Answered step by step

Verified Expert Solution

Question

1 Approved Answer

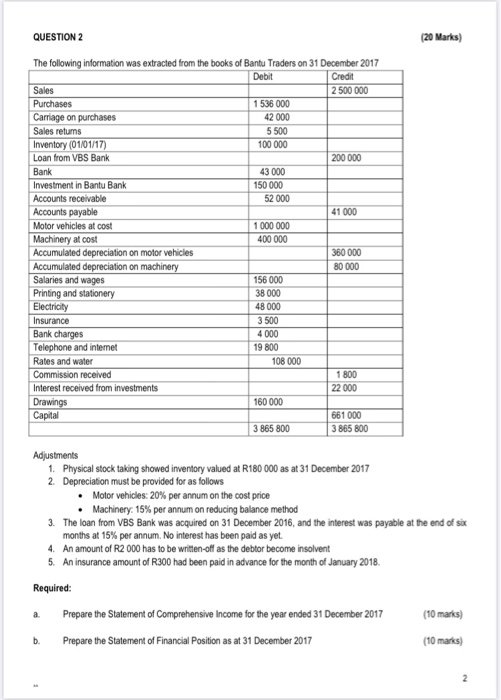

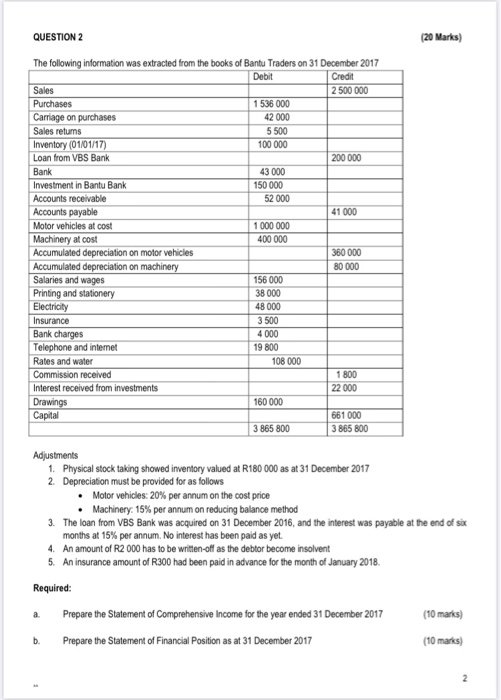

(20 Marks) QUESTION 2 The following information was extracted from the books of Bantu Traders on 31 December 2017 Debit Credit Sales 2 500 000

(20 Marks) QUESTION 2 The following information was extracted from the books of Bantu Traders on 31 December 2017 Debit Credit Sales 2 500 000 Purchases 1 538 000 Carriage on purchases 42 000 Sales retums 5500 Inventory (01/01/17) 100 000 Loan from VBS Bank 200 000 Bank 43 000 Investment in Bantu Bank 150 000 Accounts receivable 52 000 Accounts payable 41 000 Motor vehicles at cost 1 000 000 Machinery at cost 400 000 Accumulated depreciation on motor vehicles 360 000 Accumulated depreciation on machinery 80 000 Salaries and wages 156 000 Printing and stationery 38 000 Electricity 48000 Insurance 3500 Bank charges 4 000 Telephone and internet 19 800 Rates and water 108 000 Commission received 1 800 Interest received from investments 22 000 Drawings 160 000 Capital 661 000 3 865 800 3 865 800 Adjustments 1. Physical stock taking showed inventory valued at R180 000 as at 31 December 2017 2. Depreciation must be provided for as follows Motor vehicles: 20% per annum on the cost price Machinery: 15% per annum on reducing balance method 3. The loan from VBS Bank was acquired on 31 December 2016, and the interest was payable at the end of six months at 15% per annum. No interest has been paid as yet. 4. An amount of R2 000 has to be written-off as the debtor become insolvent 5. An insurance amount of R300 had been paid in advance for the month of January 2018. Required: Prepare the Statement of Comprehensive Income for the year ended 31 December 2017 (10 marks) Prepare the Statement of Financial Position as at 31 December 2017 (10 marks b. 2

(20 Marks) QUESTION 2 The following information was extracted from the books of Bantu Traders on 31 December 2017 Debit Credit Sales 2 500 000 Purchases 1 538 000 Carriage on purchases 42 000 Sales retums 5500 Inventory (01/01/17) 100 000 Loan from VBS Bank 200 000 Bank 43 000 Investment in Bantu Bank 150 000 Accounts receivable 52 000 Accounts payable 41 000 Motor vehicles at cost 1 000 000 Machinery at cost 400 000 Accumulated depreciation on motor vehicles 360 000 Accumulated depreciation on machinery 80 000 Salaries and wages 156 000 Printing and stationery 38 000 Electricity 48000 Insurance 3500 Bank charges 4 000 Telephone and internet 19 800 Rates and water 108 000 Commission received 1 800 Interest received from investments 22 000 Drawings 160 000 Capital 661 000 3 865 800 3 865 800 Adjustments 1. Physical stock taking showed inventory valued at R180 000 as at 31 December 2017 2. Depreciation must be provided for as follows Motor vehicles: 20% per annum on the cost price Machinery: 15% per annum on reducing balance method 3. The loan from VBS Bank was acquired on 31 December 2016, and the interest was payable at the end of six months at 15% per annum. No interest has been paid as yet. 4. An amount of R2 000 has to be written-off as the debtor become insolvent 5. An insurance amount of R300 had been paid in advance for the month of January 2018. Required: Prepare the Statement of Comprehensive Income for the year ended 31 December 2017 (10 marks) Prepare the Statement of Financial Position as at 31 December 2017 (10 marks b. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started