Question

20. 21. You purchase a bond with a coupon rate of 6%, semiannual coupons, and a clean (quoted) price of $985. If the next

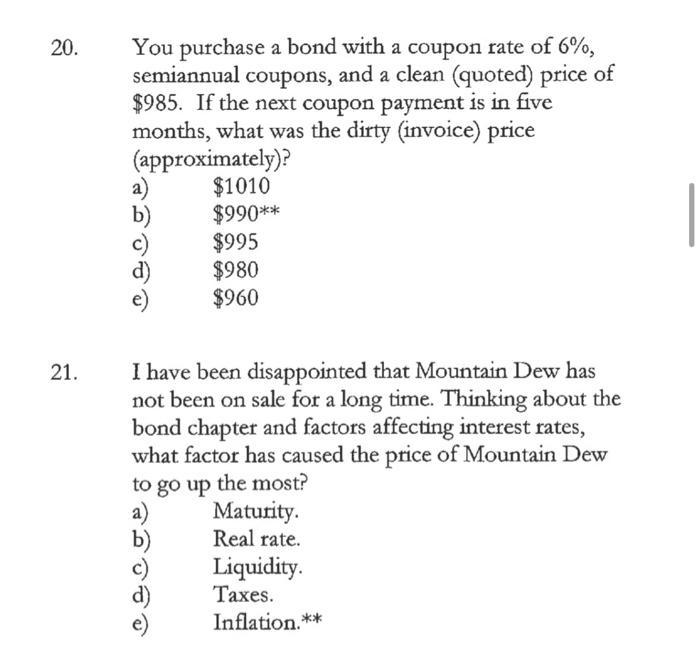

20. 21. You purchase a bond with a coupon rate of 6%, semiannual coupons, and a clean (quoted) price of $985. If the next coupon payment is in five months, what was the dirty (invoice) price (approximately)? $1010 $990** $995 $980 $960 I have been disappointed that Mountain Dew has not been on sale for a long time. Thinking about the bond chapter and factors affecting interest rates, what factor has caused the price of Mountain Dew to go up the most? a) Maturity. b) Real rate. Liquidity. Taxes. Inflation.**

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the dirty price invoice price we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Stephen Ross, Randolph Westerfield, Bradford Jordan

9th edition

978-0077459451, 77459458, 978-1259027628, 1259027627, 978-0073382395

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App