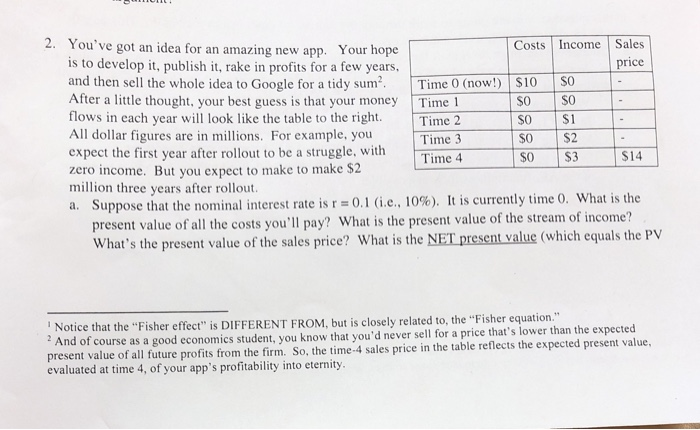

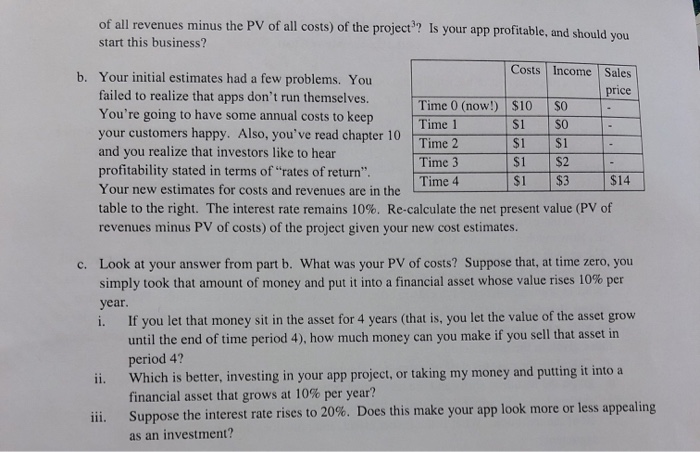

2. You've got an idea for an amazing new app. Your hope is to develop it, publish it, rake in profits for a few years and then sell the whole idea to Google for a tidy sum2 After a little thought, your best guess is that your money flows in each year will look like the table to the right. All dollar figures are in millions. For example, you expect the first year after rollout to be a struggle, with zero income. But you expect to make to make $2 million three years after rollout. a. Suppose that the nominal interest rate is r = 0.1 (i.e., 10%). It is currently time 0. What is the present value of all the costs you'll pay? What is the present value of the stream of income? What's the present value of the sales price? What is the NET present value (which equals the PV Costs Income Sales price Time 0 (now!) $10 S0 $0 $0 Time 1 $1 $0 Time 2 $0 $2 Time 3 $0 $14 $3 Time 4 Notice that the "Fisher effect" is DIFFERENT FROM, but is closely related to, the "Fisher equation." 2 And of course as a good economics student, you know that you'd never sell for a price that's lower than the expected present value of all future profits from the firm. So, the time-4 sales price in the table reflects the expected present value, evaluated at time 4, of your app's profitability into eternity of all revenues minus the PV of all costs) of the project? Is your app profitable, and should you start this business? Costs Income Sales b. Your initial estimates had a few problems. You price failed to realize that apps don't run themselves. Time 0 (now!) $10 $0 You're going to have some annual costs to keep your customers happy. Also, you've read chapter 10 and you realize that investors like to hear profitability stated in terms of rates of return" Your new estimates for costs and revenues are in the table to the right. The interest rate remains 109%. Re-calculate the net present value (PV of Time 1 $1 $0 Time 2 $1 $1 $1 $2 Time 3 Time 4 $1 $3 $14 revenues minus PV of costs) of the project given your new cost estimates. Look at your answer from part b. What was your PV of costs? Suppose that, at time zero, you c. simply took that amount of money and put it into a financial asset whose value rises 10% per year. If you let that money sit in the asset for 4 years (that is, you let the value of the asset grow until the end of time period 4), how much money can you make if you sell that asset in i. period 4? Which is better, investing in your app project, or taking my money and putting it into a financial asset that grows at 10% per year? Suppose the interest rate rises to 20 %. Does this make your app look more or less appealing ii. iii. as an investment