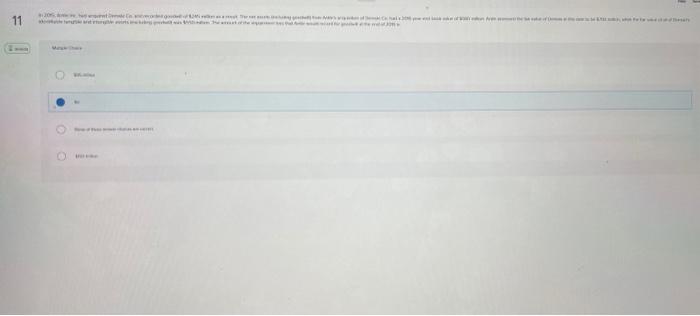

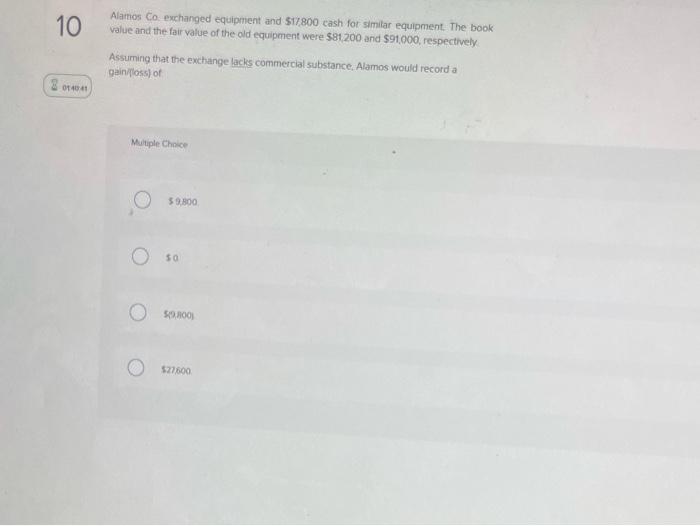

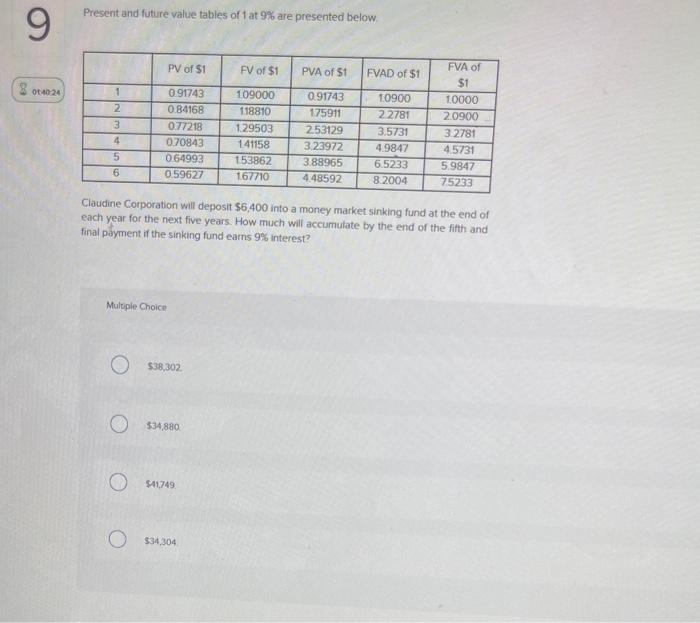

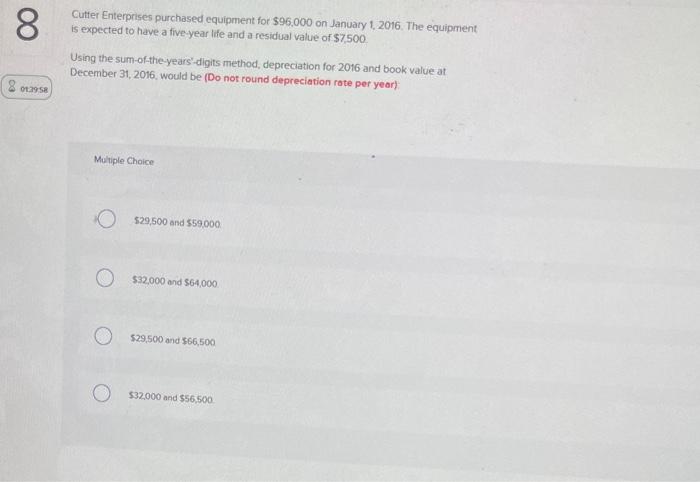

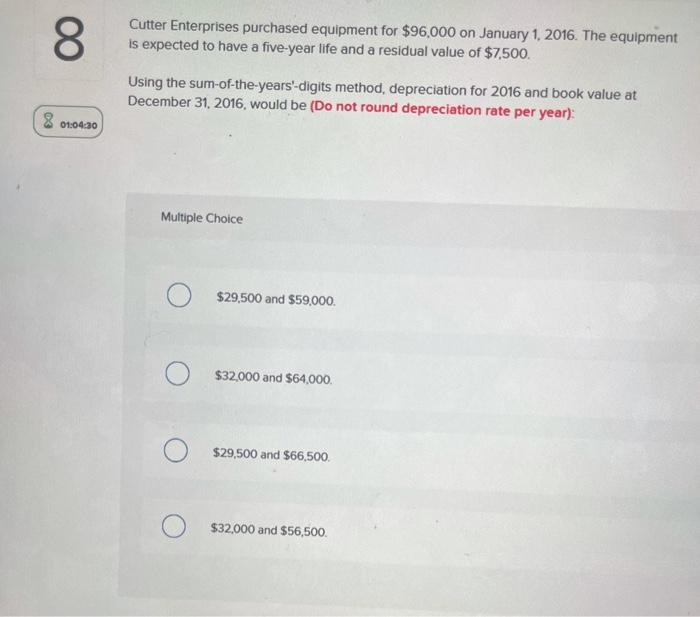

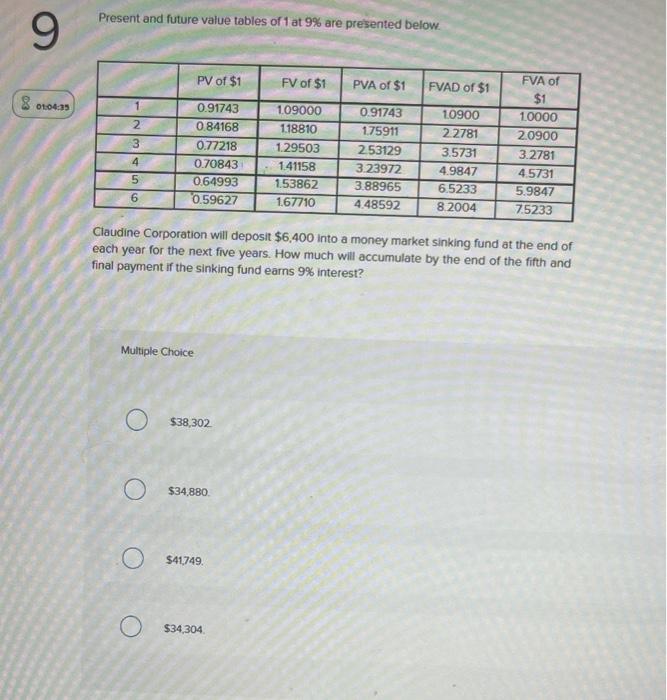

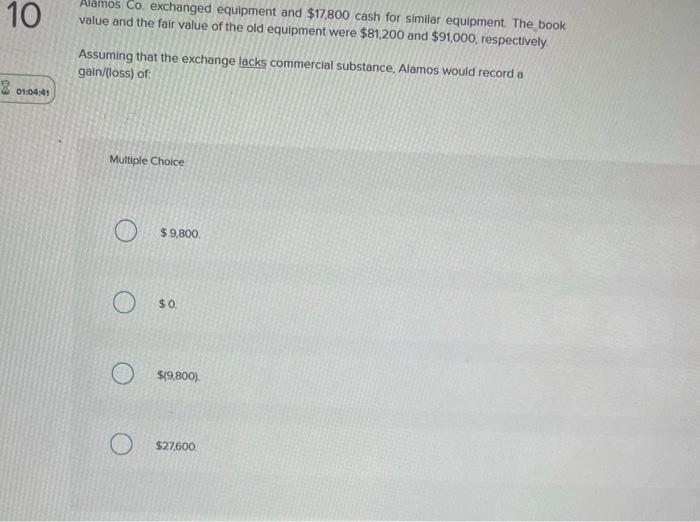

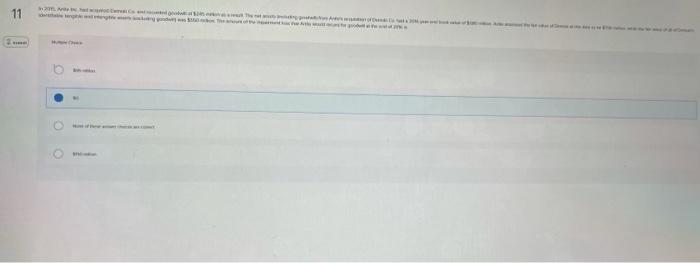

20. 11 10 Alamos co exchanged equipment and 517800 cash for similar equipment. The book value and the fair value of the old equipment were $81200 and $91,000, respectively Assuming that the exchange lacks commercial substance. Alamos would record a gain ifloss) of 014041 Multiple Choice 59.800 O SO 59.00 527600 Present and future value tables of 1 at 9% are presented below. 9 PV of $1 FV of $1 PVA of St EVAD of $1 01:4024 1 2 3 4 5 6 0.91743 0 84168 0.77218 070843 064993 0.59627 109000 118810 129503 141158 153862 167710 0.91743 175911 2.53129 323972 3.88965 4.48592 10900 22781 3.5731 4.9847 6.5233 8.2004 FVA of $1 10000 20900 3.2781 4.5731 5.9847 75233 Claudine Corporation will deposit $6,400 into a money market sinking fund at the end of each year for the next five years. How much will accumulate by the end of the fifth and final payment if the sinking fund earns 9% interest? Multiple Choice O $38,302 $34,880 $4,749 O $34,304 8 Cutter Enterprises purchased equipment for 596,000 on January 1, 2016. The equipment is expected to have a five-year life and a residual value of $7,500 Using the sum-of-the-years-digits method, depreciation for 2016 and book value at December 31, 2016, would be (Do not round depreciation rate per year) 8 012958 Multiple Choice O $29,500 and $59.000 0 $32,000 and 864,000 529.500 and $66.500 $32000 and 556 500 00 Cutter Enterprises purchased equipment for $96,000 on January 1, 2016. The equipment is expected to have a five-year life and a residual value of $7,500. Using the sum-of-the-years'-digits method, depreciation for 2016 and book value at December 31, 2016, would be (Do not round depreciation rate per year): 01:04:30 Multiple Choice $29,500 and $59,000 $32.000 and $64,000. $29,500 and $66,500 $32,000 and $56,500 Present and future value tables of 1 at 9% are presented below. 9 PV of $1 FV of $1 PVA of $1 FVAD of $1 8 0104:35 1 10900 2 2781 2 3 4 5 6 0.91743 0.84168 0.77218 0.70843 0.64993 0.59627 109000 118810 1.29503 1.41158 1.53862 167710 0.91743 175911 253129 3.23972 3.88965 4.48592 FVA of $1 1.0000 2.0900 3.2781 4.5731 5.9847 7.5233 3.5731 4.9847 6.5233 8.2004 Claudine Corporation will deposit $6,400 into a money market sinking fund at the end of each year for the next five years. How much will accumulate by the end of the fifth and final payment if the sinking fund earns 9% interest? Multiple Choice O $38,302 SA B20 $34,880 O $41749 O $34,304 10 Alamos Co. exchanged equipment and $17,800 cash for similar equipment. The book value and the fair value of the old equipment were $81,200 and $91,000, respectively. Assuming that the exchange lacks commercial substance, Alamos would record a gain/loss) of 8 01:04:41 Multiple Choice O $ 9,800 $0 $19,800) $27,600. 11