Answered step by step

Verified Expert Solution

Question

1 Approved Answer

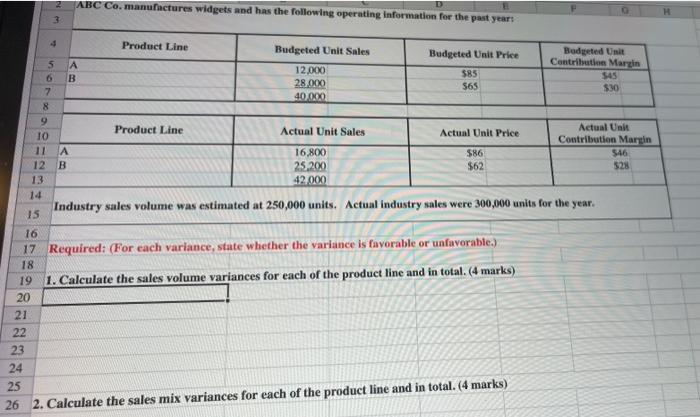

20 21 22 23 24 11 14 15 7 8 9 10 13 4 6 2 3 5 ABC Co. manufactures widgets and has

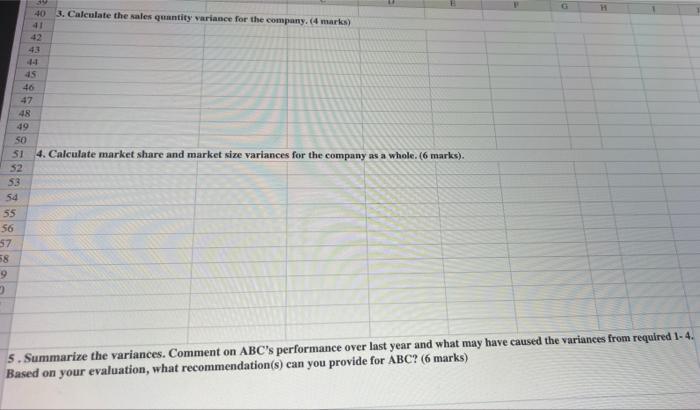

20 21 22 23 24 11 14 15 7 8 9 10 13 4 6 2 3 5 ABC Co. manufactures widgets and has the following operating information for the past year: A A 12 B B Product Line Product Line Budgeted Unit Sales 12,000 28,000 40,000 Budgeted Unit Price $85 $65 16 17 Required: (For each variance, state whether the variance is favorable or unfavorable.) 18 19 1. Calculate the sales volume variances for each of the product line and in total. (4 marks) Actual Unit Sales 16,800 25,200 42.000 Industry sales volume was estimated at 250,000 units. Actual industry sales were 300,000 units for the year. Actual Unit Price $86 $62 Bodgeted Unit Contribution Margin 25 26 2. Calculate the sales mix variances for each of the product line and in total. (4 marks) $45 $30 Actual Unit Contribution Margin $46 528 53 54 55 56 57 58 9 D 41 42 43 49 40 44 45 46 47 48 50 51 4. Calculate market share and market size variances for the company as a whole. (6 marks). 52 3. Calculate the sales quantity variance for the company. (4 marks) H 5. Summarize the variances. Comment on ABC's performance over last year and what may have caused the variances from required 1-4. Based on your evaluation, what recommendation(s) can you provide for ABC? (6 marks)

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Calcul ate the sales volume var iances for each of the product line and in total 4 marks ANS WER Product Line A B udget ed Unit Sales 12 000 units Act ual Unit Sales 16 800 units Sales Volume Vari a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started