Answered step by step

Verified Expert Solution

Question

1 Approved Answer

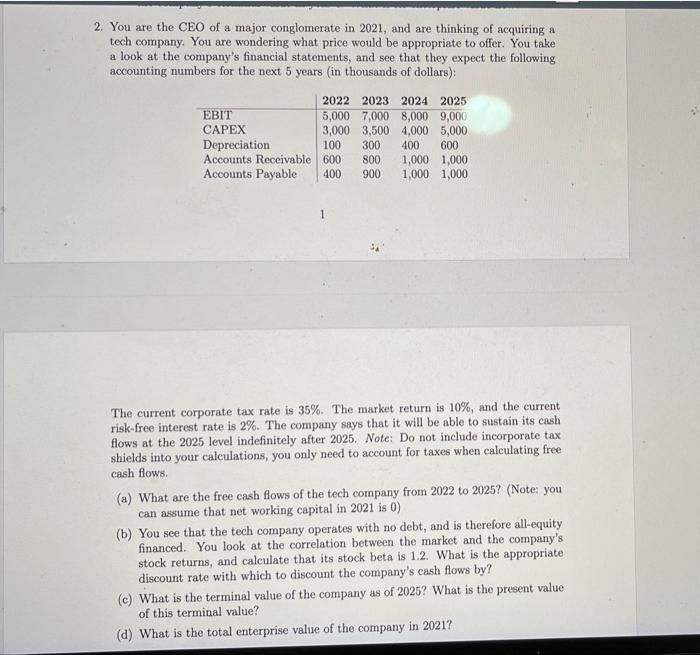

2. You are the CEO of a major conglomerate in 2021, and are thinking of acquiring a tech company. You are wondering what price

2. You are the CEO of a major conglomerate in 2021, and are thinking of acquiring a tech company. You are wondering what price would be appropriate to offer. You take a look at the company's financial statements, and see that they expect the following accounting numbers for the next 5 years (in thousands of dollars): EBIT Depreciation Accounts Receivable 600 Accounts Payable 2022 2023 2024 2025 5,000 7,000 8,000 9,000 3,000 3,500 4,000 5,000 100 300 400 600 800 1,000 1,000 1,000 1,000 400 900 The current corporate tax rate is 35%. The market return is 10%, and the current risk-free interest rate is 2%. The company says that it will be able to sustain its cash flows at the 2025 level indefinitely after 2025. Note: Do not include incorporate tax shields into your calculations, you only need to account for taxes when calculating free cash flows. (a) What are the free cash flows of the tech company from 2022 to 2025? (Note: you can assume that net working capital in 2021 is 0) (b) You see that the tech company operates with no debt, and is therefore all-equity financed. You look at the correlation between the market and the company's stock returns, and calculate that its stock beta is 1.2. What is the appropriate discount rate with which to discount the company's cash flows by? (c) What is the terminal value of the company as of 2025? What is the present value of this terminal value? (d) What is the total enterprise value of the company in 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

my answer is as shown in the excel format below b Cost of equity is calculated in excel and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started