Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You are given with the following information: you have three funds, the 0.35 expected rates of return are shown as the vector 0.18 and

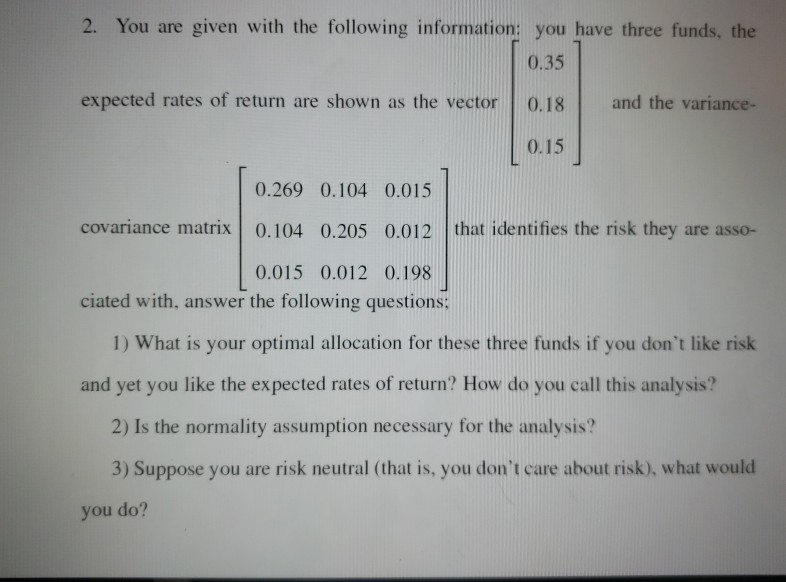

2. You are given with the following information: you have three funds, the 0.35 expected rates of return are shown as the vector 0.18 and the variance- 0.15 0.269 0.104 0.015 covariance matrix 0.104 0.205 0.012 that identifies the risk they are asso- 0.015 0.012 0.198 ciated with, answer the following questions: 1) What is your optimal allocation for these three funds if you don't like risk and yet you like the expected rates of return? How do you call this analysis?! 2) Is the normality assumption necessary for the analysis? 3) Suppose you are risk neutral (that is, you don't care about risk), what would you do? 2. You are given with the following information: you have three funds, the 0.35 expected rates of return are shown as the vector 0.18 and the variance- 0.15 0.269 0.104 0.015 covariance matrix 0.104 0.205 0.012 that identifies the risk they are asso- 0.015 0.012 0.198 ciated with, answer the following questions: 1) What is your optimal allocation for these three funds if you don't like risk and yet you like the expected rates of return? How do you call this analysis?! 2) Is the normality assumption necessary for the analysis? 3) Suppose you are risk neutral (that is, you don't care about risk), what would you do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started