Question

2. Your firm processes 50,000 checks each year with an average face.value of $50 per check. Col- lecting on these checks requires two days

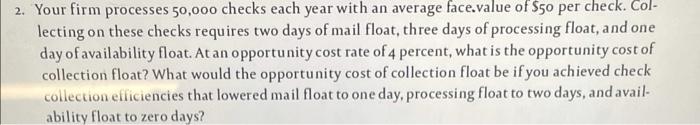

2. Your firm processes 50,000 checks each year with an average face.value of $50 per check. Col- lecting on these checks requires two days of mail float, three days of processing float, and one day of availability float. At an opportunity cost rate of 4 percent, what is the opportunity cost of collection float? What would the opportunity cost of collection float be if you achieved check collection efficiencies that lowered mail float to one day, processing float to two days, and avail- ability float to zero days?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the opportunity cost of collection float we first need to determine the total float per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Supply Chain Management

Authors: Nada R. Sanders

2nd Edition

1119392195, 1119392322, 9781119392194, 9781119392323

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App