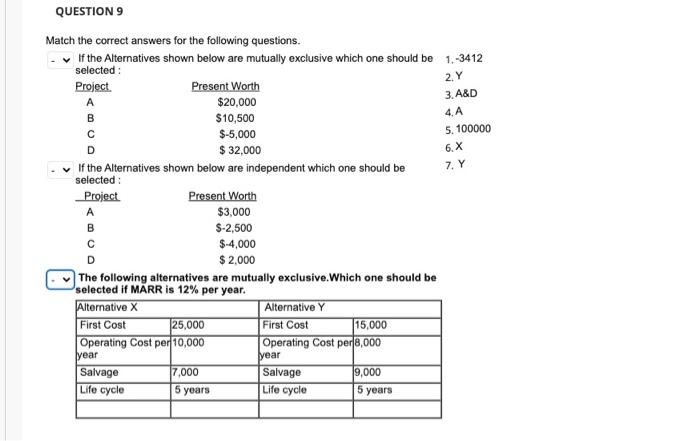

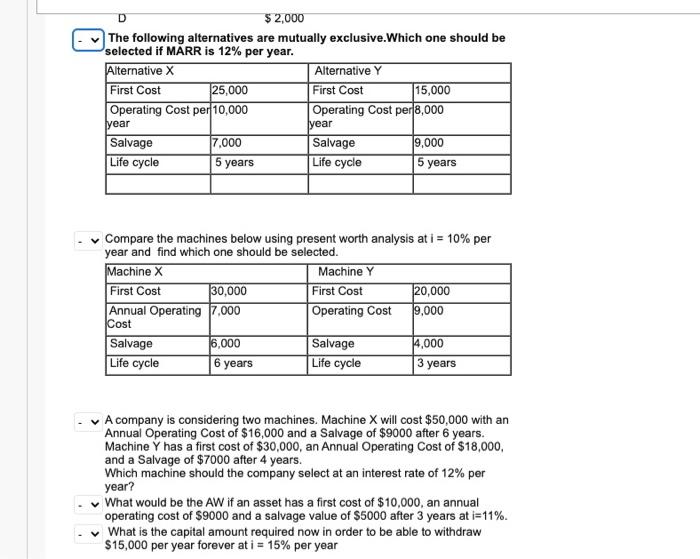

2. Y 3. A&D 4.A 5. 100000 6, X 7 Y QUESTION 9 Match the correct answers for the following questions. If the Alternatives shown below are mutually exclusive which one should be 1.-3412 selected Project Present Worth A $20,000 B $10,500 $-5,000 D $ 32,000 If the Alternatives shown below are independent which one should be selected : Project Present Worth A $3,000 B $-2,500 $ 4,000 $ 2,000 The following alternatives are mutually exclusive. Which one should be selected if MARR is 12% per year. Alternative Alternative Y First Cost 125,000 First Cost 15,000 Operating Cost per 10,000 Operating Cost per 8,000 year year Salvage 7,000 Salvage 9,000 Life cycle years years 5 Life cycle 5 $ 2,000 The following alternatives are mutually exclusive.Which one should be selected if MARR is 12% per year. Alternative X Alternative Y First Cost 25,000 First Cost 15,000 Operating cost per 10,000 Operating Cost per 8,000 Iyear lyear Salvage 17.000 Salvage 9,000 Life cycle Life cycle 5 years 5 years Compare the machines below using present worth analysis at i = 10% per year and find which one should be selected. Machine X Machine Y First Cost 30,000 First Cost 20,000 Annual Operating 7.000 Operating Cost 19.000 Cost Salvage |6,000 Salvage 14.000 Life cycle Life cycle 3 years 6 years A company is considering two machines. Machine X will cost $50,000 with an Annual Operating Cost of $16,000 and a Salvage of $9000 after 6 years. Machine Y has a first cost of $30,000, an Annual Operating cost of $18,000, and a Salvage of $7000 after 4 years. Which machine should the company select at an interest rate of 12% per year? What would be the AW if an asset has a first cost of $10,000, an annual operating cost of $9000 and a salvage value of $5000 after 3 years at i=11%. What is the capital amount required now in order to be able to withdraw $15,000 per year forever at i = 15% per year 2. Y 3. A&D 4.A 5. 100000 6, X 7 Y QUESTION 9 Match the correct answers for the following questions. If the Alternatives shown below are mutually exclusive which one should be 1.-3412 selected Project Present Worth A $20,000 B $10,500 $-5,000 D $ 32,000 If the Alternatives shown below are independent which one should be selected : Project Present Worth A $3,000 B $-2,500 $ 4,000 $ 2,000 The following alternatives are mutually exclusive. Which one should be selected if MARR is 12% per year. Alternative Alternative Y First Cost 125,000 First Cost 15,000 Operating Cost per 10,000 Operating Cost per 8,000 year year Salvage 7,000 Salvage 9,000 Life cycle years years 5 Life cycle 5 $ 2,000 The following alternatives are mutually exclusive.Which one should be selected if MARR is 12% per year. Alternative X Alternative Y First Cost 25,000 First Cost 15,000 Operating cost per 10,000 Operating Cost per 8,000 Iyear lyear Salvage 17.000 Salvage 9,000 Life cycle Life cycle 5 years 5 years Compare the machines below using present worth analysis at i = 10% per year and find which one should be selected. Machine X Machine Y First Cost 30,000 First Cost 20,000 Annual Operating 7.000 Operating Cost 19.000 Cost Salvage |6,000 Salvage 14.000 Life cycle Life cycle 3 years 6 years A company is considering two machines. Machine X will cost $50,000 with an Annual Operating Cost of $16,000 and a Salvage of $9000 after 6 years. Machine Y has a first cost of $30,000, an Annual Operating cost of $18,000, and a Salvage of $7000 after 4 years. Which machine should the company select at an interest rate of 12% per year? What would be the AW if an asset has a first cost of $10,000, an annual operating cost of $9000 and a salvage value of $5000 after 3 years at i=11%. What is the capital amount required now in order to be able to withdraw $15,000 per year forever at i = 15% per year