Answered step by step

Verified Expert Solution

Question

1 Approved Answer

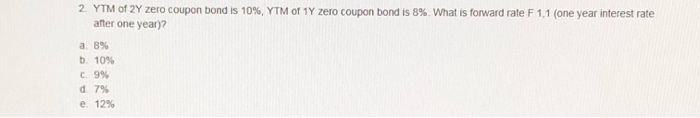

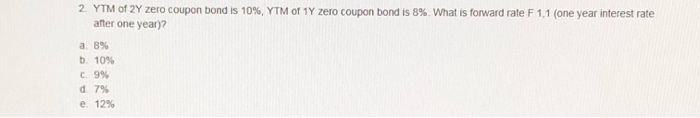

2. YTM of 2Y zero coupon bond is 10%, YTM of 1Y zero coupon bond is 8% What is forward rate F 1,1 (one year

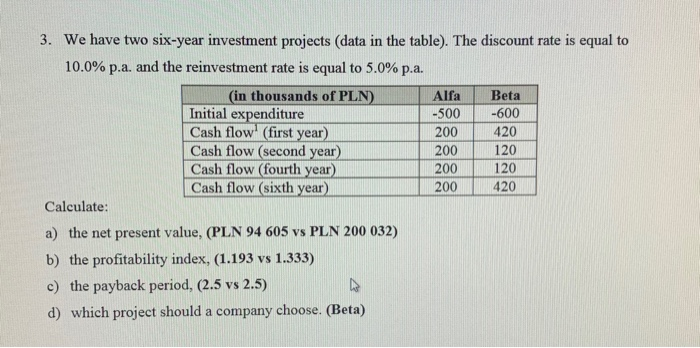

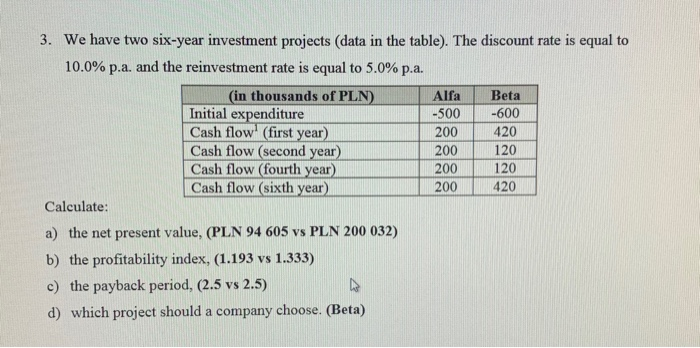

2. YTM of 2Y zero coupon bond is 10%, YTM of 1Y zero coupon bond is 8% What is forward rate F 1,1 (one year interest rate after one year)? 8% a. b. 10% 9% c. d7% 12% 3. We have two six-year investment projects (data in the table). The discount rate is equal to 10.0% p.a. and the reinvestment rate is equal to 5.0% pa. Alfa Beta -500 -600 200 420 (in thousands of PLN) Initial expenditure Cash flow (first year) Cash flow (second year) Cash flow (fourth year) Cash flow (sixth year) 120 200 200 120 200 420 Calculate: a) the net present value, (PLN 94 605 vs PLN 200 032) b) the profitability index, (1.193 vs 1.333) c) the payback period, (2.5 vs 2.5) d) which project should a company choose. (Beta)

2. YTM of 2Y zero coupon bond is 10%, YTM of 1Y zero coupon bond is 8% What is forward rate F 1,1 (one year interest rate after one year)? 8% a. b. 10% 9% c. d7% 12% 3. We have two six-year investment projects (data in the table). The discount rate is equal to 10.0% p.a. and the reinvestment rate is equal to 5.0% pa. Alfa Beta -500 -600 200 420 (in thousands of PLN) Initial expenditure Cash flow (first year) Cash flow (second year) Cash flow (fourth year) Cash flow (sixth year) 120 200 200 120 200 420 Calculate: a) the net present value, (PLN 94 605 vs PLN 200 032) b) the profitability index, (1.193 vs 1.333) c) the payback period, (2.5 vs 2.5) d) which project should a company choose. (Beta)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started