Answered step by step

Verified Expert Solution

Question

1 Approved Answer

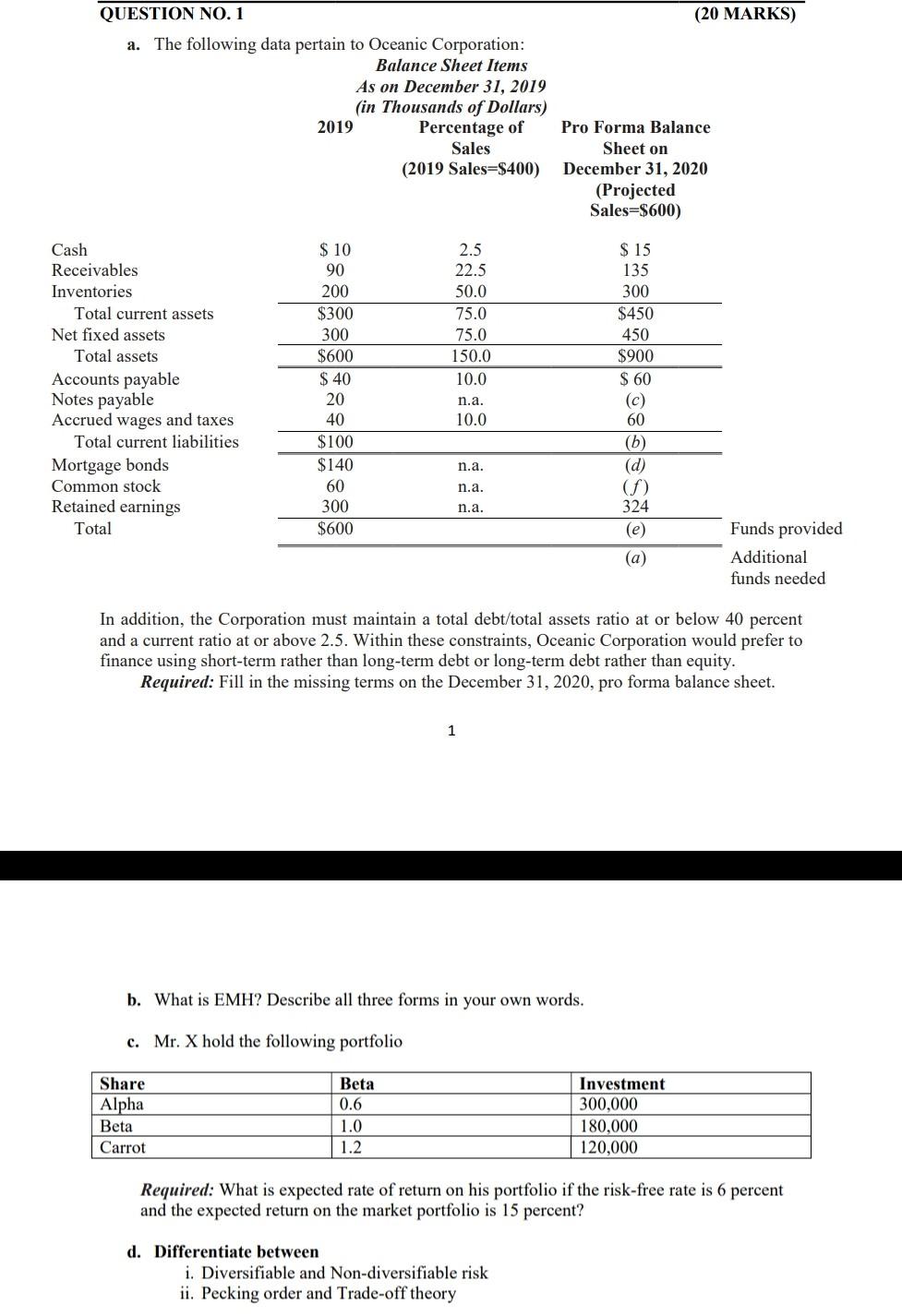

(20 MARKS) QUESTION NO. 1 a. The following data pertain to Oceanic Corporation: Balance Sheet Items As on December 31, 2019 (in Thousands of Dollars)

(20 MARKS) QUESTION NO. 1 a. The following data pertain to Oceanic Corporation: Balance Sheet Items As on December 31, 2019 (in Thousands of Dollars) 2019 Percentage of Sales (2019 Sales=S400) Pro Forma Balance Sheet on December 31, 2020 (Projected Sales=$600) Cash Receivables Inventories Total current assets Net fixed assets Total assets Accounts payable Notes payable Accrued wages and taxes Total current liabilities Mortgage bonds Common stock Retained earnings Total $ 10 90 200 $300 300 $600 $ 40 20 40 $100 $140 60 300 $600 2.5 22.5 50.0 75.0 75.0 150.0 10.0 n.a. 10.0 $ 15 135 300 $450 450 $900 $ 60 (C) 60 (b) (d) n.a. n.a. n.a. 324 (e) (a) Funds provided Additional funds needed In addition, the Corporation must maintain a total debt/total assets ratio at or below 40 percent and a current ratio at or above 2.5. Within these constraints, Oceanic Corporation would prefer to finance using short-term rather than long-term debt or long-term debt rather than equity. Required: Fill in the missing terms on the December 31, 2020, pro forma balance sheet. 1 b. What is EMH? Describe all three forms in your own words. c. Mr. X hold the following portfolio Share Alpha Beta Carrot Beta 0.6 1.0 1.2 Investment 300,000 180,000 120,000 Required: What is expected rate of return on his portfolio if the risk-free rate is 6 percent and the expected return on the market portfolio is 15 percent? d. Differentiate between i. Diversifiable and Non-diversifiable risk ii. Pecking order and Trade-off theory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started