Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. XYZ Plc is an unlisted company which has been trading for almost 10 years. The board of directors is concerned about the cost and

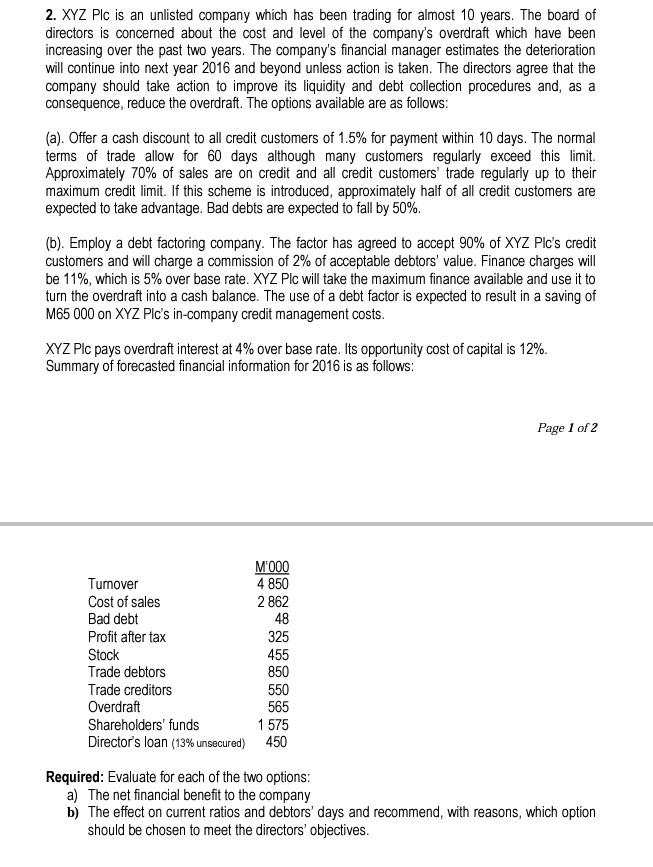

2. XYZ Plc is an unlisted company which has been trading for almost 10 years. The board of directors is concerned about the cost and level of the company's overdraft which have been increasing over the past two years. The company's financial manager estimates the deterioration will continue into next year 2016 and beyond unless action is taken. The directors agree that the company should take action to improve its liquidity and debt collection procedures and, as a consequence, reduce the overdraft. The options available are as follows: (a). Offer a cash discount to all credit customers of 1.5% for payment within 10 days. The normal terms of trade allow for 60 days although many customers regularly exceed this limit. Approximately 70% of sales are on credit and all credit customers' trade regularly up to their maximum credit limit. If this scheme is introduced, approximately half of all credit customers are expected to take advantage. Bad debts are expected to fall by 50%. (b). Employ a debt factoring company. The factor has agreed to accept 90% of XYZ Plc's credit customers and will charge a commission of 2% of acceptable debtors' value. Finance charges will be 11%, which is 5% over base rate. XYZ Plc will take the maximum finance available and use it to turn the overdraft into a cash balance. The use of a debt factor is expected to result in a saving of M65 000 on XYZ Plc's in-company credit management costs. XYZ Plc pays overdraft interest at 4% over base rate. Its opportunity cost of capital is 12%. Summary of forecasted financial information for 2016 is as follows: Page 1 of 2 M'000 4 850 Turnover Cost of sales 2 862 Bad debt 48 Profit after tax 325 Stock 455 Trade debtors 850 Trade creditors 550 Overdraft 565 Shareholders' funds 1 575 Director's loan (13% unsecured) 450 Required: Evaluate for each of the two options: a) The net financial benefit to the company b) The effect on current ratios and debtors' days and recommend, with reasons, which option should be chosen to meet the directors' objectives

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started