Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You are given the duty of valuing the company, which will be soon acquired by a Hedge Fund. Last dividend distributed was 2,30TL,

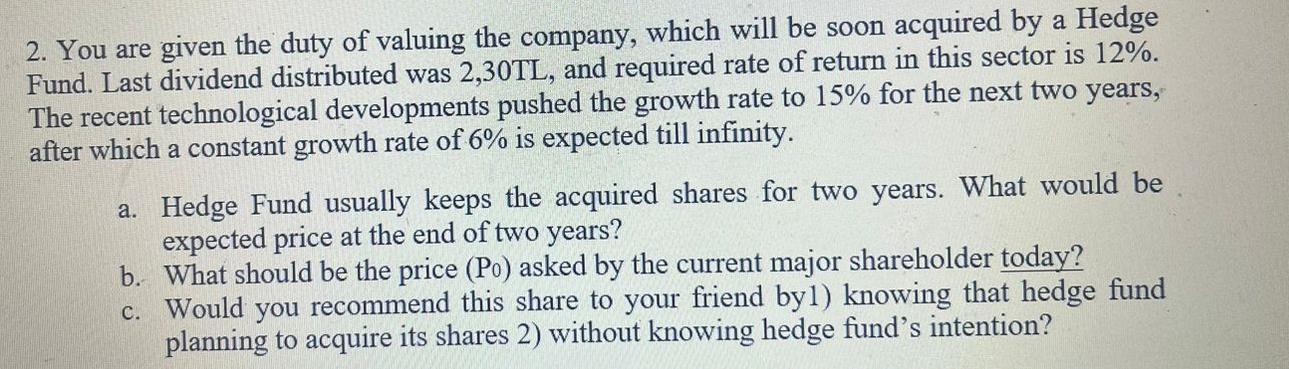

2. You are given the duty of valuing the company, which will be soon acquired by a Hedge Fund. Last dividend distributed was 2,30TL, and required rate of return in this sector is 12%. The recent technological developments pushed the growth rate to 15% for the next two years, after which a constant growth rate of 6% is expected till infinity. a. Hedge Fund usually keeps the acquired shares for two years. What would be expected price at the end of two years? b. What should be the price (Po) asked by the current major shareholder today? c. Would you recommend this share to your friend by1) knowing that hedge fund planning to acquire its shares 2) without knowing hedge fund's intention?

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To value the company we can use the dividend discount model DDM to calculate the expected price of the shares at the end of two years P2 The DDM formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started