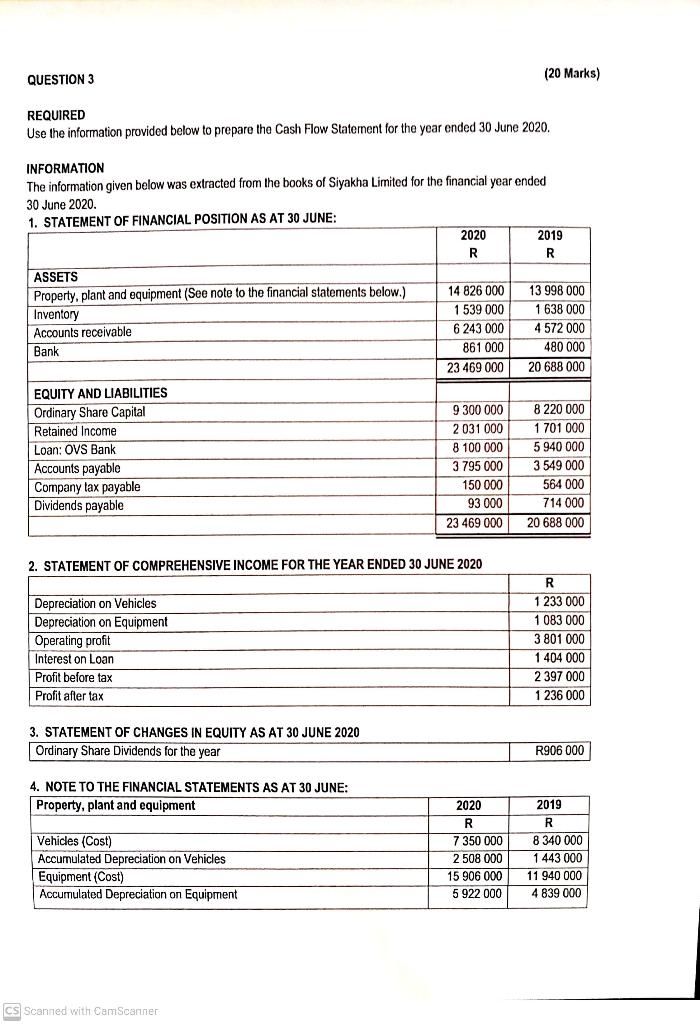

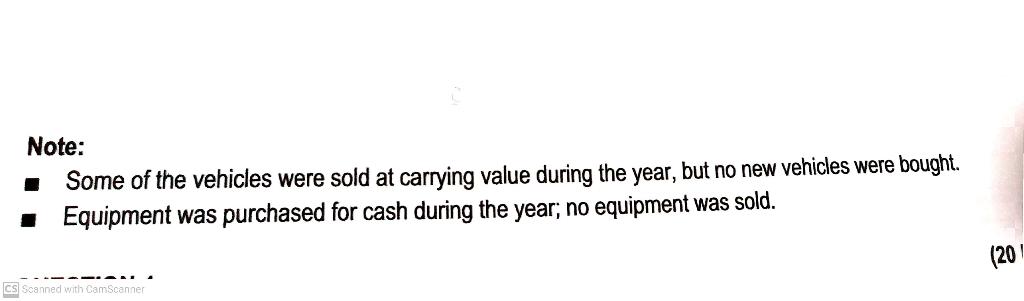

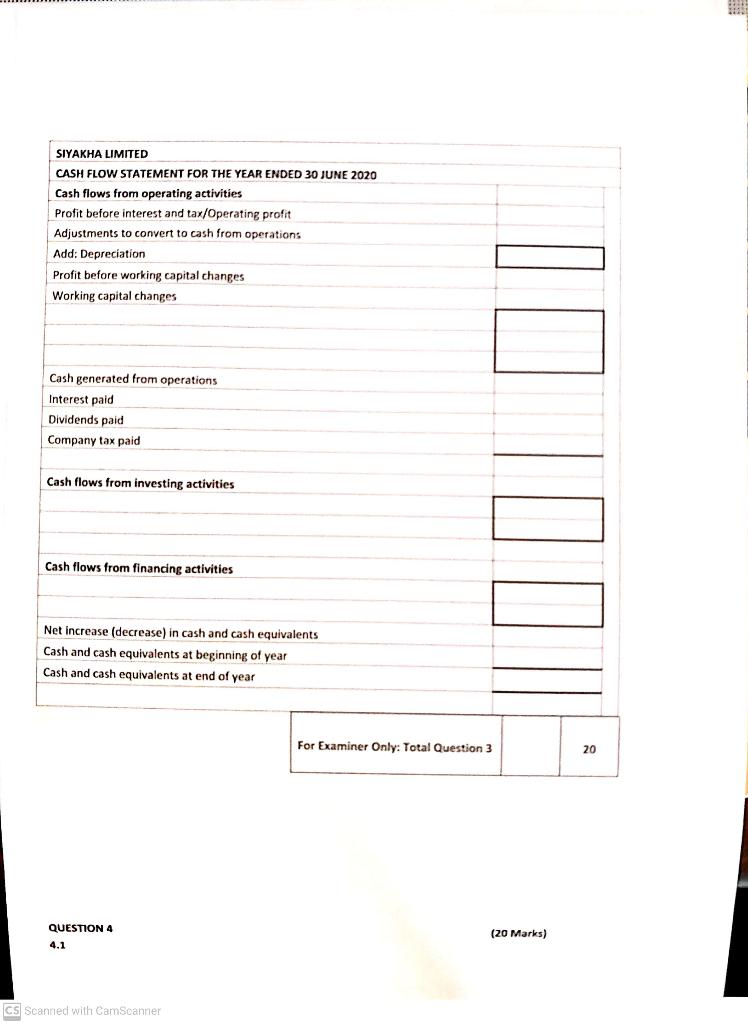

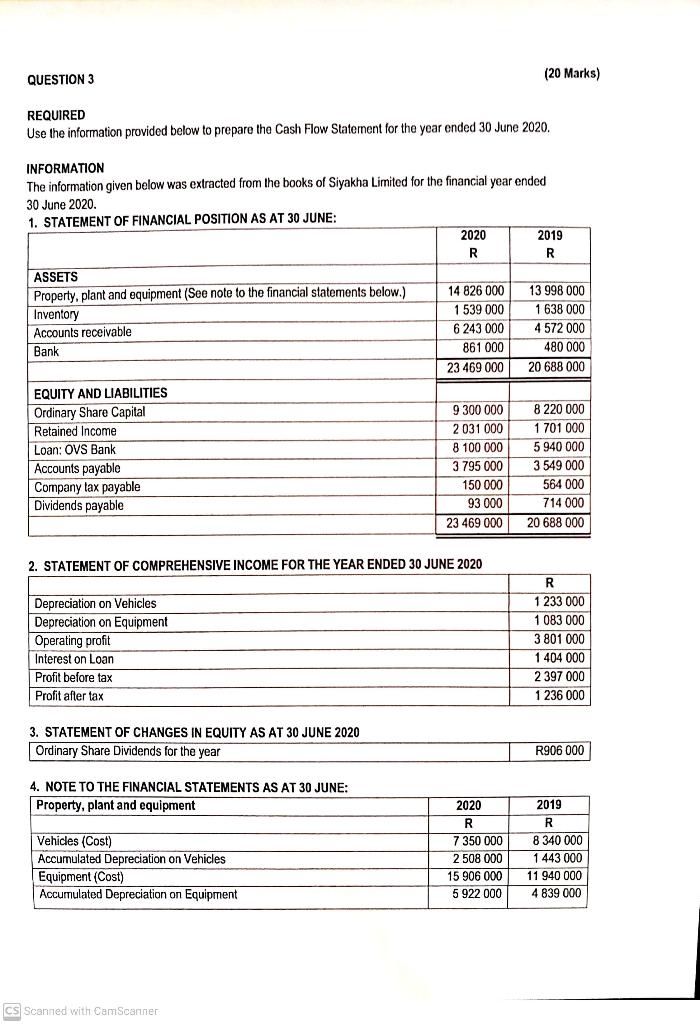

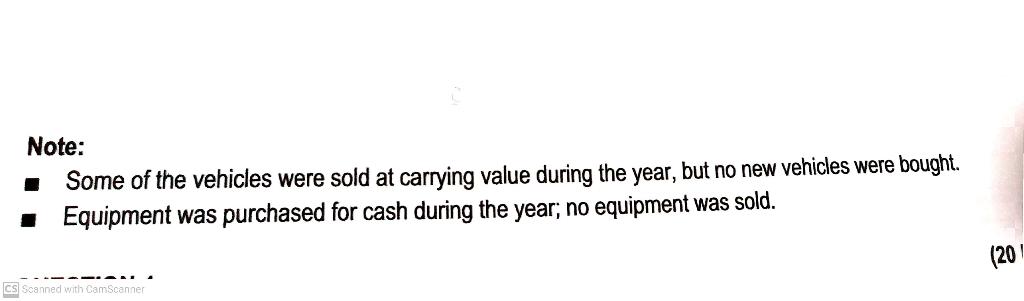

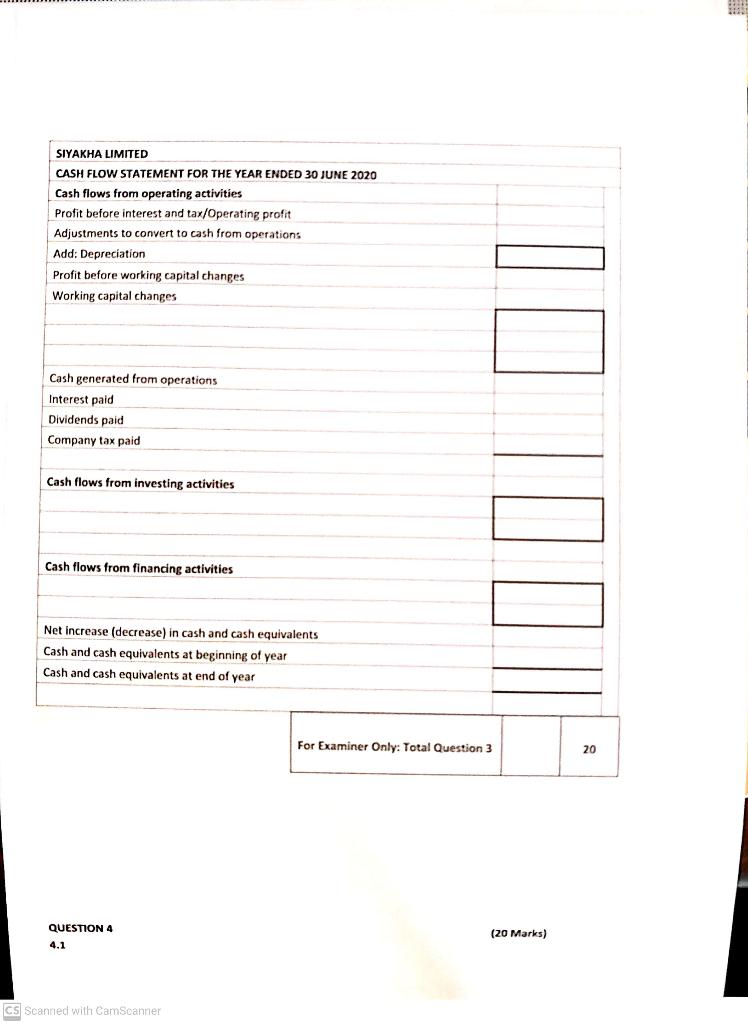

(20 Marks) QUESTION 3 REQUIRED Use the information provided below to prepare the Cash Flow Statement for the year ended 30 June 2020. INFORMATION The information given below was extracted from the books of Siyakha Limited for the financial year ended 30 June 2020. 1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE: 2020 2019 R R ASSETS Property, plant and equipment (See note to the financial statements below.) 14 826 000 13 998 000 Inventory 1 539 000 1 638 000 Accounts receivable 6 243 000 4 572 000 Bank 861 000 480 000 23 469 000 20 688 000 EQUITY AND LIABILITIES Ordinary Share Capital 9 300 000 8 220 000 Retained Income 2 031 000 1 701 000 Loan: OVS Bank 8 100 000 5 940 000 Accounts payable 3 795 000 3 549 000 Company tax payable 150 000 564 000 Dividends payable 93 000 714 000 23 469 000 20 688 000 2. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 Depreciation on Vehicles Depreciation on Equipment Operating profit Interest on Loan Profit before tax Profit after tax R 1 233 000 1 083 000 3 801 000 1 404 000 2 397 000 1 236 000 3. STATEMENT OF CHANGES IN EQUITY AS AT 30 JUNE 2020 Ordinary Share Dividends for the year R906 000 4. NOTE TO THE FINANCIAL STATEMENTS AS AT 30 JUNE: Property, plant and equipment Vehicles (Cost) Accumulated Depreciation on Vehicles Equipment (Cost) Accumulated Depreciation on Equipment 2020 R 7 350 000 2 508 000 15 906 000 5 922 000 2019 R 8 340 000 1 443 000 11 940 000 4 839 000 CS Scanned with CamScanner Note: Some of the vehicles were sold at carrying value during the year, but no new vehicles were bought. Equipment was purchased for cash during the year; no equipment was sold. (20 d with CamScanner SIYAKHA LIMITED CASH FLOW STATEMENT FOR THE YEAR ENDED 30 JUNE 2020 Cash flows from operating activities Profit before interest and tax/Operating profit Adjustments to convert to cash from operations Add: Depreciation Profit before working capital changes Working capital changes Cash generated from operations Interest paid Dividends paid Company tax paid Cash flows from investing activities Cash flows from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year For Examiner Only: Total Question 3 20 QUESTIONS QUESTION 4 4.1 20 Marks) (20 Marks) CS Scanned with CamScanner