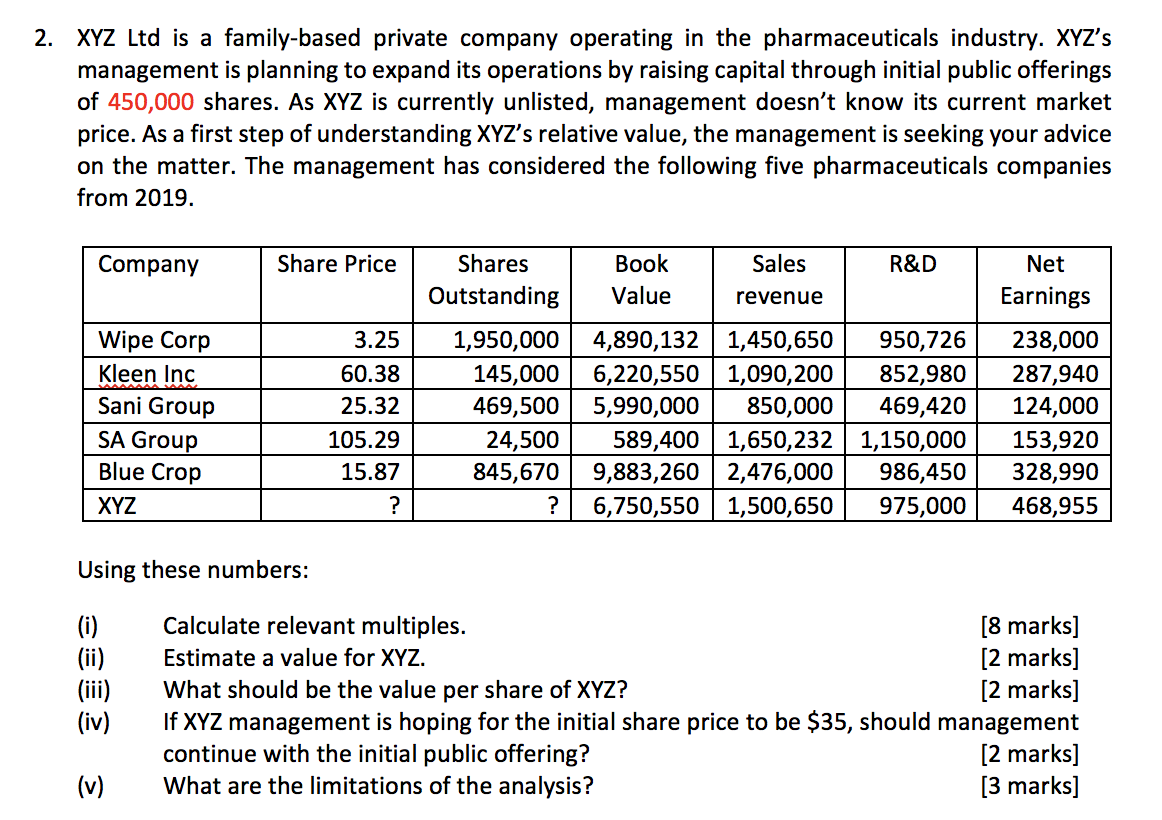

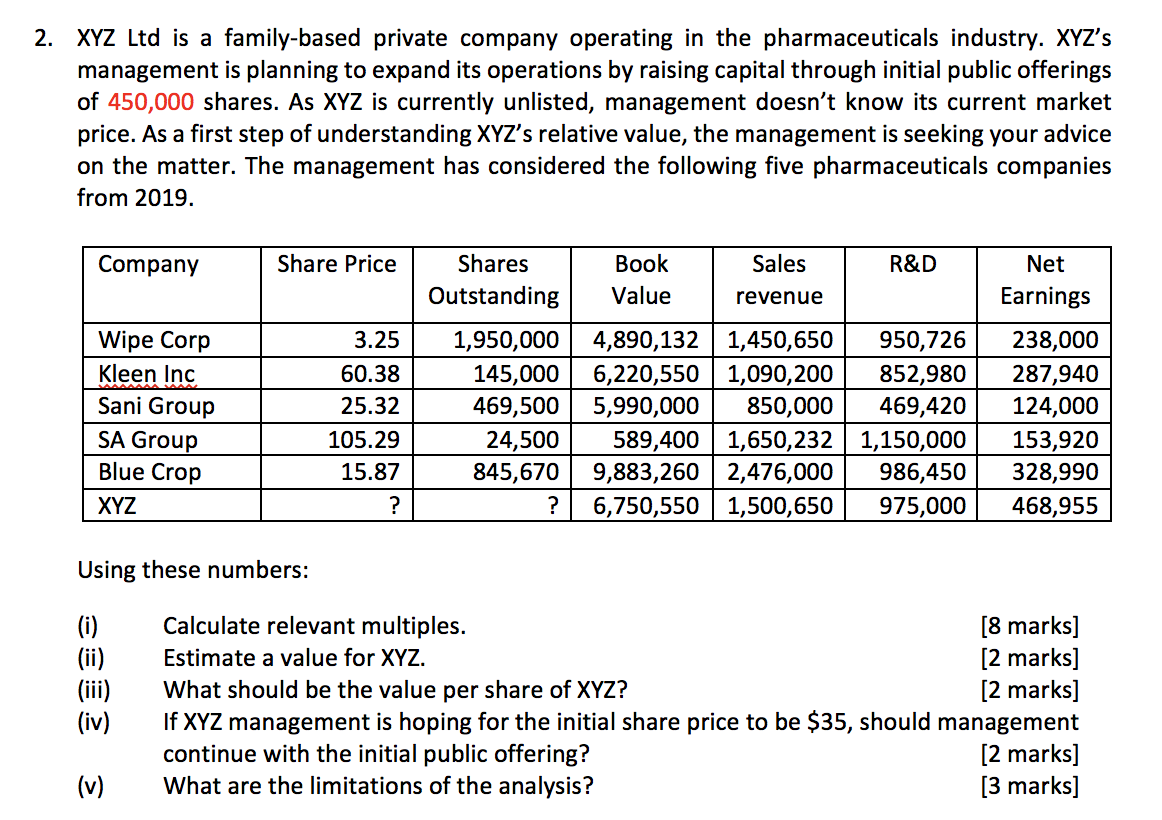

2. XYZ Ltd is a family-based private company operating in the pharmaceuticals industry. XYZ's management is planning to expand its operations by raising capital through initial public offerings of 450,000 shares. As XYZ is currently unlisted, management doesn't know its current market price. As a first step of understanding XYZ's relative value, the management is seeking your advice on the matter. The management has considered the following five pharmaceuticals companies from 2019. Company Share Price Sales R&D Shares Outstanding Book Value Net Earnings revenue Wipe Corp Kleen Inc Sani Group SA Group Blue Crop XYZ 3.25 60.38 25.32 105.29 15.87 1,950,000 145,000 469,500 24,500 845,670 ? 4,890,132 1,450,650 950,726 6,220,550 1,090,200 852,980 5,990,000 850,000 469,420 589,400 1,650,232 1,150,000 9,883,260 2,476,000 986,450 6,750,550 1,500,650 975,000 238,000 287,940 124,000 153,920 328,990 468,955 ? Using these numbers: (i) (ii) (iii) (iv) Calculate relevant multiples. [8 marks] Estimate a value for XYZ. [2 marks] What should be the value per share of XYZ? [2 marks] If XYZ management is hoping for the initial share price to be $35, should management continue with the initial public offering? [2 marks] What are the limitations of the analysis? [3 marks] (v) 2. XYZ Ltd is a family-based private company operating in the pharmaceuticals industry. XYZ's management is planning to expand its operations by raising capital through initial public offerings of 450,000 shares. As XYZ is currently unlisted, management doesn't know its current market price. As a first step of understanding XYZ's relative value, the management is seeking your advice on the matter. The management has considered the following five pharmaceuticals companies from 2019. Company Share Price Sales R&D Shares Outstanding Book Value Net Earnings revenue Wipe Corp Kleen Inc Sani Group SA Group Blue Crop XYZ 3.25 60.38 25.32 105.29 15.87 1,950,000 145,000 469,500 24,500 845,670 ? 4,890,132 1,450,650 950,726 6,220,550 1,090,200 852,980 5,990,000 850,000 469,420 589,400 1,650,232 1,150,000 9,883,260 2,476,000 986,450 6,750,550 1,500,650 975,000 238,000 287,940 124,000 153,920 328,990 468,955 ? Using these numbers: (i) (ii) (iii) (iv) Calculate relevant multiples. [8 marks] Estimate a value for XYZ. [2 marks] What should be the value per share of XYZ? [2 marks] If XYZ management is hoping for the initial share price to be $35, should management continue with the initial public offering? [2 marks] What are the limitations of the analysis? [3 marks] (v)