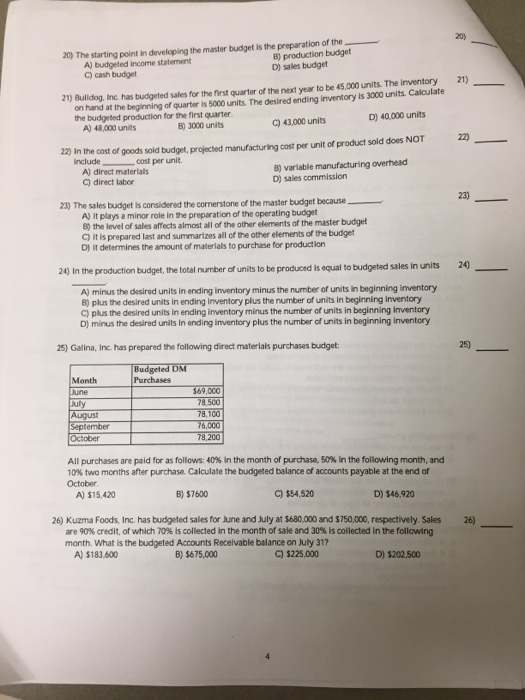

20) 20) The starting point in developing the master budget is the preparation of the B) production budget D) sales budget A) budgeted income statement C) cash budiget 21) 21) on hand at the beginning of quarter is 5000 units. The desired ending inventory Is 3000 units. Calculate the budgeted production for the first quarter 21) Buldog, Inc has budgeted sales for the first quarter of the next year to be 45,000 units. The inventory D) 40,000 units B) 3000 units C) 43,000 units A) 48,000 units 22) In the cost of goods sold budget, projected manufacturing cost per unit of product sold does NOT Include cost per unit. A) direct materials C) direct labor B) variable manufacturing overhead D) sales commission 23) 23) The sales budget is cansidered the cornerstone of the master budget because A) it plays a minor role in the preparation of the operating budget 8) the level of sales affects almost all of the other elements of the master budget C) it is prepared last and summarizes all of the other elements of the budget D) it determines the amount of materials to purchase for production 2) In the production budget, the total number of units to be produced is equal to budgeted sales in units2 A) minus the desired units in ending inventory minus the number of units in beginning inventory 8) plus the desired units in ending Inventory plus the number of units in beginning inventory C) plus the desired units in ending inventory minus the number of units in beginning inventory D) minus the desired units in ending inventory plus the number of units in beginning inventory 25) 25) Galina, Inc. has prepared the following direct materials purchases budget Budgefed DNM Month $69,000 78,100 September Allpurchases are paid for as follows: 40% in the month of purchase, 50% in the following month, and 10% two months after purchase. Calculate the budgeted balance of accounts payable at the end of October A) $15,420 B) $7600 C) $54,520 D) $46,920 26) Kuzma Foods, Inc. has budgeted sales for June and July at $680,000 and $750,000, respectively. Sales 26) are 90% credit, of which M% is collected in the month of sale and 30% is collected in the following month. What is the budgeted Accounts Recelvable balance on July 31? A) $183,600 B) $675,000 C) $225,000 D) $202,500