Question

Consider a savings accounts model. At time t=0, you invest $30,000 in RBC bank. RBC provides 12% return in year 1, 12% return in

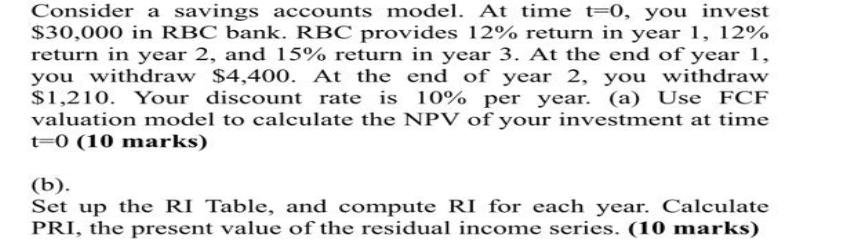

Consider a savings accounts model. At time t=0, you invest $30,000 in RBC bank. RBC provides 12% return in year 1, 12% return in year 2, and 15% return in year 3. At the end of year 1, you withdraw $4,400. At the end of year 2, you withdraw $1,210. Your discount rate is 10% per year. (a) Use FCF valuation model to calculate the NPV of your investment at time t=0 (10 marks) (b). Set up the RI Table, and compute RI for each year. Calculate PRI, the present value of the residual income series. (10 marks)

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a At time t0 the initial investment is 30000 The cash flows in each year are Year 1 12 return 3600 w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Financial Management

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

15th edition

77861612, 1259194078, 978-0077861612, 978-1259194078

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App