Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) You want to buy a house for $400,000 with 10% down payment. You take two mortgages to over the $360,000 needed to buy

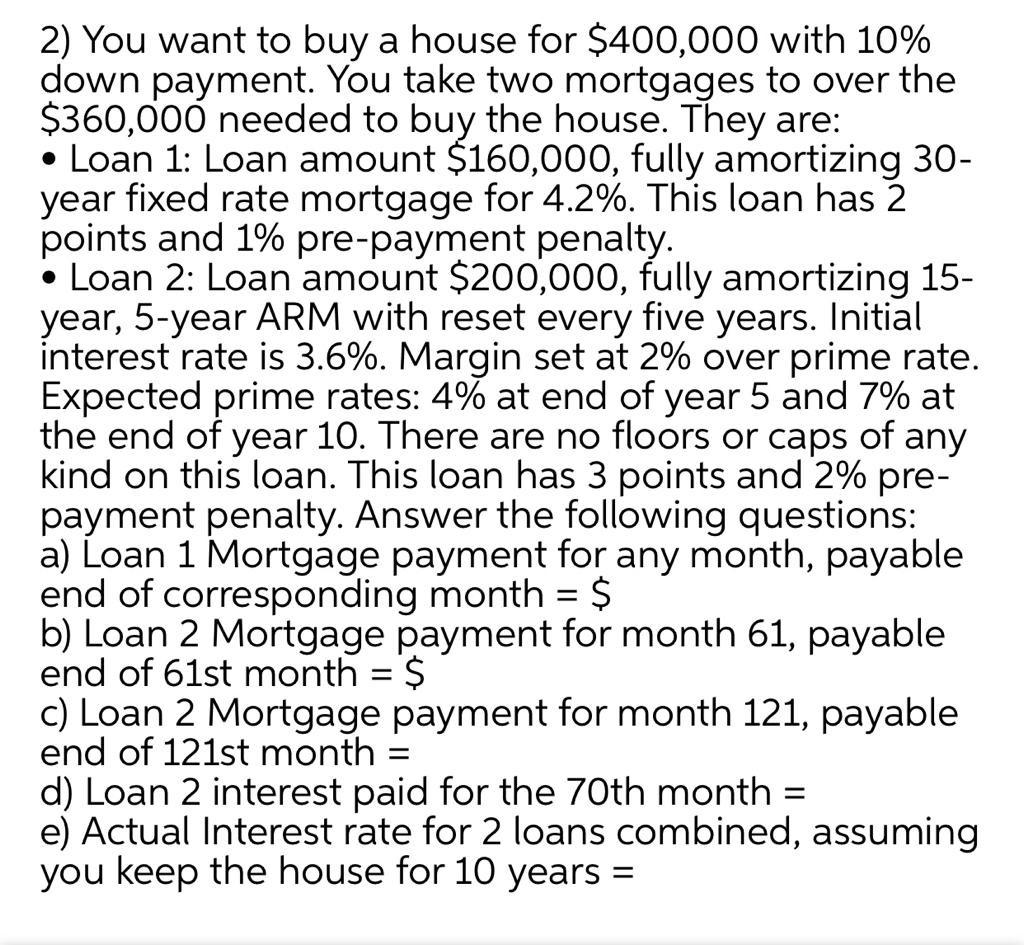

2) You want to buy a house for $400,000 with 10% down payment. You take two mortgages to over the $360,000 needed to buy the house. They are: Loan 1: Loan amount $160,000, fully amortizing 30- year fixed rate mortgage for 4.2%. This loan has 2 points and 1% pre-payment penalty. Loan 2: Loan amount $200,000, fully amortizing 15- year, 5-year ARM with reset every five years. Initial interest rate is 3.6%. Margin set at 2% over prime rate. Expected prime rates: 4% at end of year 5 and 7% at the end of year 10. There are no floors or caps of any kind on this loan. This loan has 3 points and 2% pre- payment penalty. Answer the following questions: a) Loan 1 Mortgage payment for any month, payable end of corresponding month = $ b) Loan 2 Mortgage payment for month 61, payable end of 61st month = $ c) Loan 2 Mortgage payment for month 121, payable end of 121st month = d) Loan 2 interest paid for the 70th month = e) Actual Interest rate for 2 loans combined, assuming you keep the house for 10 years =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Page1 Answer As per the information provided in the question a Loan I mootagage payment for any mont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started