Answered step by step

Verified Expert Solution

Question

1 Approved Answer

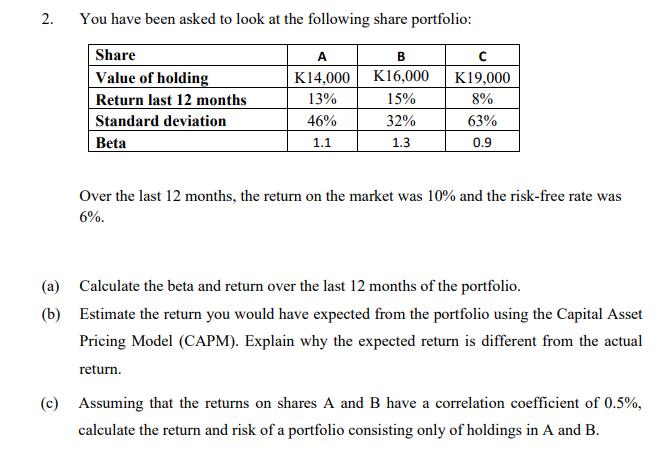

2. You have been asked to look at the following share portfolio: Share Value of holding Return last 12 months Standard deviation Beta A

2. You have been asked to look at the following share portfolio: Share Value of holding Return last 12 months Standard deviation Beta A K14,000 13% 46% 1.1 B K16,000 15% 32% 1.3 K19,000 8% 63% 0.9 Over the last 12 months, the return on the market was 10% and the risk-free rate was 6%. (a) Calculate the beta and return over the last 12 months of the portfolio. (b) Estimate the return you would have expected from the portfolio using the Capital Asset Pricing Model (CAPM). Explain why the expected return is different from the actual return. (c) Assuming that the returns on shares A and B have a correlation coefficient of 0.5%, calculate the return and risk of a portfolio consisting only of holdings in A and B.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Beta To calculate the beta of the portfolio we need to calculate the weighted average of the betas ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started