Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20 Marks QUESTION 1: APX programmers PTY Lid deals in developing programs legible for use in the artificial intelligence space of the information technology industry

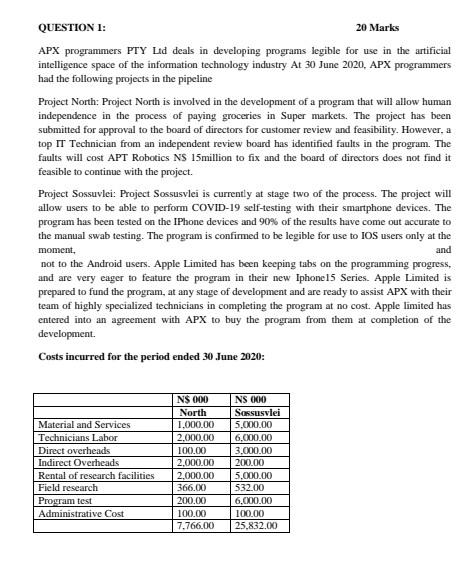

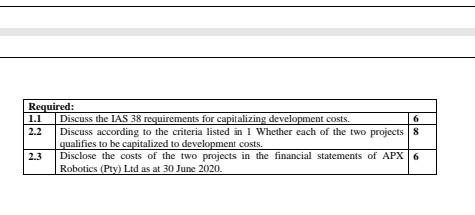

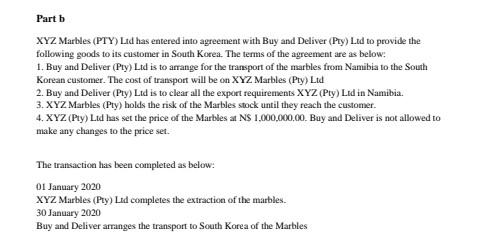

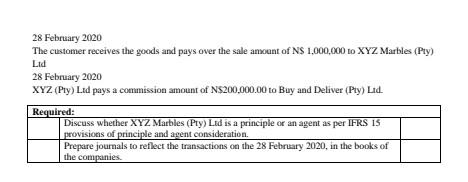

20 Marks QUESTION 1: APX programmers PTY Lid deals in developing programs legible for use in the artificial intelligence space of the information technology industry At 30 June 2020, APX programmers had the following projects in the pipeline Project North: Project North is involved in the development of a program that will allow human independence in the process of paying groceries in Super markets. The project has been submitted for approval to the board of directors for customer review and feasibility. However, a top IT Technician from an independent review board has identified faults in the program. The faults will cost APT Robotics NS 15 million to fix and the board of directors does not find it feasible to continue with the project. Project Sossuvlei: Project Sossusvlei is currently at stage two of the process. The project will allow users to be able to perform COVID-19 self-testing with their smartphone devices. The program has been tested on the IPhone devices and 90% of the results have come out accurate to the manual swab testing. The program is confirmed to be legible for use to IOS users only at the moment, not to the Android users. Apple Limited has been keeping tabs on the programming progress, and are very eager to feature the program in their new Iphonel Series. Apple Limited is prepared to fund the program, at any stage of development and are ready to assist APX with their team of highly specialized technicians in completing the program at no cost. Apple limited has entered into an agreement with APX to buy the program from them at completion of the development Costs incurred for the period ended 30 June 2020: and Material and Services Technicie Labor Direct overheads Indirect Overheads Rental of research facilities Field research Program test Administrative Cost N$ 000 North 1.000.00 2.000.0 100.00 2.000.00 2.000.00 366.00 200.00 100.00 7.766.00 NS 000 Sossusvlei 5.000.00 6,000.00 3.000.00 200.00 5.000.00 532.00 6,000.00 100.00 25.832.00 Required: 1.1 Discuss the IAS 38 requirements for capitalizing development costs. 6 2.2 Discuss according to the criteria listed in 1 Whether each of the two projects qualifies to be capitalized to development costs. 2.3 Disclose the costs of the two projects in the financial statements of APX 6 Robotics (Pty) Ltd as at 30 June 2020. Part b XYZ Marbles (PTY) Ltd has entered into agreement with Buy and Deliver (Pty) Ltd to provide the following goods to its customer in South Korea. The terms of the agreement are as below: 1. Buy and Deliver (Pty) Ltd is to arrange for the transport of the marbles from Namibia to the South Korean customer. The cost of transport will be on XYZ Marbles (Pty) Ltd 2. Buy and Deliver (Pty) Ltd is to clear all the export requirements XYZ (Pty) Ltd in Namibia 3. XYZ Marbles (Pty) holds the risk of the Marbles stock until they reach the customer. 4. XYZ (Pty) Ltd has set the price of the Marbles at NS 1.000.000.00. Buy and Deliver is not allowed to make any changes to the price set. The transaction has been completed as below: 01 January 2020 XYZ Marbles (Pty) Lid completes the extraction of the marbles. 30 January 2020 Buy and Deliver arranges the transport to South Korea of the Marbles 28 February 2020 The customer receives the goods and pays over the sale anscent of NS 1,000,000 to XYZ Marbles (Pty) ) Ltd 28 February 2020 XYZ (Pty) Ltd pays a commission amount of N$200,000.00 to Buy and Deliver (Pty) Ltd Required: Discuss whether XYZ Marbles (Pty) Ltd is a principle or an agent as per IFRS 15 provisions of principle and agent consideration. Prepare journals to reflect the transactions on the 28 February 2020, in the books of the companies

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started