2. You are considering partial retirement. To do so you need to use part of your savings to supplement your income for the next 3 years. Suppose you need an extra $55,000 per year. What lump sum do you have to invest now to supplement your income for 3 years? Assume that your required rate of return is a. 8%, compounded annually. b. 12%, compounded annually. c. 16%, compounded annually. 3. You just won a lump sum of $7,000,000 in a state lottery. You have decided to invest the winnings and withdraw an equal amount each year for 20 years. How much can you withdraw each year and have a zero balance left at the end of 20 years if you invest at a. 3%, compounded annually? b. 6%, compounded annually? 4. An NHL hockey player is offered the choice of two 4-year salary contracts, contract X for $3.22 million and contract Y for $3.12 million: Contract X Contract Y End of year 1 $230,000 $530,000 End of year 2 730,000 780,000 End of year 3 1,030,000 880,000 End of year 4 1,230,000 930,000 Total $3,220,000 $3,120,000

Which contract has the higher PV at 12% compounded annually? Show computations to support your answer.

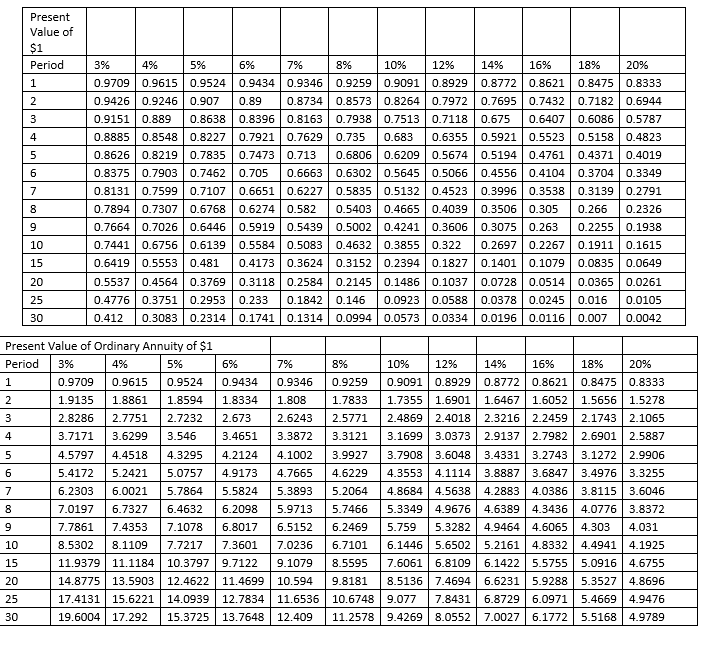

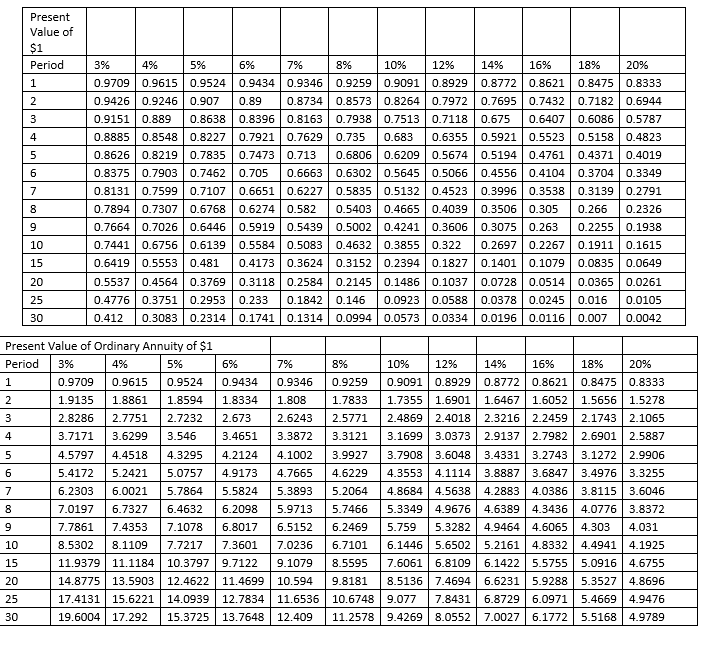

Present Value of $1 Period 1 2 3 4 5 6 7 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 0.9709 0.9615 0.9524 0.94340.9346 0.9259 0.9091 0.8929 0.87720.8621 0.8475 0.8333 0.9426 0.9246 0.907 0.89 0.8734 0.8573 0.8264 0.7972 0.7695 0.7432 0.7182 0.6944 0.9151 0.889 0.8638 0.8396 0.8163 0.7938 0.7513 0.7118 0.675 0.6407 0.6086 0.5787 0.8885 0.8548 0.8227 0.7921 0.7629 0.735 0.683 0.6355 0.5921 0.5523 0.5158 0.4823 0.8626 0.8219 0.7835 0.7473 0.713 0.6806 0.6209 0.5674 0.51940.4761 0.4371 0.4019 0.8375 0.7903 0.7462 0.705 0.6663 0.6302 0.5645 0.5066 0.4556 0.4104 0.3704 0.3349 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5132 0.4523 0.3996 0.3538 0.3139 0.2791 0.7894 0.7307 0.6768 0.6274 0.582 0.5403 0.4665 0.4039 0.3506 0.305 0.266 0.2326 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4241 0.3606 0.3075 0.263 0.22550.1938 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.3855 0.322 0.26970.2267 0.1911 0.1615 0.64190.5553 0.481 0.4173 0.3624 0.3152 0.2394 0.1827 0.1401 0.1079 0.0835 0.0649 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1486 0.1037 0.0728 0.0514 0.0365 0.0261 0.4776 0.3751 0.2953 0.233 0.1842 0.146 0.0923 0.0588 0.0378 0.0245 0.016 0.0105 0.412 0.30830.2314 0.1741 0.1314 0.0994 0.0573 0.0334 0.0196 0.0116 0.007 0.0042 8 | 10 15 20 25 30 6% 0.9434 Present Value of Ordinary Annuity of $1 Period 3% 4% 5% 1 0.9709 0.9615 0.9524 2 1.9135 1.8861 1.8594 3 2.8286 2.7751 2.7232 4 3.7171 3.6299 3.546 1.8334 2.673 3.4651 4.2124 7% 0.9346 1.808 2.6243 3.3872 5 4.3295 4.1002 6 7 8 4.5797 4.4518 5.4172 5.2421 6.2303 6.0021 7.0197 6.7327 7.7861 7.4353 8.5302 8.1109 11.9379 11.1184 14.8775 13.5903 17.4131 15.6221 19.6004 | 17.292 9 8% 10% 12% 14% 16% 18% 20% 0.9259 0.9091 0.8929 0.87720.8621 0.8475 0.8333 1.7833 1.7355 1.6901 1.6467 1.6052 1.5656 1.5278 2.5771 2.48692.40182.3216 2.2459 2.1743 2.1065 3.3121 3.16993.0373 2.9137 2.7982 2.6901 2.5887 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 5.7466 5.33494.9676 4.6389 4.3436 4.0776 3.8372 6.2469 5.759 5.3282 4.94644.6065 4.303 4.031 6.7101 6.1446 5.6502 5.21614.8332 4.4941 4.1925 8.5595 7.60616.8109 6.1422 5.5755 5.0916 4.6755 9.8181 8.51367.4694 6.6231 5.9288 5.3527 4.8696 10.67489.077 7.8431 6.87296.0971 5.4669 4.9476 11.2578 9.4269 8.0552 7.00276.1772 5.5168 4.9789 5.0757 4.9173 5.7864 5.5824 6.4632 6.2098 7.1078 6.8017 7.7217 7.3601 10.37979.7122 12.4622 11.4699 14.0939 12.7834 15.3725 13.7648 4.7665 5.3893 5.9713 6.5152 7.0236 9.1079 10.594 11.6536 10 15 20 25 30 12.409