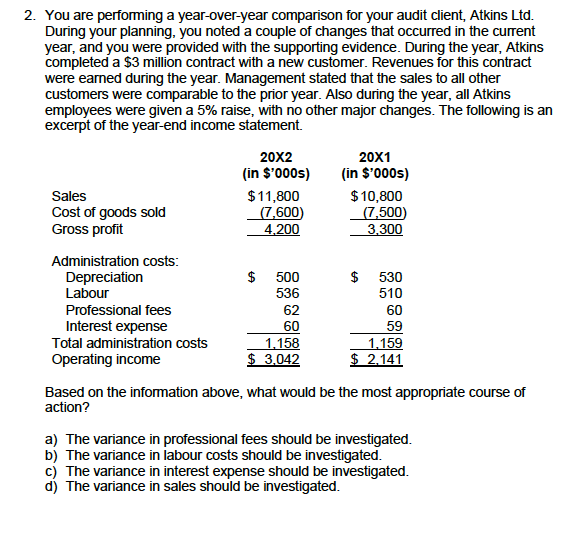

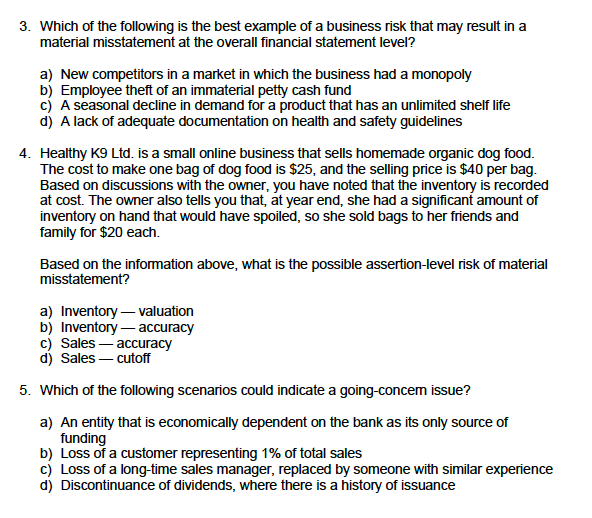

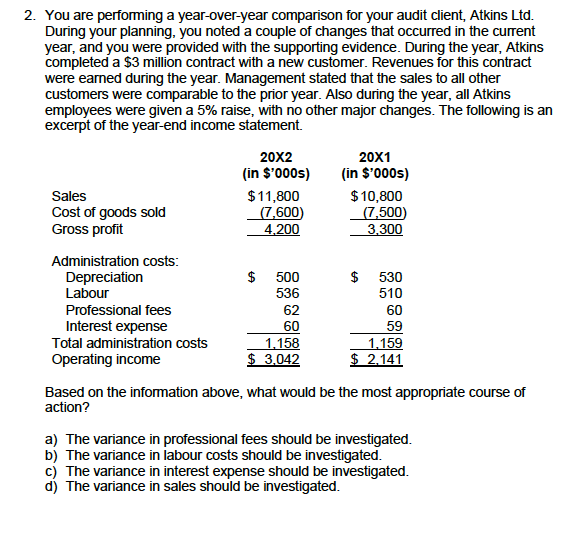

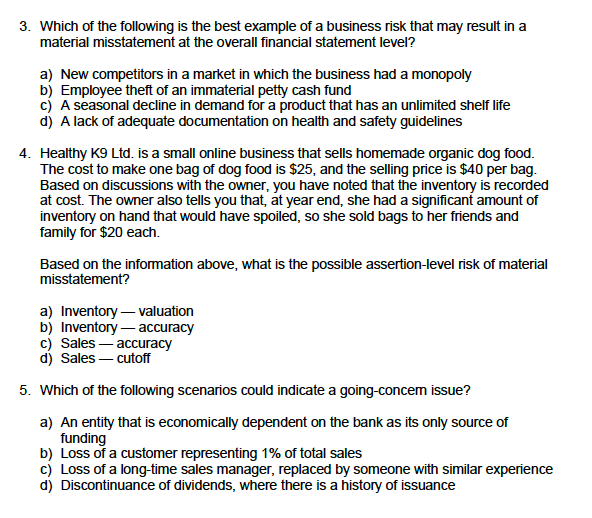

2. You are performing a year-over-year comparison for your audit client, Atkins Ltd. During your planning, you noted a couple of changes that occurred in the current year, and you were provided with the supporting evidence. During the year, Atkins completed a $3 million contract with a new customer. Revenues for this contract were earned during the year. Management stated that the sales to all other customers were comparable to the prior year. Also during the year, all Atkins employees were given a 5% raise, with no other major changes. The following is an excerpt of the year-end income statement. 20X2 20X1 (in $'000s) (in $'000s) Sales $11,800 $ 10,800 Cost of goods sold (7,600 (7,500 Gross profit 4,200 3,300 Administration costs: Depreciation $ 500 $ 530 Labour 536 510 Professional fees 62 60 Interest expense 60 59 Total administration costs 1.158 1.159 Operating income $ 3,042 $ 2.141 Based on the information above, what would be the most appropriate course of action? a) The variance in professional fees should be investigated. b) The variance in labour costs should be investigated. c) The variance in interest expense should be investigated. d) The variance in sales should be investigated. 3. Which of the following is the best example of a business risk that may result in a material misstatement at the overall financial statement level? a) New competitors in a market in which the business had a monopoly b) Employee theft of an immaterial petty cash fund c) A seasonal decline in demand for a product that has an unlimited shelf life d) A lack of adequate documentation on health and safety guidelines 4. Healthy K9 Ltd. is a small online business that sells homemade organic dog food. The cost to make one bag of dog food is $25, and the selling price is $40 per bag. Based on discussions with the owner, you have noted that the inventory is recorded at cost. The owner also tells you that, at year end, she had a significant amount of inventory on hand that would have spoiled, so she sold bags to her friends and family for $20 each. Based on the information above, what is the possible assertion-level risk of material misstatement? a) Inventory - valuation b) Inventory - accuracy c) Sales - accuracy d) Sales - cutoff 5. Which of the following scenarios could indicate a going-concem issue? a) An entity that is economically dependent on the bank as its only source of funding b) Loss of a customer representing 1% of total sales c) Loss of a long-time sales manager, replaced by someone with similar experience d) Discontinuance of dividends, where there is a history of issuance