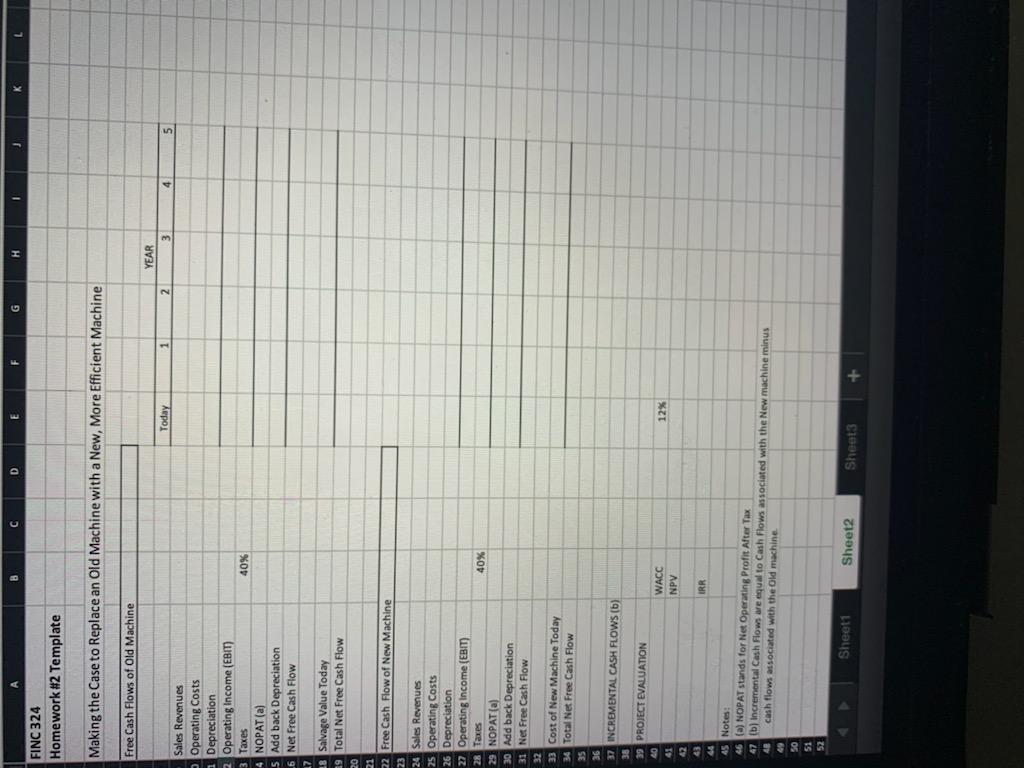

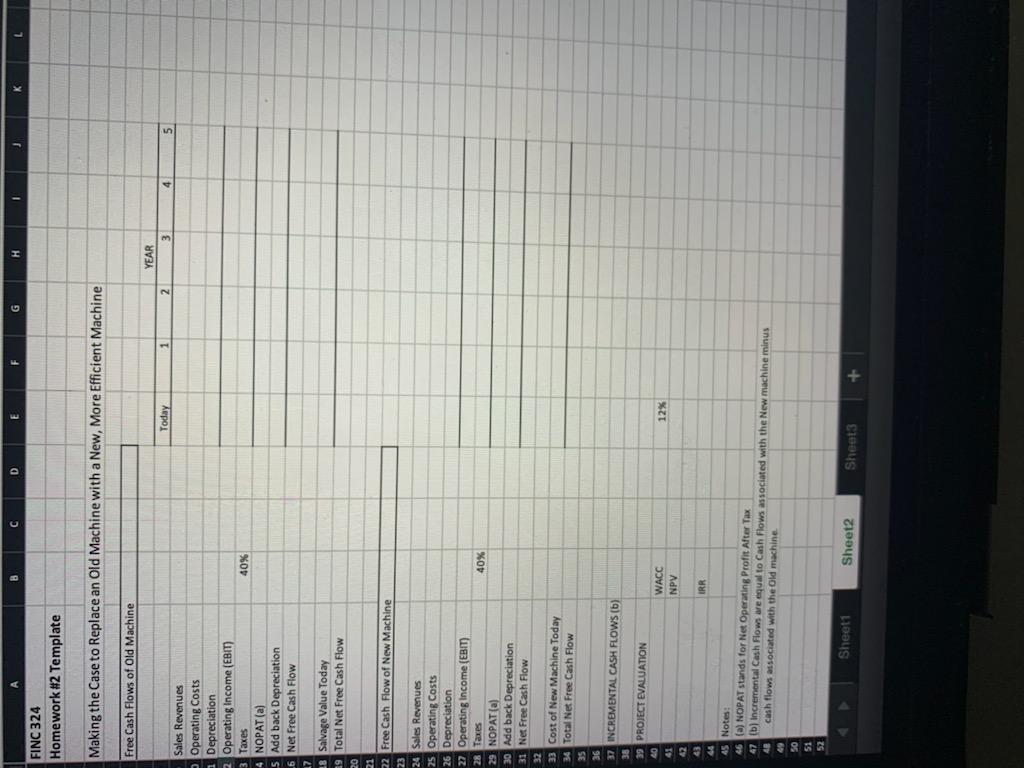

2.) Your department is interested in replacing an old, inefficient production machine with a new, more efficient machine. Youve been asked by your supervisor to justify the expense involved in purchasing the new machine. The following is information that has been collected about the situation:Information Relevant to Both MachinesSales revenue: $100,000 per yearUseful life of both machines: 5 yearsWACC12%Tax Rate40%Information on the Old MachineSale value of the old machine today $15,000Labor costs per year $12,000Materials costs per year$3,000Energy costs per year$20,000Depreciation expense per year$5,000. Information on the New MachineCost of the new machine$60,000Labor costs per year$2,000Materials costs per year$1,500Energy costs per year$10,000Depreciation expense per year$12,000What is NPV, IRR and Payback for this project?

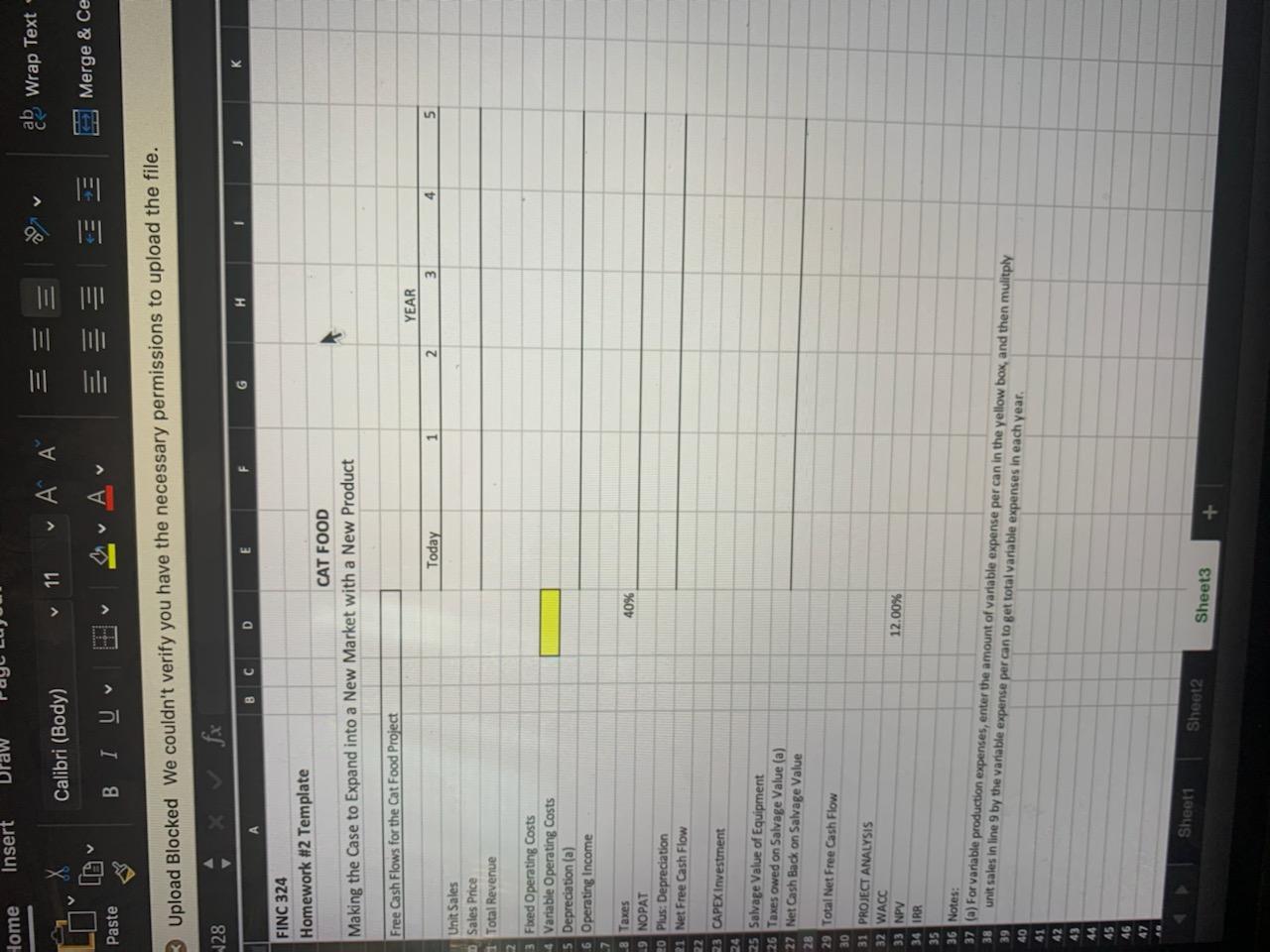

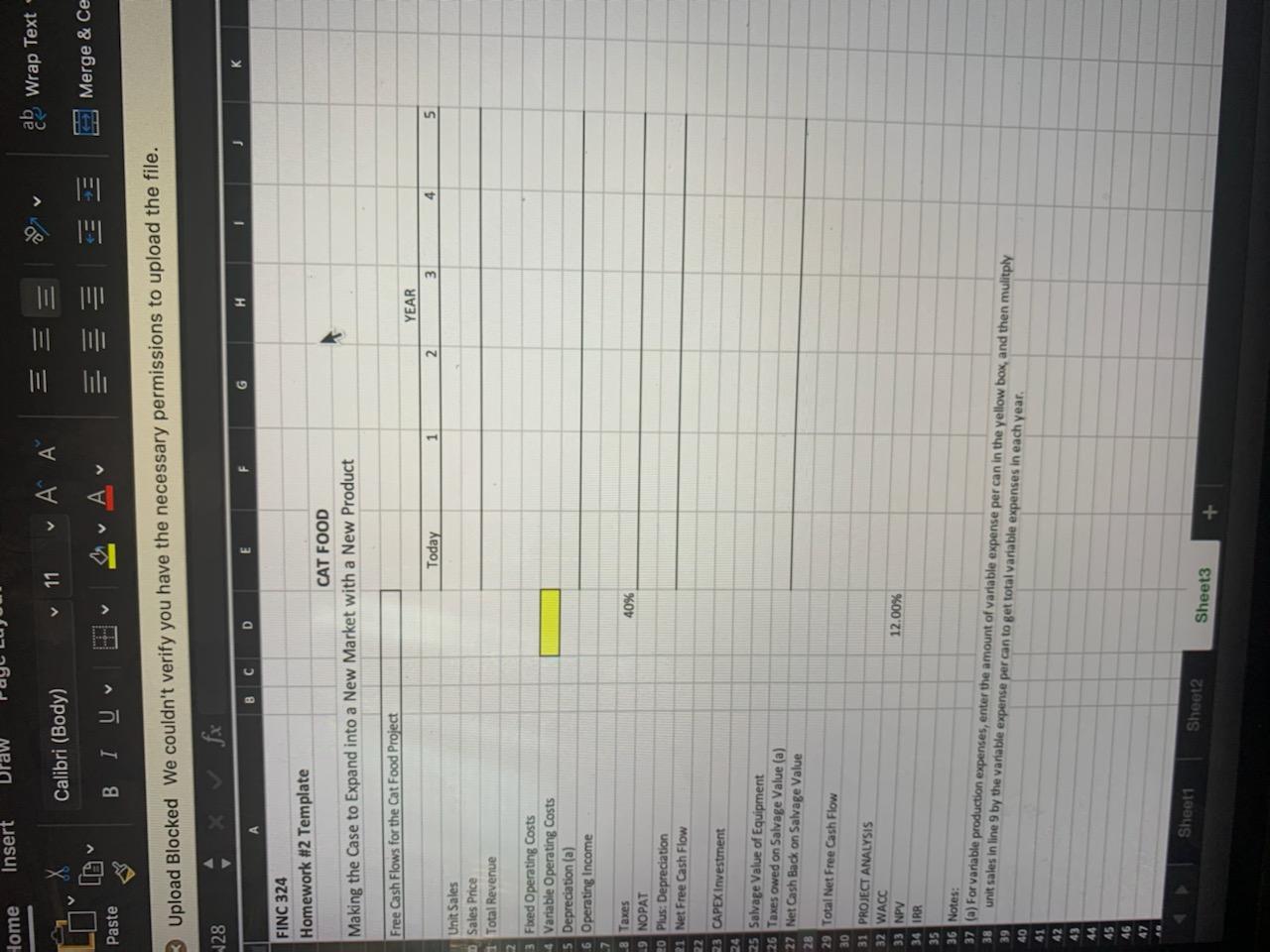

3.) Your business unit currently manufactures and sells dog food. Your managers believe there is an opportunity to expand into cat food. Youve collected the following data about this opportunity through discussions with your marketing, sales and production teams:Marketing Data:There appears to be a total market today for 10,000,000 cans of cat food per year of which we think we can capture 10% of the market for the next 5 years (and then after 5 years the opportunity will go away so build a 5 year model).Current pricing for cat food per can averages $3.00. We think we will need to price our cat food at a 20% discount to the average in order to capture market share.Marketing believes that they will need to spend $500,000 per year on advertising regardless of the level of sales to promote this productProduction Data:We will need to spend $750,000 on new production machines today to manufacture cat food which will be depreciated on a straight-line basis over the course of the 5-year life of the opportunity.Fixed costs of production are expected to be $250,000 per year with variable expenses of $1.40 per can of cat food produced.It is expected that at the end of the 5-year project the equipment will have salvage value equal to $50,000.General:The companys overall tax rate is 40%Youve been told that the companys hurdle rate on a new project proposal is 12%Calculate the NPV and IRR for this project. Should this project be taken on? Why or why not?

Home Insert ako Wrap Text - = V ' V 11 Calibri (Body) V Merge & Ce TI Paste B I U V V Upload Blocked We couldn't verify you have the necessary permissions to upload the file. 128 K H G B E D C F FINC 324 Homework #2 Template CAT FOOD Making the Case to Expand into a New Market with a New Product Free Cash Flows for the Cat Food Project YEAR Today 1 2 3 4 5 Unit Sales Sales Price Total Revenue Fixed Operating costs Variable Operating costs Depreciation (a) Operating Income 40% Taxes 19 NOPAT 20 Plus: Depreciation 21 Net Free Cash Flow 22 23 CAPEX Investment 25 Salvage Value of Equipment 26 Taxes Owed on Salvage Value (a) 27 Net Cash Back on Salvage Value 28 29 Total Net Free Cash Flow 30 31 PROJECT ANALYSIS 32 WACC 12.00% 33 NPV 34 IRR 35 36 Notes: 38 37 () For variable production expenses, enter the amount of variable expense per can in the yellow box, and then mulitply 39 unit sales in line 9 by the vanable expense per can to get total variable expenses in each year. 40 41 42 43 44 45 46 47 Sheet1 Sheet2 Sheet3 B C D E F G H 1 L FINC 324 Homework #2 Template Making the Case to Replace an Old Machine with a New, More Efficient Machine Free Cash Flows of Old Machine YEAR Today 2 4 5 Sales Revenues Operating costs Depreciation Operating Income (EBIT) Taxes NOPAT (a) Add back Depreciation Net Free Cash Flow 40% Salvage Value Today Total Net Free Cash Flow 22 Free Cash Flow of New Machine Sales Revenues Operating Costs 26 Depreciation 27 Operating Income (EBIT) Taxes NOPAT (0) Add back Depreciation 31 Net Free Cash Flow 40% 33 Cost New Machine Today 34 Total Net Free Cash Flow 37 INCREMENTAL CASH FLOWS (b) 38 39 PROJECT EVALUATION 40 WACC 41 NPV 12% 63 IRR 45 Notes 46 (a) NOPAT stands for Net Operating Profit After Tax 47 (b) Incremental Cash Flows are equal to Cash Flows associated with the New machine minus cash flows associated with the Old machine. 30 51 52 Sheet1 Sheet2 Sheet3 + Home Insert ako Wrap Text - = V ' V 11 Calibri (Body) V Merge & Ce TI Paste B I U V V Upload Blocked We couldn't verify you have the necessary permissions to upload the file. 128 K H G B E D C F FINC 324 Homework #2 Template CAT FOOD Making the Case to Expand into a New Market with a New Product Free Cash Flows for the Cat Food Project YEAR Today 1 2 3 4 5 Unit Sales Sales Price Total Revenue Fixed Operating costs Variable Operating costs Depreciation (a) Operating Income 40% Taxes 19 NOPAT 20 Plus: Depreciation 21 Net Free Cash Flow 22 23 CAPEX Investment 25 Salvage Value of Equipment 26 Taxes Owed on Salvage Value (a) 27 Net Cash Back on Salvage Value 28 29 Total Net Free Cash Flow 30 31 PROJECT ANALYSIS 32 WACC 12.00% 33 NPV 34 IRR 35 36 Notes: 38 37 () For variable production expenses, enter the amount of variable expense per can in the yellow box, and then mulitply 39 unit sales in line 9 by the vanable expense per can to get total variable expenses in each year. 40 41 42 43 44 45 46 47 Sheet1 Sheet2 Sheet3 B C D E F G H 1 L FINC 324 Homework #2 Template Making the Case to Replace an Old Machine with a New, More Efficient Machine Free Cash Flows of Old Machine YEAR Today 2 4 5 Sales Revenues Operating costs Depreciation Operating Income (EBIT) Taxes NOPAT (a) Add back Depreciation Net Free Cash Flow 40% Salvage Value Today Total Net Free Cash Flow 22 Free Cash Flow of New Machine Sales Revenues Operating Costs 26 Depreciation 27 Operating Income (EBIT) Taxes NOPAT (0) Add back Depreciation 31 Net Free Cash Flow 40% 33 Cost New Machine Today 34 Total Net Free Cash Flow 37 INCREMENTAL CASH FLOWS (b) 38 39 PROJECT EVALUATION 40 WACC 41 NPV 12% 63 IRR 45 Notes 46 (a) NOPAT stands for Net Operating Profit After Tax 47 (b) Incremental Cash Flows are equal to Cash Flows associated with the New machine minus cash flows associated with the Old machine. 30 51 52 Sheet1 Sheet2 Sheet3 +