Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3.1 Prepare a projected statement of comprehensive income for the year ended 31 December 2021 to determine the sales needed to produce a profit

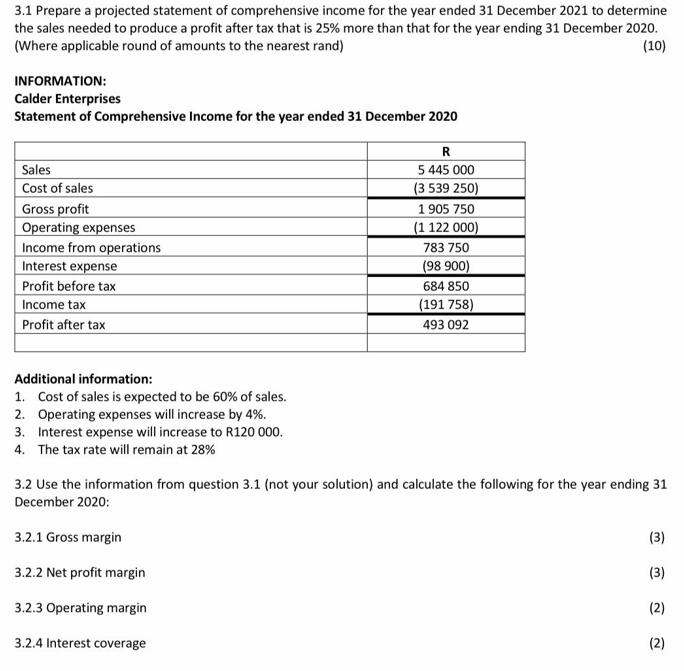

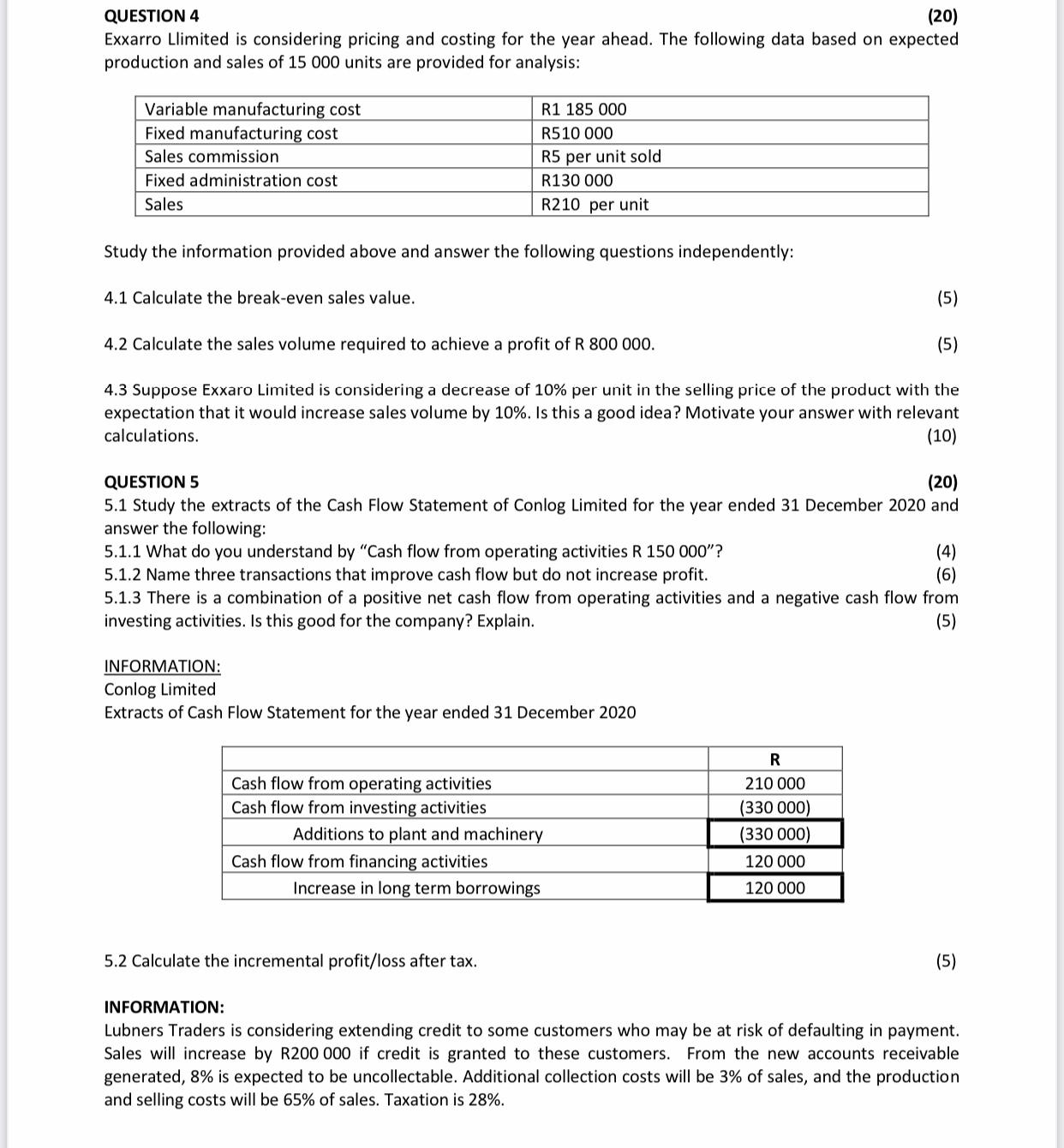

3.1 Prepare a projected statement of comprehensive income for the year ended 31 December 2021 to determine the sales needed to produce a profit after tax that is 25% more than that for the year ending 31 December 2020. (Where applicable round of amounts to the nearest rand) (10) INFORMATION: Calder Enterprises Statement of Comprehensive Income for the year ended 31 December 2020 R 5 445 000 (3 539 250) 1905 750 (1 122 000) Sales Cost of sales Gross profit Operating expenses Income from operations Interest expense Profit before tax Income tax Profit after tax 783 750 (98 900) 684 850 (191 758) 493 092 Additional information: 1. Cost of sales is expected to be 60% of sales. 2. Operating expenses will increase by 4%. 3. Interest expense will increase to R120 000. 4. The tax rate will remain at 28% 3.2 Use the information from question 3.1 (not your solution) and calculate the following for the year ending 31 December 2020: 3.2.1 Gross margin (3) 3.2.2 Net profit margin (3) 3.2.3 Operating margin (2) 3.2.4 Interest coverage (2) QUESTION 4 (20) Exxarro Llimited is considering pricing and costing for the year ahead. The following data based on expected production and sales of 15 000 units are provided for analysis: Variable manufacturing cost Fixed manufacturing cost R1 185 000 R510 000 Sales commission R5 per unit sold Fixed administration cost R130 000 Sales R210 per unit Study the information provided above and answer the following questions independently: 4.1 Calculate the break-even sales value. (5) 4.2 Calculate the sales volume required to achieve a profit of R 800 000. (5) 4.3 Suppose Exxaro Limited is considering a decrease of 10% per unit in the selling price of the product with the expectation that it would increase sales volume by 10%. Is this a good idea? Motivate your answer with relevant (10) calculations. (20) 5.1 Study the extracts of the Cash Flow Statement of Conlog Limited for the year ended 31 December 2020 and QUESTION 5 answer the following: 5.1.1 What do you understand by "Cash flow from operating activities R 150 000"? 5.1.2 Name three transactions that improve cash flow but do not increase profit. 5.1.3 There is a combination of a positive net cash flow from operating activities and a negative cash flow from investing activities. Is this good for the company? Explain. (4) (6) (5) INFORMATION: Conlog Limited Extracts of Cash Flow Statement for the year ended 31 December 2020 R Cash flow from operating activities 210 000 Cash flow from investing activities (330 000) Additions to plant and machinery (330 000) Cash flow from financing activities 120 000 Increase in long term borrowings 120 000 5.2 Calculate the incremental profit/loss after tax. (5) INFORMATION: Lubners Traders is considering extending credit to some customers who may be at risk of defaulting in payment. Sales will increase by R200 000 if credit is granted to these customers. From the new accounts receivable generated, 8% is expected to be uncollectable. Additional collection costs will be 3% of sales, and the production and selling costs will be 65% of sales. Taxation is 28%.

Step by Step Solution

★★★★★

3.47 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

Answer to 31 Projected statement of Comprehensive income for the year ended 31 Dec 2021 Particulars Calculation Amount R Sales G H 5357358 Cost of Sales H G 60 40 3214415 Gross profit G E F 2142943 Op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started