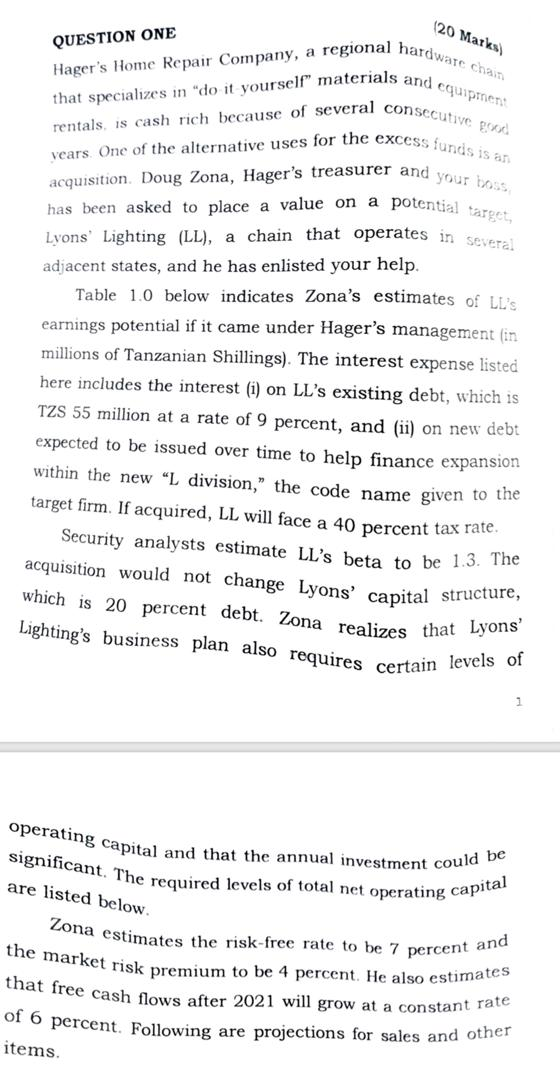

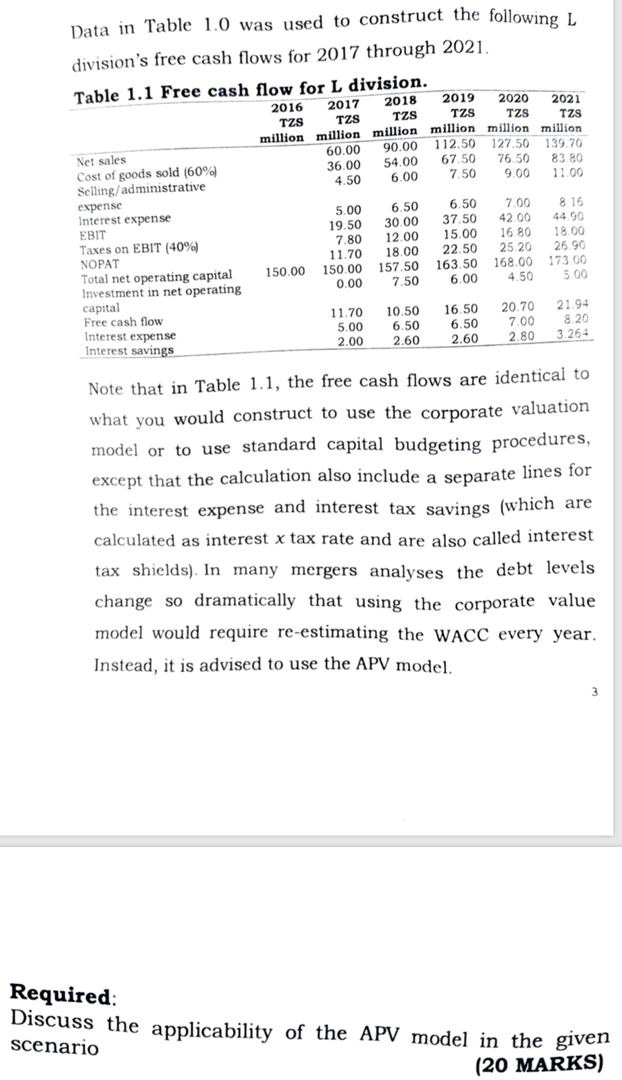

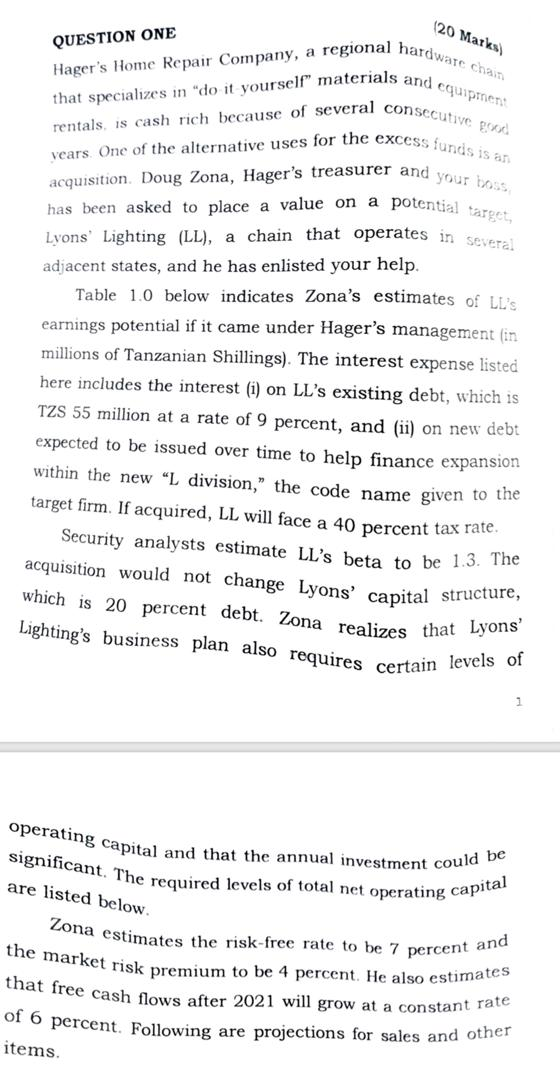

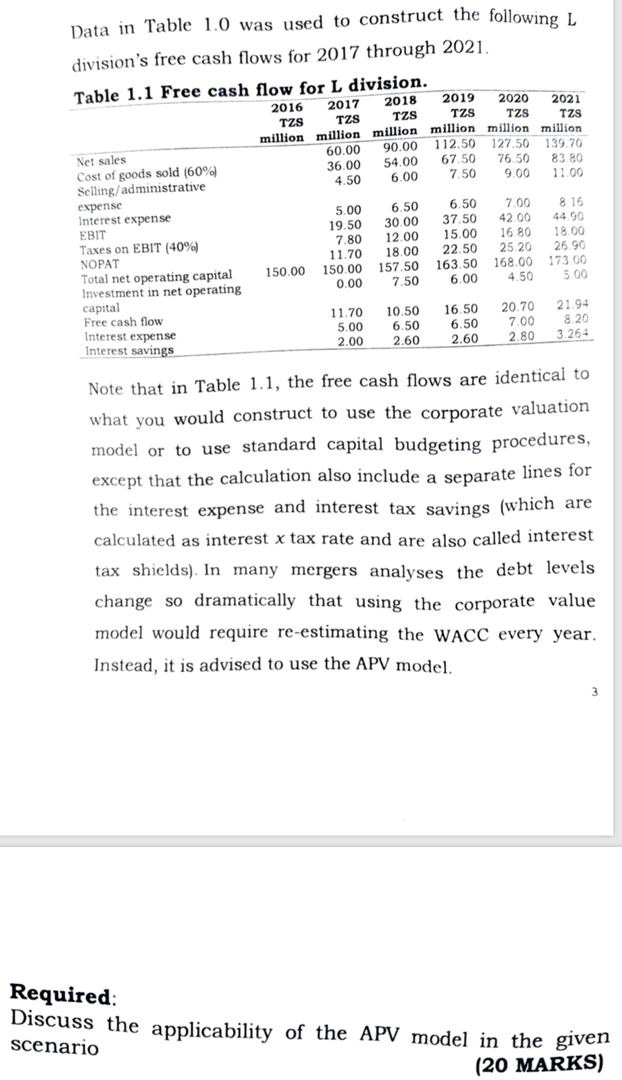

20 Marks hardware chain QUESTION ONE Hager's Home Repair Company, a regional har that specializes in "do it yourself" materials and rentals is cash rich because of several conser als and equipment consecutive En excess funds is an urer and your boss potential target vears. One of the alternative uses for the excess fun acquisition. Doug Zona, Hager's treasurer and you has been asked to place a value on a potential Lyons' Lighting (LL), a chain that operates in se adjacent states, and he has enlisted your help. Table 1.0 below indicates Zona's estimates of LL'S earnings potential if it came under Hager's management in millions of Tanzanian Shillings). The interest expense listed here includes the interest (i) on LL's existing debt, which is TZS 55 million at a rate of 9 percent, and (ii) on new debt expected to be issued over time to help finance expansion within the new "L division," the code name given to the target firm. If acquired, LL will face a 40 percent tax rate. Security analysts estimate LL's beta to be 1.3. The acquisition would not change Lyons' capital struc which is 20 percent debt. Zona realizes that Lyon Lighting's business plan also requires certain levels operating capital and that significant. The required le are listed below. The required levels of total net operating cap it could be rating capital a estimates the risk-free rate to be 7 percent an the market risk premium free cash flows after 2021 will grow at a constant rate Of 6 percent. Following are projections for sales and oth items. Data in Table 1.0 was used to construct the following L division's free cash flows for 2017 through 2021 Table 1.1 Free cash flow for L division. 2016 2017 2018 2019 2020 2021 TZS TZS TZS TZS TZS TZS million million million million million million 60.00 90.00 112.50 127.50 139.70 36.00 54.00 67.50 76 50 83 80 4.50 6.00 7.50 9.00 11.00 Net sales Cost of goods sold (60%) Selling/administrative expense Interest expense EBIT Taxes on EBIT (40%) NOPAT Total net operating capital Investment in net operating capital Free cash flow Interest expense Interest savings 5.00 19.50 7.80 11.70 150.00 0.00 6.50 30.00 12.00 18.00 157.50 7.50 6.50 37.50 15.00 22.50 163.50 6.00 7.00 4200 1680 25 20 168.00 4.50 8 16 44 90 18.00 26.90 17300 5.00 150.00 11.70 5.00 2.00 10.50 6.50 2.60 16.50 6.50 2.60 20.70 7.00 2.80 21.94 820 3.264 Note that in Table 1.1, the free cash flows are identical to what you would construct to use the corporate valuation model or to use standard capital budgeting procedures, except that the calculation also include a separate lines for the interest expense and interest tax savings (which are calculated as interest x tax rate and are also called interest tax shields). In many mergers analyses the debt levels change so dramatically that using the corporate value model would require re-estimating the WACC every year. Instead, it is advised to use the APV model. Required: Discuss the applicability of the APV model in the given scenario (20 MARKS) 20 Marks hardware chain QUESTION ONE Hager's Home Repair Company, a regional har that specializes in "do it yourself" materials and rentals is cash rich because of several conser als and equipment consecutive En excess funds is an urer and your boss potential target vears. One of the alternative uses for the excess fun acquisition. Doug Zona, Hager's treasurer and you has been asked to place a value on a potential Lyons' Lighting (LL), a chain that operates in se adjacent states, and he has enlisted your help. Table 1.0 below indicates Zona's estimates of LL'S earnings potential if it came under Hager's management in millions of Tanzanian Shillings). The interest expense listed here includes the interest (i) on LL's existing debt, which is TZS 55 million at a rate of 9 percent, and (ii) on new debt expected to be issued over time to help finance expansion within the new "L division," the code name given to the target firm. If acquired, LL will face a 40 percent tax rate. Security analysts estimate LL's beta to be 1.3. The acquisition would not change Lyons' capital struc which is 20 percent debt. Zona realizes that Lyon Lighting's business plan also requires certain levels operating capital and that significant. The required le are listed below. The required levels of total net operating cap it could be rating capital a estimates the risk-free rate to be 7 percent an the market risk premium free cash flows after 2021 will grow at a constant rate Of 6 percent. Following are projections for sales and oth items. Data in Table 1.0 was used to construct the following L division's free cash flows for 2017 through 2021 Table 1.1 Free cash flow for L division. 2016 2017 2018 2019 2020 2021 TZS TZS TZS TZS TZS TZS million million million million million million 60.00 90.00 112.50 127.50 139.70 36.00 54.00 67.50 76 50 83 80 4.50 6.00 7.50 9.00 11.00 Net sales Cost of goods sold (60%) Selling/administrative expense Interest expense EBIT Taxes on EBIT (40%) NOPAT Total net operating capital Investment in net operating capital Free cash flow Interest expense Interest savings 5.00 19.50 7.80 11.70 150.00 0.00 6.50 30.00 12.00 18.00 157.50 7.50 6.50 37.50 15.00 22.50 163.50 6.00 7.00 4200 1680 25 20 168.00 4.50 8 16 44 90 18.00 26.90 17300 5.00 150.00 11.70 5.00 2.00 10.50 6.50 2.60 16.50 6.50 2.60 20.70 7.00 2.80 21.94 820 3.264 Note that in Table 1.1, the free cash flows are identical to what you would construct to use the corporate valuation model or to use standard capital budgeting procedures, except that the calculation also include a separate lines for the interest expense and interest tax savings (which are calculated as interest x tax rate and are also called interest tax shields). In many mergers analyses the debt levels change so dramatically that using the corporate value model would require re-estimating the WACC every year. Instead, it is advised to use the APV model. Required: Discuss the applicability of the APV model in the given scenario (20 MARKS)