Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. You are the investment manager of a well-diversified portfolio. Due to recent interest in the farming and mining industries, you are considering adding

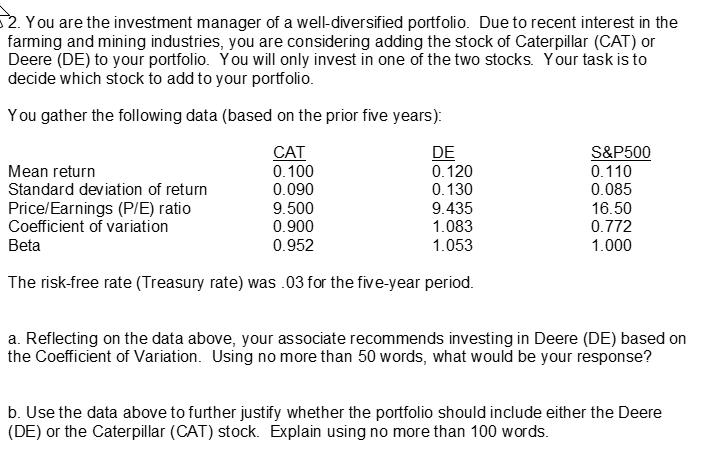

2. You are the investment manager of a well-diversified portfolio. Due to recent interest in the farming and mining industries, you are considering adding the stock of Caterpillar (CAT) or Deere (DE) to your portfolio. You will only invest in one of the two stocks. Your task is to decide which stock to add to your portfolio. You gather the following data (based on the prior five years): CAT DE S&P500 Mean return 0.100 0.120 0.110 Standard deviation of return 0.090 0.130 0.085 Price/Earnings (P/E) ratio 9.500 9.435 16.50 Coefficient of variation 0.900 1.083 0.772 Beta 0.952 1.053 1.000 The risk-free rate (Treasury rate) was .03 for the five-year period. a. Reflecting on the data above, your associate recommends investing in Deere (DE) based on the Coefficient of Variation. Using no more than 50 words, what would be your response? b. Use the data above to further justify whether the portfolio should include either the Deere (DE) or the Caterpillar (CAT) stock. Explain using no more than 100 words.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started