Question

20. Compute the following scenarios using different interest rates of 6%, 8%, and 10% compounded annually throughout. a. What is the present value of a

20. Compute the following scenarios using different interest rates of 6%, 8%, and 10% compounded annually throughout.

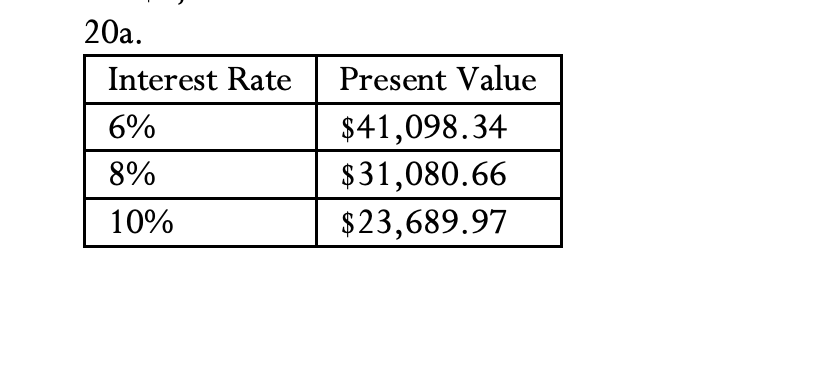

a. What is the present value of a deferred annuity with a 10-year deferral period followed by a 10-year ordinary annuity with annual $10,000 payments?

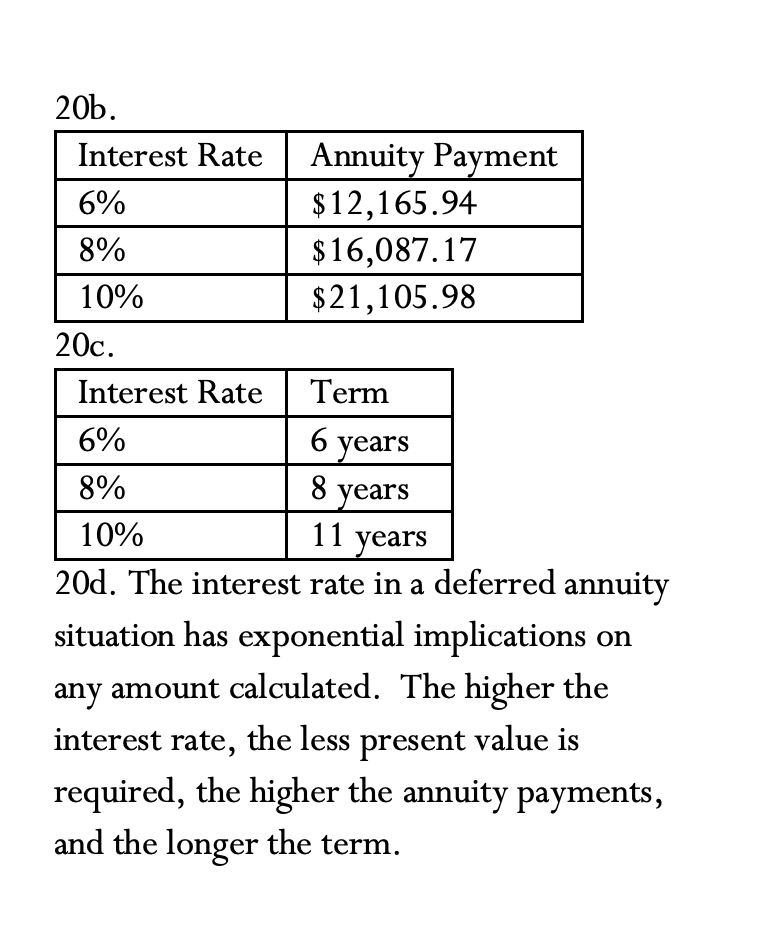

b. What is the annual annuity payment if a lump sum of $50,000 is invested for 10 years followed by a 10-year ordinary annuity?

c. What is the term of the annuity if a lump sum of $50,000 is invested for 10 years followed by an ordinary annuity paying $20,000 annually? d. Discuss your observations from all of the above scenarios.

20b. Interest Rate Annuity Payment 6% $12,165.94 8% $16,087.17 10% $21,105.98 20c. Interest Rate Term 6% 6 years 8% 8 years 10% 11 years 20d. The interest rate in a deferred annuity situation has exponential implications on any amount calculated. The higher the interest rate, the less present value is required, the higher the annuity payments, and the longer the term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started