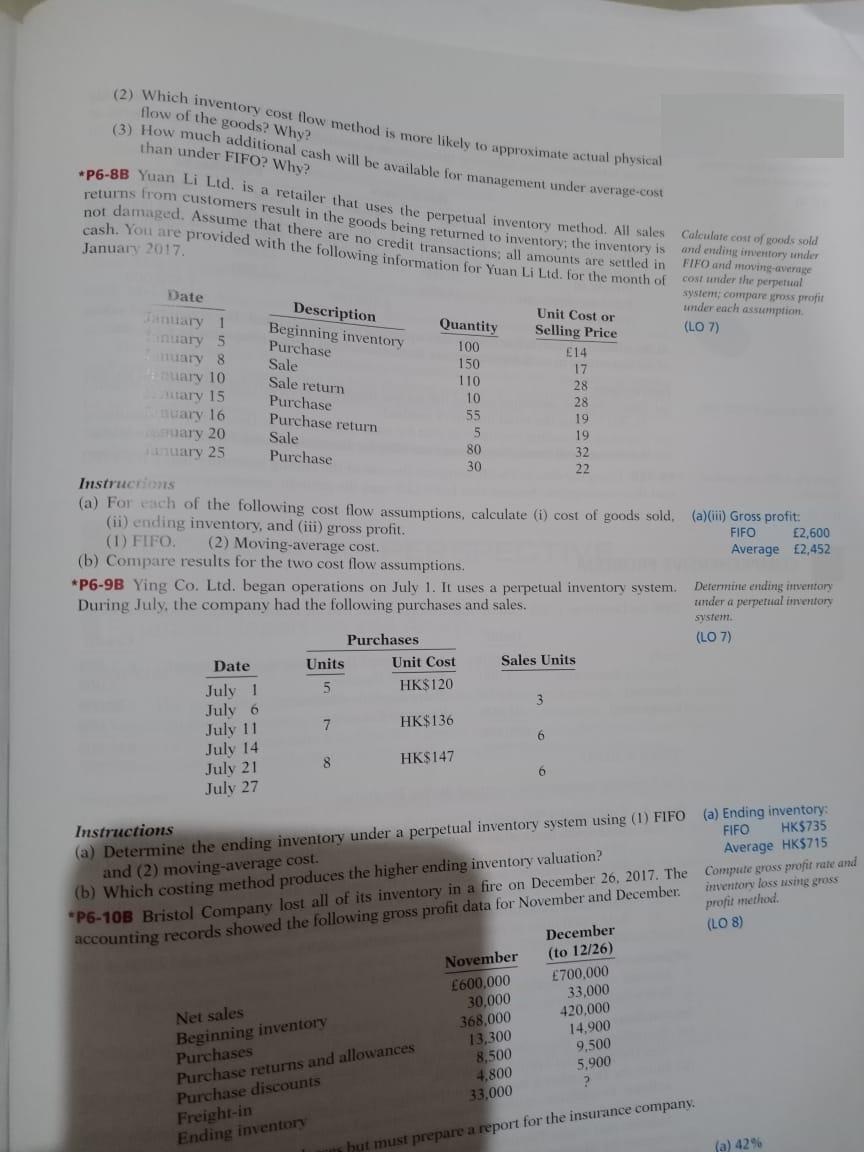

returns from customers result in the goods being returned to inventory; the inventory is and ending imventory under (2) Which inventory cost flow method is more likely to approximate actual physican flow of the goods? Why? (3) How much additional cash will be available for management under average-cost than under FIFO? Why? P6-8B Yuan Li Ltd. is a retailer that uses the perpetual inventory method. All sales not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Yuan Li Ltd. for the month of Calculate cost of goods sold January 2017. FIFO and moving-average cost under the perpetual system; compare gross profit under each assumption. Date Description Beginning inventory Purchase Unit Cost or January 1 Tanuary 5 Quantity Selling Price (LO 7) 100 E14 muary 8 nuary 10 Sale Sale return 150 17 110 28 tary 15 nuary 16 10 Purchase Purchase return Sale Purchase 28 55 19 uary 20 nuary 25 5 19 80 32 30 22 Instructions (a) For each of the following cost flow assumptions, calculate (i) cost of goods sold, (a)(iii) Gross profit: (ii) ending inventory, and (iii) gross profit. (1) FIFO. (b) Compare results for the two cost flow assumptions. FIFO 2,600 (2) Moving-average cost. Average 2,452 *P6-9B Ying Co. Ltd. began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Determine ending inventory under a perpetual imventory system. Purchases (LO 7) Date Units Unit Cost Sales Units July 1 5. HK$120 3 July 6 7 HK$136 July 11 July 14 July 21 6. HK$147 July 27 Instructions (a) Determine the ending inventory under a perpetual inventory system using (1) FIFO (a) Ending inventory: and (2) moving-average cost. (b) Which costing method produces the higher ending inventory valuation? "P6-10B Bristol Company lost all of its inventory in a fire on December 26, 2017. The Compute gross profit rate and accounting records showed the following gross profit data for November and December. FIFO HK$735 Average HK$715 inventory loss using gross profit method. (LO 8) December November 600,000 30,000 368,000 13,300 8,500 4,800 33,000 (to 12/26) 700,000 33,000 420,000 14,900 9,500 5,900 Net sales Beginning inventory Purchases Purchase returns and allowances Purchase discounts Freight-in Ending inventory but must prepare a report for the insurance company. (a) 42%

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

computation ending Inventory under FIFO method Totalco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started